PEPE vs Shiba Inu: Which memecoin dominates July’s market?

07/15/2024 14:00

Pepe and Shiba Inu were both trading within a range, but a closer look at the indicators and on-chain metrics showed one of them was bullish.

- Two of the leading memecoins had little on the price charts and metrics to separate them.

- There was evidence for a shift in short-term momentum and slow accumulation for one of them.

Pepe [PEPE] and Shiba Inu [SHIB] were both near the highs of a range for ten days long. The Shiba Inu team posted about a marketplace that would revolutionize Web3 commerce and was in the news recently, although no solid timeline was released.

The recent PEPE rejection from a key resistance meant that its bulls have little to cheer for. Which has the more bullish outlook for July among the two memecoins?

The range and the hurdles ahead

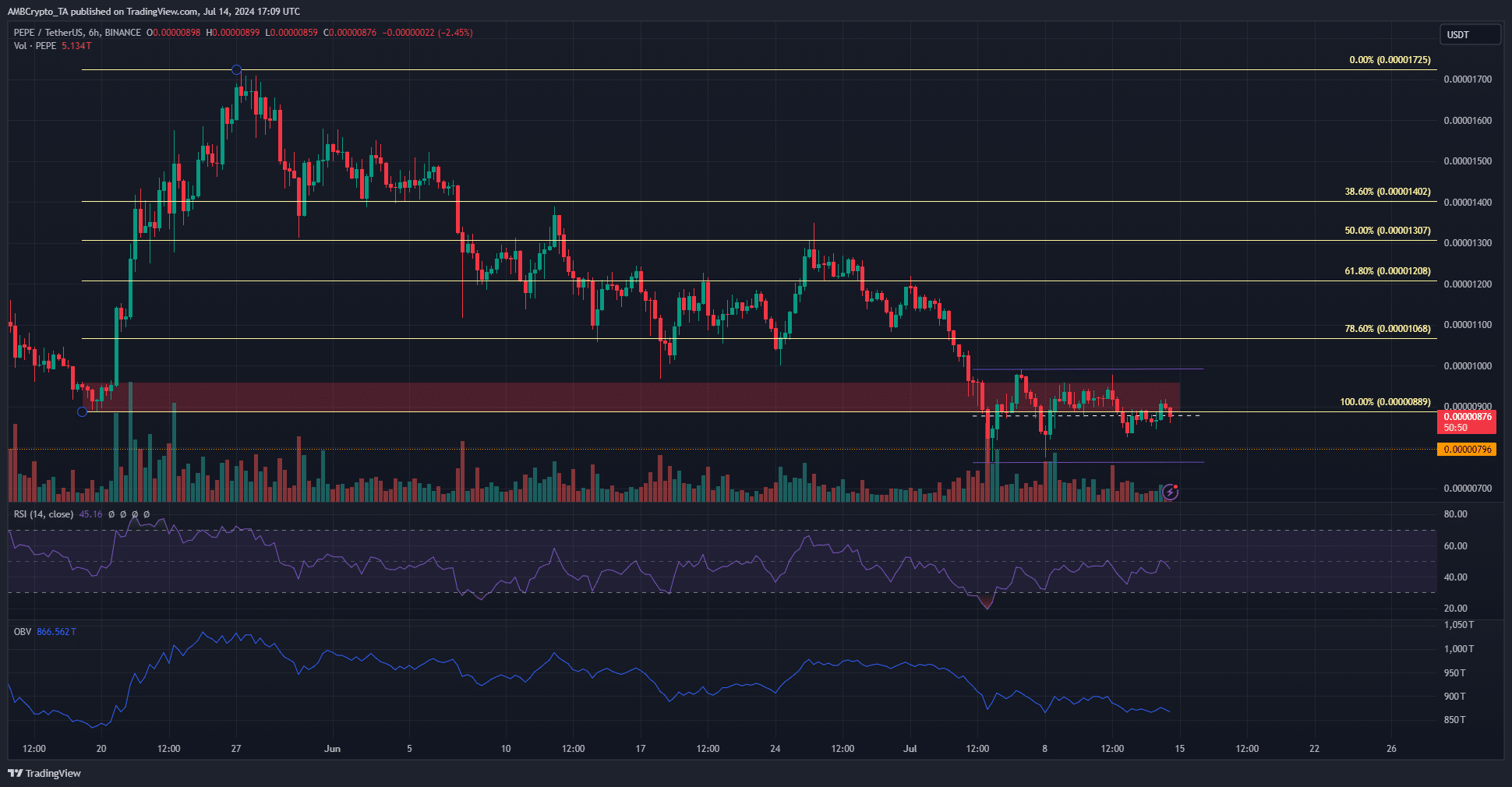

PEPE has traded within a range that reached from $0.0000099 to $0.0000076. At press time, the mid-range level at $0.0000088 was acting as support. The former support at $0.000009-$0.0000096 was flipped to resistance.

The RSI on the 6-hour chart was not yet above neutral 50, and the OBV was also in a downtrend. The buying pressure was not present and further losses are anticipated.

