Chainlink: Whales scoop up $167M in LINK – New strategy?

07/15/2024 19:00

Chainlink whales moved in recently to take advantage of the market fluctuations and gathered millions of LINK tokens.

- The number of LINK active addresses was over 47,000.

- LINK was now slightly in a bull trend.

Historically, Chainlink [LINK] has consistently attracted the attention of whale investors, particularly during periods of price volatility.

Recent records indicate that this trend has continued, with an increase in whale activity over the last few weeks. Interestingly, despite this spike in whale activity, the number of active Chainlink addresses has remained steady.

Chainlink whales go on a spree

According to data from Lookonchain, recent weeks have seen significant activity among Chainlink holders, particularly from whales or institutional investors.

The data revealed that 93 new wallets have collectively withdrawn approximately 12.75 million LINK tokens from Binance since 24th June.

Additionally, these tokens are valued at around $167 million.

This substantial movement of funds from the exchange indicates strategic positioning by these large holders, reflecting their long-term confidence in LINK or a response to specific market conditions.

LINK supply to whales increase

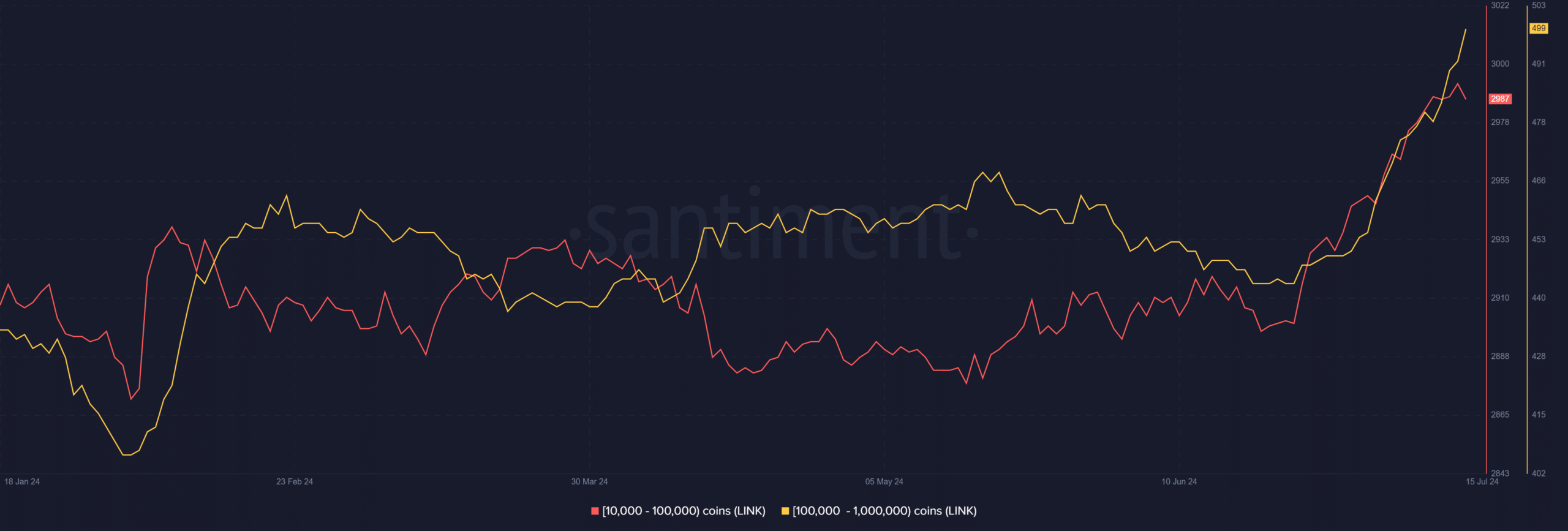

The analysis of Chainlink whale addresses, according to data from Santiment, has shown a notable shift in the distribution of holdings among larger investors.

Specifically, addresses holding between 10,000 and 100,000 LINK tokens have increased from approximately 2,946 to 2,987 since July 1st.

Similarly, wallets holding between 100,000 and 1 million tokens have risen from 451 to 499 over the same period.

In the last two weeks alone, the total value held by these addresses has surged by around $120 million. Such movements can significantly influence the market, as larger holders can impact liquidity and price stability.

Chainlink active addresses stay steady

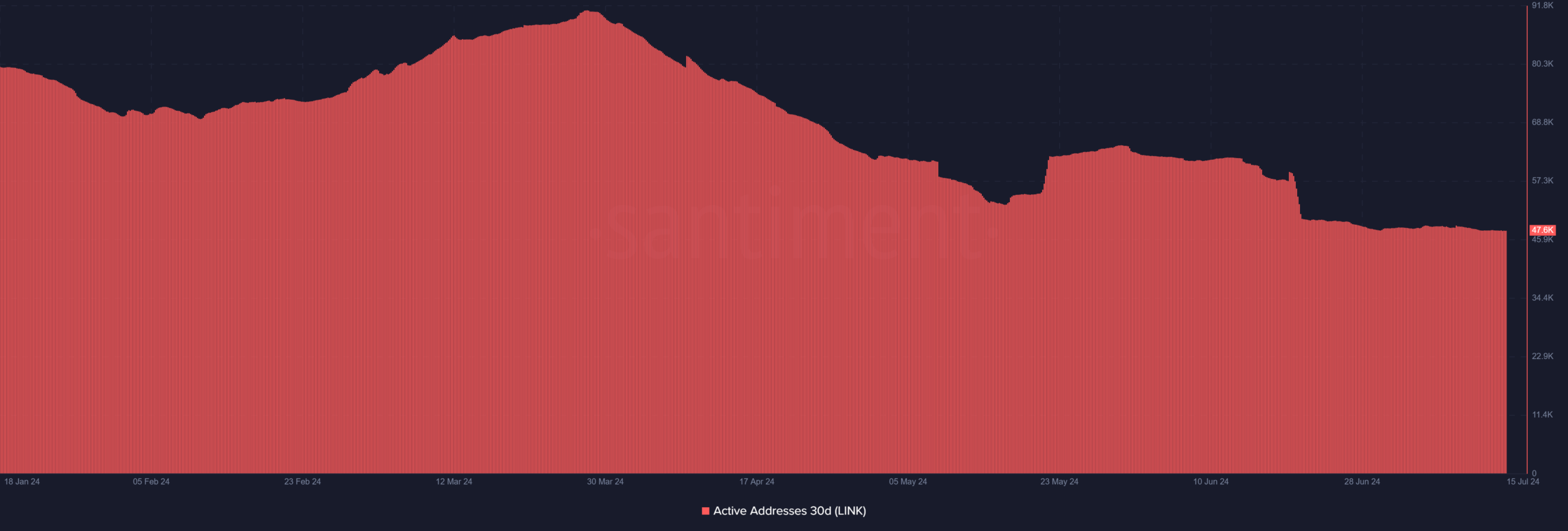

Despite significant movements and activity within whale wallets in the Chainlink network, the overall number of active addresses has shown a steady trend.

According to a 30-day analysis on Santiment, there has been no significant spike in active addresses over the last few weeks.

At the beginning of the month, the number of active addresses was approximately 48,817, and as of the latest data, it stands at around 47,686.

The relative stability suggests that the increased activity among whales has not necessarily translated into broader market participation.

Also, it has not translated to new entries into the Chainlink market.

Realistic or not, here’s LINK market cap in BTC’s terms

Instead, it appears that the existing participants are reshuffling their holdings, which might indicate strategic adjustments rather than an expansion in the user base.

LINK was trading at around $13.7 as of this writing, with an increase of over 2%.