Will Bitcoin ETFs’ $15.5 billion net inflows be enough to rescue BTC’s price?

07/13/2024 22:00

Bitcoin [BTC]'s price dipping below the $60,000-mark had an extremely negative impact on the sentiment around the world's largest...

- Bitcoin ETF inflows remained positive despite its declining price

- Overall miner revenues fell materially over the past month

Bitcoin [BTC]’s price dipping below the $60,000-mark had an extremely negative impact on the sentiment around the world’s largest cryptocurrency. And yet, recent data seems to suggest that maybe, Wall Street remains optimistic about the future of the king coin.

A thumbs up from Wall Street

At the time of writing, latest figures revealed cumulative net inflows of $15.50 billion since launch, with daily inflows averaging at around $79 million. This marked the sixth consecutive day of positive net flows for these ETFs, indicating sustained bullish sentiment among investors.

On the contrary, the Grayscale Bitcoin Trust ETF (GBTC) registered a different trend altogether. On 11 July, it saw daily net outflows of $38 million, contributing to total net outflows of $18.7 billion.

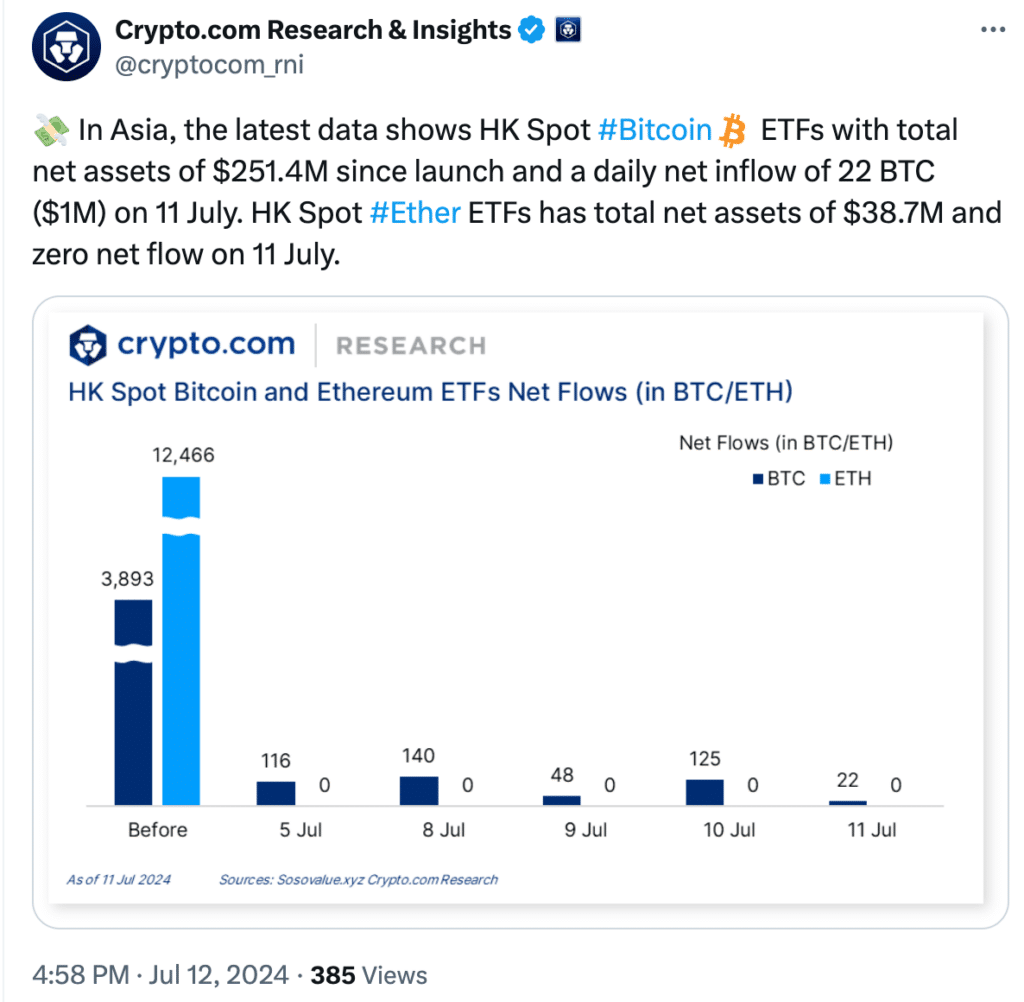

Shifting focus to Asia, the nascent HK Spot Bitcoin ETF market is gaining traction too. Since its inception, it has amassed total net assets of $251.4 million. As of 11 July, this ETF was recording daily net inflows of 22 Bitcoin, equivalent to approximately $1 million – A sign of growing investor appetite for Bitcoin exposure in the region.

Significant inflows into ETFs can provide price support for Bitcoin, especially during recent market corrections. ETFs act as buying pressure, and can potentially mitigate significant price declines.

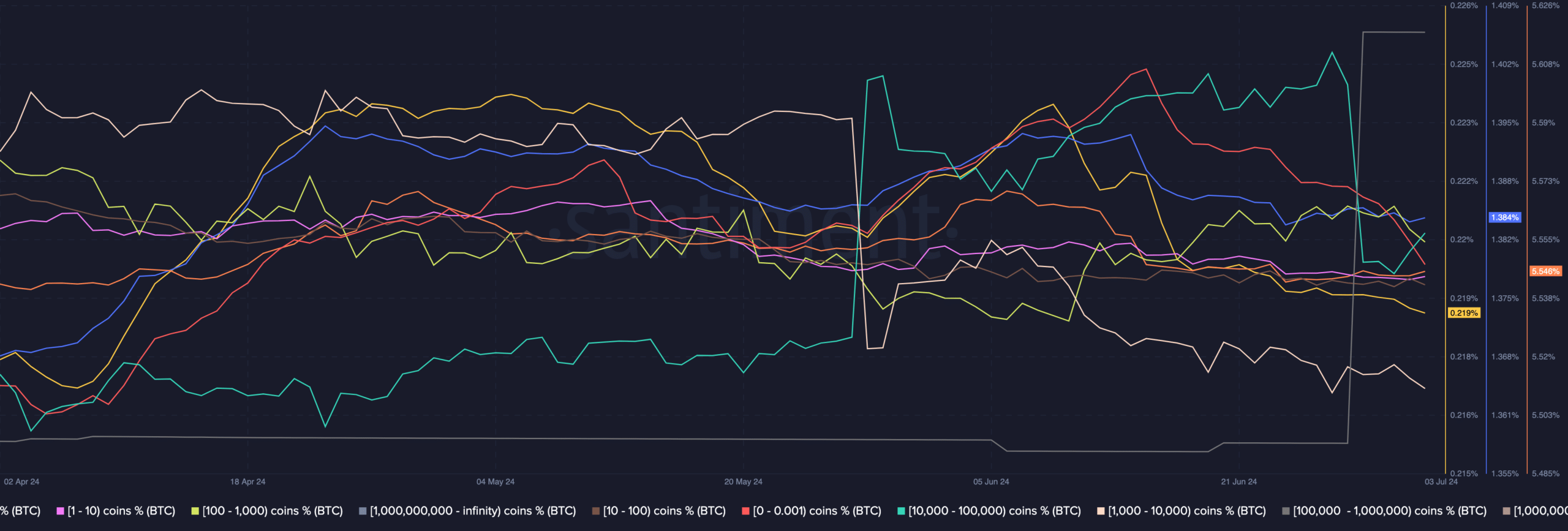

Now, even though Wall Street investors have been showing interest in BTC, the same couldn’t be said about crypto investors. AMBCrypto’s analysis of Santiment’s data revealed that both whale and retail interest in BTC fell recently. Accumulation across multiple cohorts declined over the last few days too.

Despite the support given to BTC by ETF inflows, the decline in whale and retail interest may place additional selling pressure on Bitcoin.

