Cardano price prediction: How whales could turn ADA’s July prospects

07/14/2024 22:00

There was evidence of Cardano whales accumulating more of the token during the downtrend- is this enough to drive a rally?

- Cardano hinted at a bullish structure beginning to form but the downtrend was not yet reversed.

- Buyers need not FOMO yet but can wait for a pivot level to be flipped to support.

Cardano [ADA] prices bounced by 35% from Monday, the 8th of July to Saturday, the 13th of July. This swift price surge can be attributed to an increase in buying from large holders.

The long-term trend of the token was still bearish but it was likely that the nearby psychological resistance level at $0.5 would be pivotal over the coming days.

This would be the cue that the bearish trend has reversed

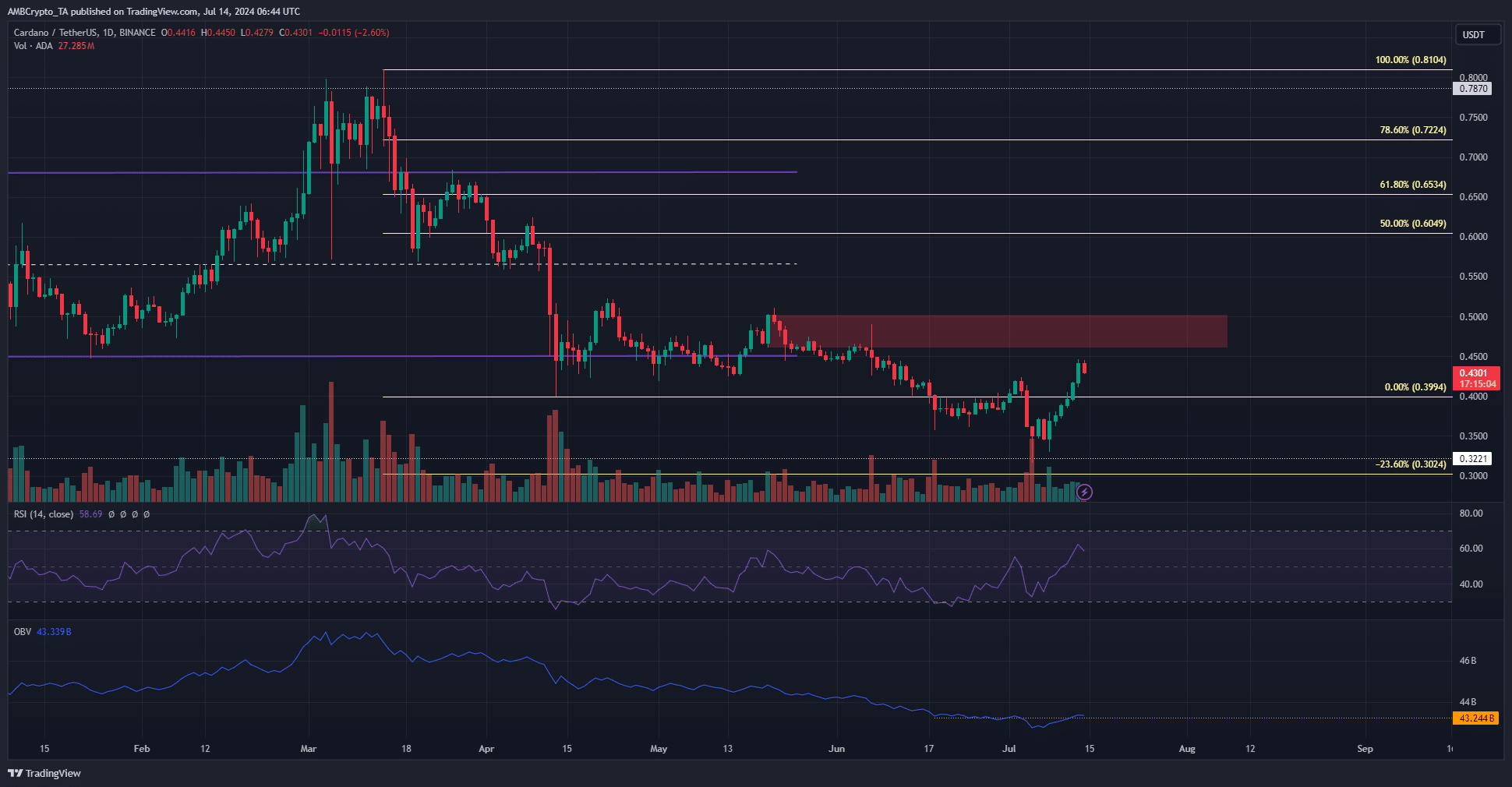

The 1-day price chart has climbed above a recent lower high at $0.4235, which is encouraging in the short-term. It is a signal of a market structure shift, but it does not guarantee an uptrend will follow.

The former range low and the support zone at $0.44-$0.475 were a stiff resistance zone. Additionally, there was a bearish order block (red) at the $0.46-$0.5 region. A daily session close above $0.5 would signal an uptrend can follow. Until then, buyers must remain wary.

The daily RSI shot past the neutral 50 mark, another signal that momentum is shifting bullishly. The OBV climbed past the lows from two weeks ago, an indication that buying pressure underpinned the recent gains.

In the near term, a retest of the $0.42-$0.43 area could offer a buying opportunity targeting $0.46-$0.5.

Whale accumulation had an uptick in the past month

The 30-day change of ADA holding distribution showed that addresses with tokens worth more than $10 million saw a 6.93% rise over the past month.

This reinforced the idea that whales were accumulating during the steady price bleed that the token saw in recent weeks.

Read Cardano’s [ADA] Price Prediction 2024-25

Overall, it appeared likely that Cardano might initiate a move upward to $0.5.

A breakout past that level would be a sign of a long-term uptrend which could extend to the $0.57 and $0.68 levels that were significant earlier this year.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.