Failed PEPE Price Recovery Leaves $600 Million Worth of Profits in Limbo

07/13/2024 21:00

PEPE's price is struggling to achieve a significant rally needed to initiate a recovery, causing risk of losing their profitability.

PEPE price has lacked the momentum to ascertain a recovery, resulting in the potential for profit depletion.

Meme coin enthusiasts are still hopeful of recovery, which is possible if a crucial resistance level is breached.

PEPE Profits on the Line

PEPE price trading at $0.00000881 is hovering under $0.00001000 and awaiting a bullish trigger to initiate a rally. This would be beneficial to the investors as their profits remain stuck in limbo due to the meme coin’s consolidation.

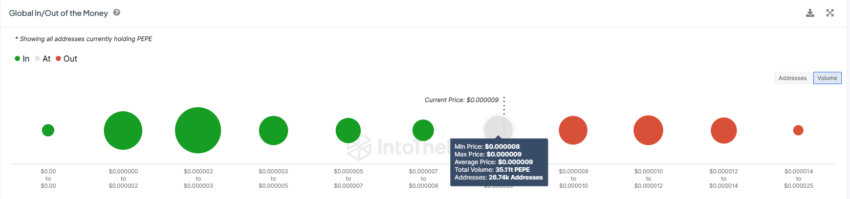

According to the Global In/Out of the Money (GIOM) indicator, about 70 trillion PEPE worth over $617 million was bought between $0.00000800 and $0.00000990. This supply will only become profitable once the PEPE price secures $0.00001000 as a support floor.

However, while the profits are massive, the demand is not at the moment, as evident in the Relative Strength Index (RSI). The bullish momentum on the RSI appears to be weak. This suggests that the buying interest is not strong enough to sustain upward price movement.

When RSI momentum is weak, it often indicates that the asset may struggle to gain further ground and could face resistance in continuing its bullish trend. Adding to this, the market is currently dominated by selling pressure. Sellers are overwhelming buyers, leading to downward price movement.

Read More: Pepe: A Comprehensive Guide to What It Is and How It Works

This selling pressure counteracts any potential gains from bullish momentum and creates an environment where further price drops are more likely. The dominance of sellers in the market is a significant factor contributing to the weakened RSI and overall bearish outlook for PEPE.

PEPE Price Prediction: Aiming for a Breakout

PEPE price would manage to flip $0.00001000 into support and escape consolidation only when the demand runs high. Since the broader market cues are weak at the moment, recovery could take a longer while.

This would keep the profits far from investors and would warrant consistent green candlesticks until the breach occurs. This could enable a rise to $0.00001146.

Read More: Pepe (PEPE) Price Prediction 2024/2025/2030

On the other hand, a drawdown to $0.00000775 would mean the meme coin is set to remain consolidated. This could invalidate the bullish thesis and leave the meme coin vulnerable to further decline.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

READ FULL BIO