'$1 Million BTC' Samson Mow Set to Bring Germany Back to Crypto

07/13/2024 22:21

CEO of Pixelmatic has something to offer Germany this October

Samson Mow, $1 million Bitcoin advocate, has shared his view on the German government’s massive sell-off of the country's national Bitcoin holdings, which imposed strong selling pressure on the lead cryptocurrency’s price.

He argues that Germany had to sell its BTC holdings, which it seized from a film pirate website, due to the illegal nature of the funds.

However, Mow believes that Germany needs to reacquire at least $50K in BTC as part of what he calls a “proper nation-state Bitcoin adoption strategy.” The entrepreneur even proposed developing a plan for this adoption strategy to implement as early as October this year.

The German government had no choice but to dispose of the 50,000 BTC seized from Movie2k. However, this October we should put together a concrete plan for Germany to re-acquire at least 50,000 BTC in a proper nation-state #Bitcoin adoption strategy. 🇩🇪 @JoanaCotar @BTCimBundestag

— Samson Mow (@Excellion) July 13, 2024

Currently, the German government holds $1 worth of Bitcoin.

What is happening

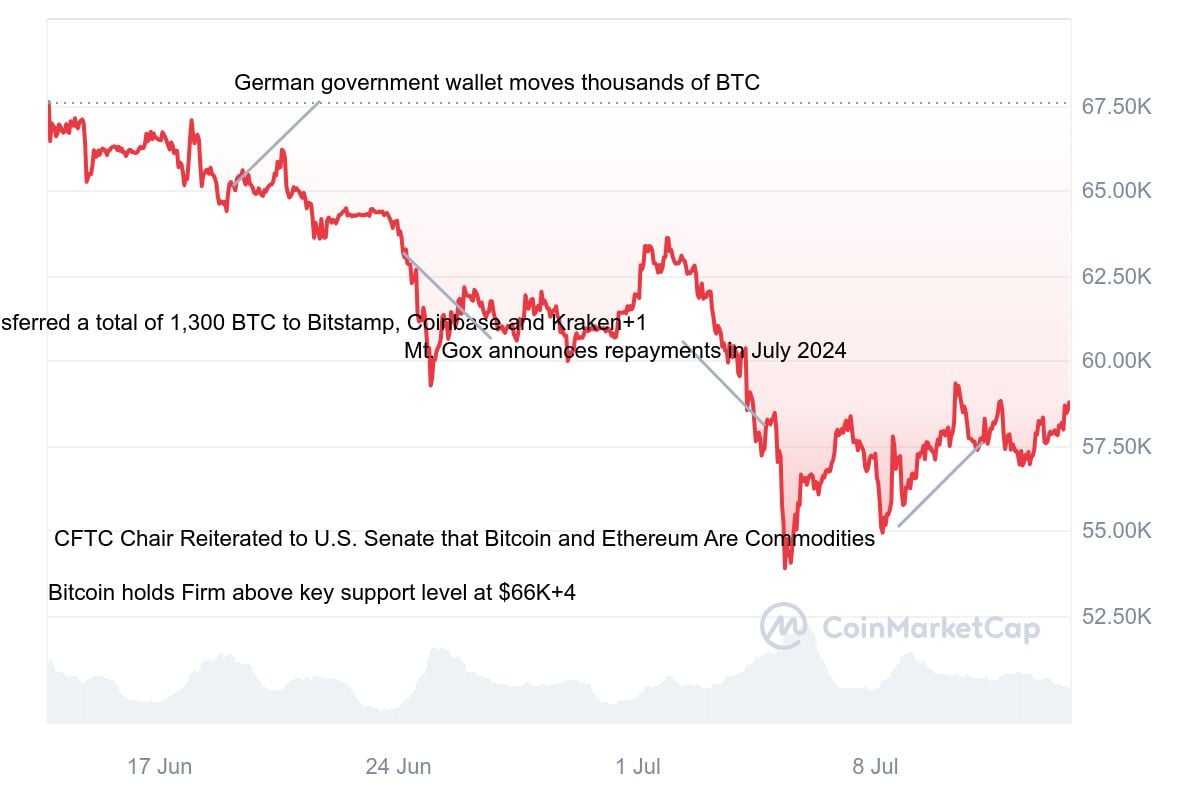

Germany started selling its almost $3 billion holdings in Bitcoin via major exchanges in late June, completing the sell-off this Friday. Putting immense selling pressure, this event caused the BTC price to drop as much as 15% in July.

According to data provided by Arkham, yesterday, Germany sold more than $550 million in BTC.

BTC ready for bull run?

Despite fair concerns and the current “extreme fear” BTC state, this selling pressure met with growing demand coming from BTC ETFs.

germany 🇩🇪 can only sell the seized #bitcoin once. at the rate they're going they'll rage sell the last 5k of it today. this time around #bitcoin ETF buyers were buying up the stream of sells too, welcome to the party guys👍 pic.twitter.com/dIJ4ulbcMN

— Adam Back (@adam3us) July 11, 2024

For instance, this Friday, the total daily inflow of Bitcoin ETFs has reached more than $300 million, according to Farside data. However, the German government BTC sell-off, however impactful, is not the only factor contributing to the crypto market correction at the moment.

Whether the BTC price correction continues or not, some experts believe that institutional investors are currently accumulating funds to “buy the dip.”

About the author

Dan Burgin

Dan is a news editor and writer with 12 years of experience in finance and emerging technologies, with a strong focus on crypto. Covering a broad spectrum of topics, from fintech startups to AI, he provides an in-depth overview of the current state of the crypto market, along with insights into its potential for future disruption.

Advertisement

TopCryptoNewsinYourMailbox

TopCryptoNewsinYourMailbox