Miner revenue declines

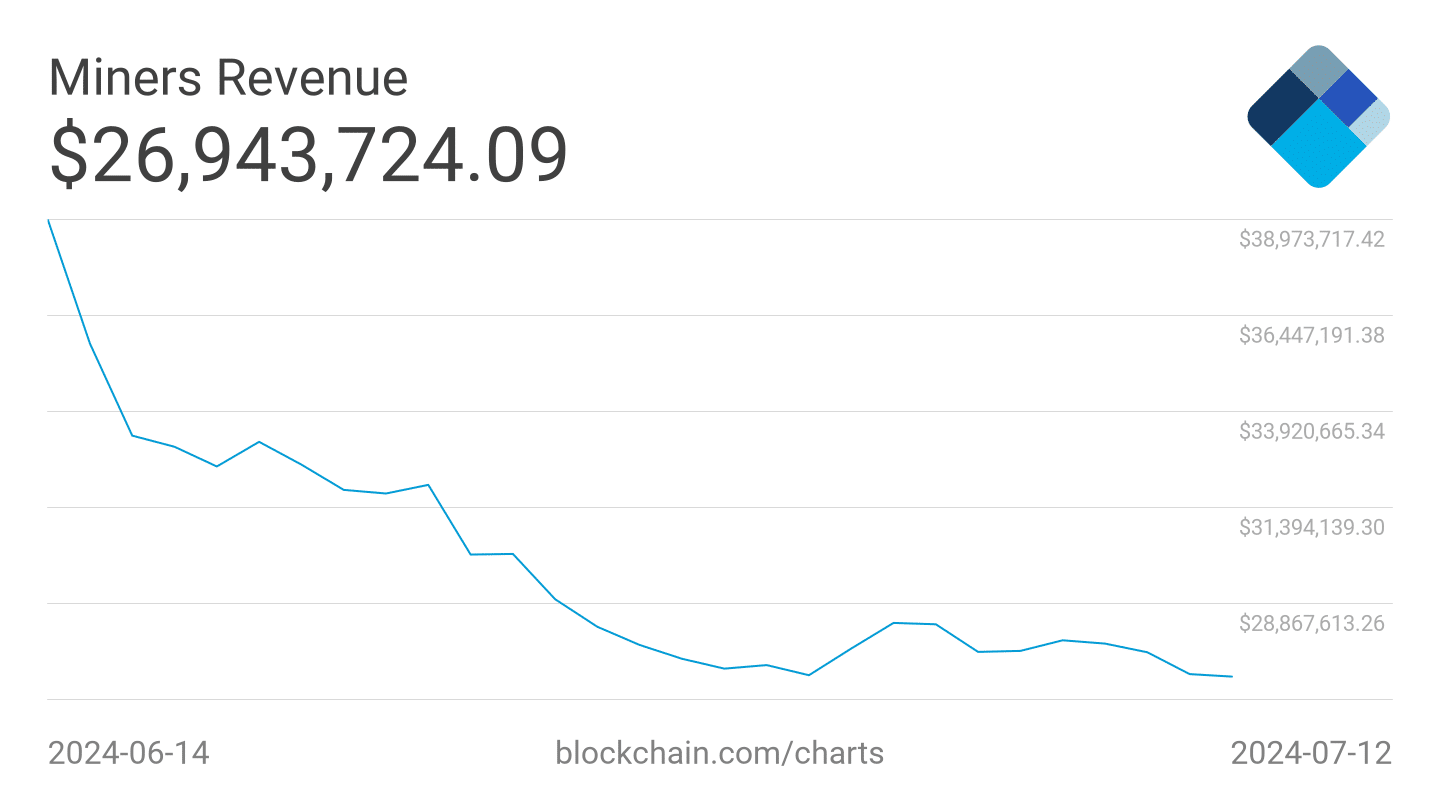

Another factor that can gravely influence the state of BTC and add additional selling pressure on the coin would be the state of the miners.

Over the past month, the revenue generated by Bitcoin miners has declined materially. This could force miners to sell additional BTC to remain profitable – Spurring selling pressure on the cryptocurrency.

With the German government finally done with offloading its seized BTC holdings, selling pressure on BTC could climb over the next few days. This, understandably, can contribute to a hike in negative sentiment across the board.

Read Bitcoin’s [BTC] Price Prediction 2024-25