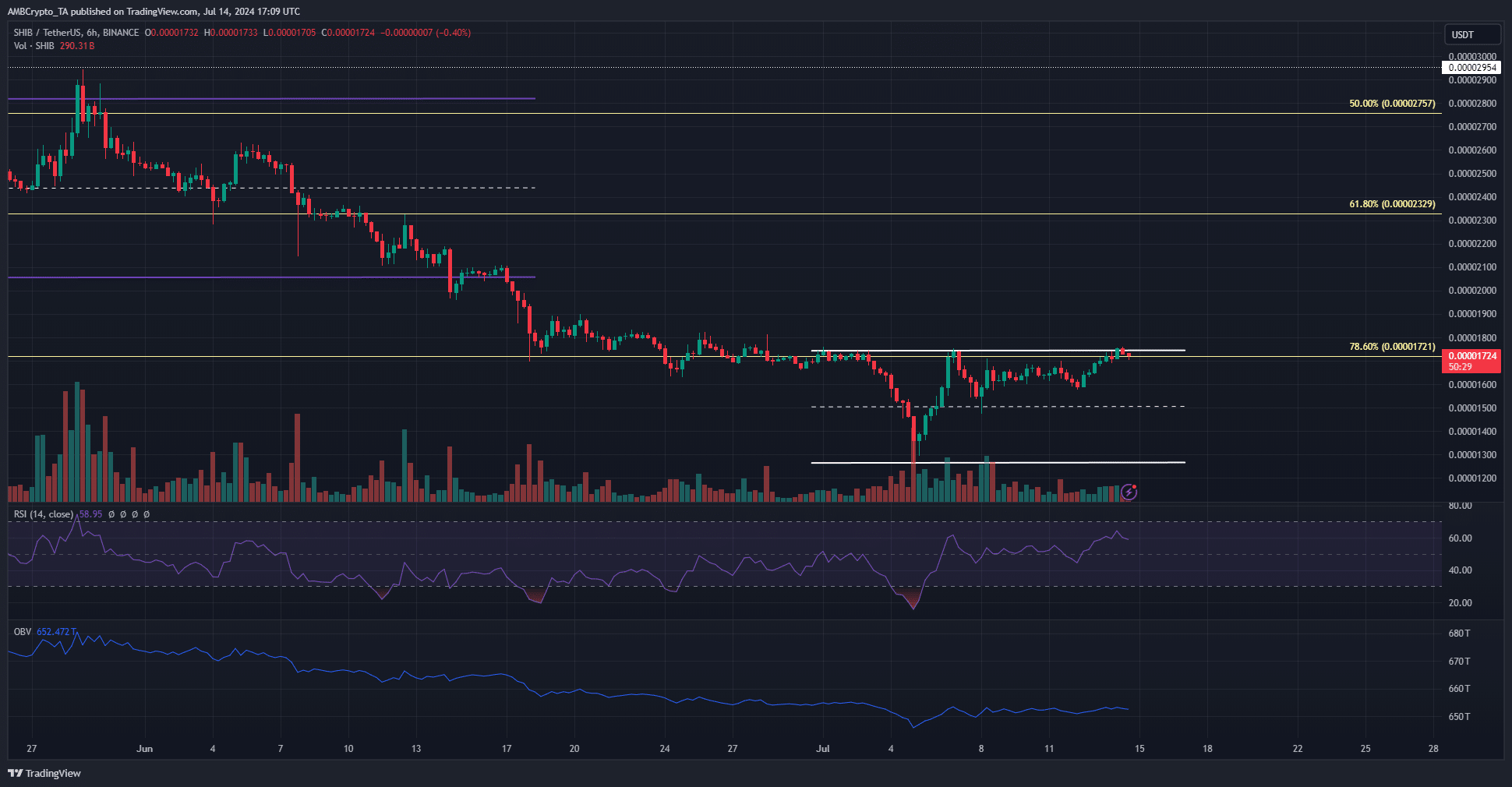

Shiba Inu also formed a range over the two weeks that extended from $0.0000174 to $0.0000127. Shiba Inu had a more bullish short-term outlook. The OBV was moving sideways instead of in a downtrend like Pepe.

The RSI was also above neutral 50 to show upward momentum. Based on technical analysis, Shiba Inu has a more positive short-term outlook, with the price at the range highs and the indicators leaning bullish.

Clashing overvalued signals with one conclusion

The Network Value to Transactions Ratio with circulation spiked high for PEPE, showing it was relatively overvalued.

However, the 30-day MVRV was negative, showing undervalued. The solution is that compared to circulating value, the asset is overvalued, but its short-term price action makes it undervalued for investors, and overall, the token is undervalued.

Organic demand was weakening with the daily active addresses also in a downtrend. The mean coin age was also in a strong downtrend to show distribution.

Together, the on-chain metrics further reinforced PEPE’s weakness in the short term.

The NVT was not as high as it was in late April, but the 30-day MVRV was poking its head into positive territory.

Read Pepe’s [PEPE] Price Prediction 2024-25

The mean coin age has slowly increased over the past month, signaling accumulation.

The daily active addresses were higher for SHIB than PEPE (2325 vs 3738 respectively on the 13th of July) and Shiba Inu had a firmer technical and on-chain basis to have bullish expectations.