XRP Eyes Explosive 250% Pump in Fund Flows as Ripple v. SEC Verdict Nears

07/15/2024 21:18

XRP investment flows skyrocket 250% as a critical Ripple v. SEC ruling looms

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

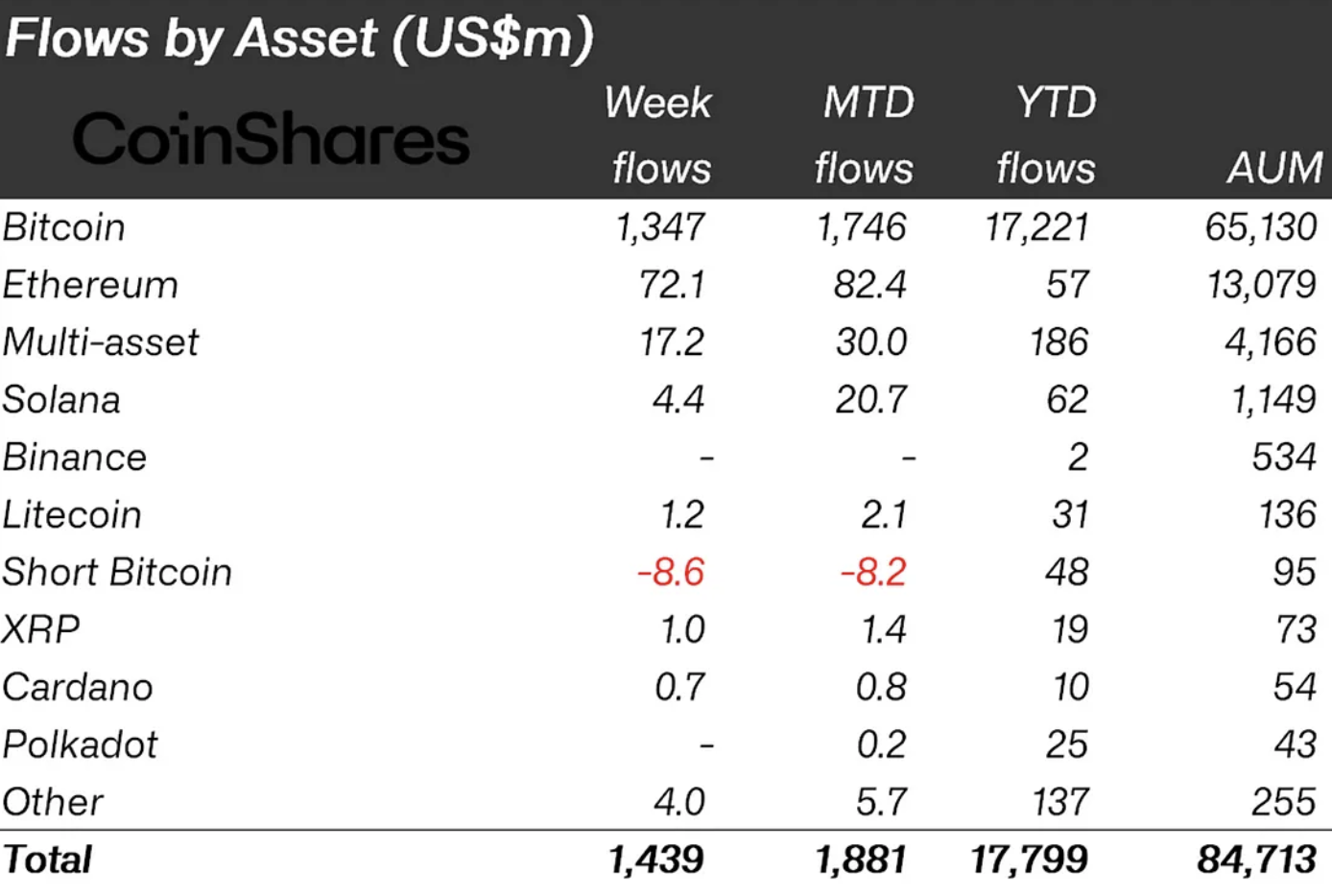

Inflows into XRP-focused investment products surged by 250% in the past week, according to a recent report by CoinShares. Over $1 million flowed into these exchange-traded products last week, up from $400,000 the previous week. This brings the total net flows into XRP ETPs to more than $19 million since the beginning of the year.

This dramatic increase in inflows is likely linked to rising expectations surrounding the SEC's case against Ripple, which may soon reach a conclusion. Currently, the parties are negotiating the final compensation amount, with the SEC demanding $2 billion, while Ripple is seeking no more than $10 million.

This ongoing case follows last year’s pivotal ruling on July 13, 2023, when XRP was officially recognized as a nonsecurity.

Pricing in?

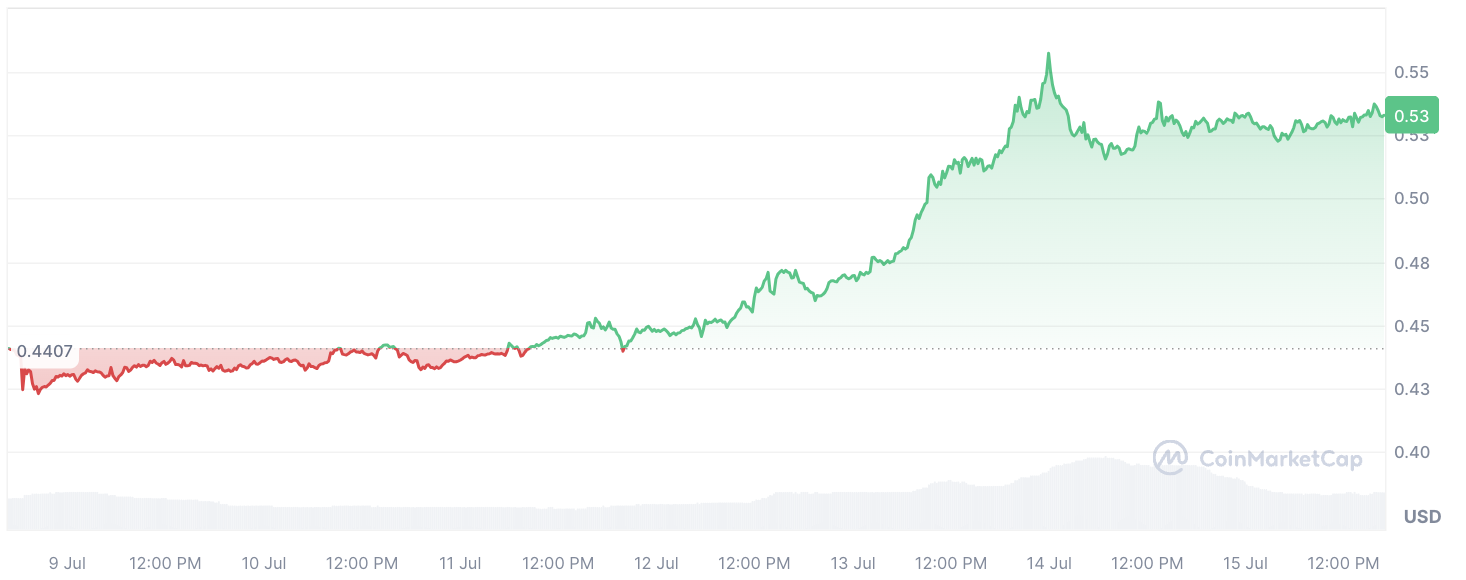

Reflecting these developments, XRP's price also saw significant movement, climbing nearly 25% last week in anticipation of the one-year anniversary of that landmark decision. As the situation between Ripple and the SEC intensifies, the influx of investment capital into XRP underscores growing optimism among investors.

All eyes are now on July 18, a crucial date, as the SEC plans a closed meeting, potentially to finalize the lawsuit against Ripple and discuss a settlement strategy. This upcoming decision could further influence market dynamics and investment flows into XRP, as stakeholders await clarity on the future of this prominent digital asset.