NewsBriefs - Bloomberg analyst says Ethereum ETFs to launch July 23

07/16/2024 02:43

Bloomberg ETF analyst Eric Balchunas predicts spot Ethereum ETF trading in the US to start July 23. SEC is asking issuers to submit final S-...

Editor-curated news, summarized by AI

Bloomberg analyst says Ethereum ETFs to launch July 23

Bloomberg ETF analyst Eric Balchunas predicts spot Ethereum ETF trading in the US to start July 23. SEC is asking issuers to submit final S-1 forms by July 17. Most issuers left fees out of initial filings, likely to gauge competition. The launch coincides with the Bitcoin Conference in Nashville. Bitwise CIO forecasts $15 billion in inflows for Ethereum ETPs by end of 2025. This development paves the way for potential approval of other crypto ETFs, with VanEck and 21Shares already filing for Solana ETFs.

Latest

-

Bloomberg analyst says Ethereum ETFs to launch July 23

Bloomberg ETF analyst Eric Balchunas predicts spot Ethereum ETF trading in the US to start July 23. SEC is asking issuers to submit final S-1 forms by July 17. Most issuers left fees out of initial filings, likely to gauge competition. The launch coincides with the Bitcoin Conference in Nashville. Bitwise CIO forecasts $15 billion in inflows for Ethereum ETPs by end of 2025. This development paves the way for potential approval of other crypto ETFs, with VanEck and 21Shares already filing for Solana ETFs.

Expand

-

BlackRock CEO declares Bitcoin a legitimate financial instrument

BlackRock CEO Larry Fink, once a Bitcoin skeptic, now endorses it as a legitimate financial instrument. Fink views Bitcoin as digital gold with industrial uses, offering uncorrelated returns and financial control in uncertain times. BlackRock's involvement was crucial in approving Bitcoin and Ethereum spot ETFs in the US. The firm has also entered the tokenization space with its BUIDL fund, which has over $524 million in tokenized US Treasuries on Ethereum.

Expand

-

US district court judge delays Tornado Cash co-founder's trial

A US judge delayed Tornado Cash co-founder Roman Storm's money laundering trial by three months. The defense cited complex legal issues and extensive documentation needing translation. Key arguments revolve around whether a decentralized service can be controlled by founders. The case highlights ongoing debates about crypto mixers' legality and use. Storm's co-developer, Alexey Pertsev, was recently convicted in the Netherlands, impacting privacy-focused crypto services globally.

Expand

-

Lazarus group moves millions from DMM Bitcoin hack

Hackers linked to the Lazarus group have laundered over $35 million from the $305 million DMM Bitcoin hack through a Cambodian marketplace. The funds were mixed, bridged to other chains, and converted to USDT before transfer. Tether blacklisted a wallet address, blocking $28.2 million. This hack is part of a trend targeting centralized exchanges, with over $1.4 billion in crypto stolen in 2024 so far.

Expand

-

XRP shows potential for 30% gain against Bitcoin as triple bottom forms

XRP is poised for a comeback against Bitcoin, with a triple bottom pattern indicating a potential 30% rebound. The XRP/BTC pair is testing neckline support at 793 satoshis, with an RSI of 36 suggesting XRP is undervalued. Bitcoin's recent sell-off, driven by German government sales and Mt. Gox reimbursements, has benefited XRP. Bitcoin dominance has dropped, hinting at a rotation into altcoins. XRP's weekly RSI is rebounding from a two-year low, historically signaling significant rallies. The potential for an XRP ETF adds to its bullish outlook.

Expand

-

Bitcoin bounces off $56,500 support as institutional investors add 100k BTC

Bitcoin rebounded from $56,500, showing demand at lower levels. Institutional investors bought 100,000 BTC in a week, viewing dips as buying opportunities. The German government's Bitcoin selling is mostly complete, but traders are watching potential selling by Mt. Gox creditors. Altcoins' recovery has slowed due to Bitcoin's weak performance, but bulls are holding positions. The crypto market remains cautious as selling pressure persists.

Expand

-

MakerDAO announces $1B tokenized treasury investment plan

MakerDAO plans to invest $1B of its reserves in tokenized US Treasury products. BlackRock's BUIDL, Ondo Finance, and Superstate are set to apply for the open competition starting next month. This move signals a major shift in MakerDAO's reserve strategy and could boost the $1.85B tokenized real-world asset space by 55%. The investment will be funded by redirecting $500-$500M from existing vaults. This initiative follows ArbitrumDAO's recent $27M allocation to tokenized offerings.

Expand

-

EU continues support for blockchain-based sustainability solutions

The EU has extended its partnership with ChromaWay to develop blockchain-based sustainability solutions. ChromaWay showcased advancements in decentralized apps for Digital Product Passports and IP rights. Their relational blockchain technology combines relational database flexibility with blockchain security. Chromia, a public layer-1 platform, will launch its mainnet on July 16. The EU's positive assessment aligns with its strategy to integrate blockchain solutions across sectors. Further evaluations and workshops are planned for 2024 and 2025.

Expand

-

Dutch court rejects bail for Tornado Cash dev Alexey Pertsev

A Dutch court denied bail for Tornado Cash developer Alexey Pertsev, convicted of money laundering $2.2 billion in crypto. Pertsev's lawyers argued he wasn't a flight risk and needed internet access for his appeal. The court rejected these claims, upholding his 64-month sentence. This case has sparked concerns in the open-source community about developer liability for user actions, especially regarding privacy tools. Fellow dev Roman Storm faces similar charges in the US.

Expand

-

US CPI data for June lower than expected, boosting crypto and equity markets

Bitcoin and the broader crypto market rallied after cooler-than-expected US CPI data for June. The unadjusted annual core CPI rate was 3.3%, below the 3.4% forecast. This sparked gains in Bitcoin, Ether, and major stock indices. Interest rate traders increased the likelihood of a September rate cut, potentially boosting liquidity and risk appetite for crypto and equities. The global crypto market cap rose to $2.29 trillion, up 1.6% in 24 hours.

Expand

-

Trump to speak at Bitcoin 2024 conference in Nashville

Former US President Donald Trump will speak at Bitcoin 2024 in Nashville, showcasing his growing support for crypto. Trump has pledged to advocate for Bitcoin mining if re-elected and now accepts crypto donations. Other politicians, including Robert F. Kennedy Jr., will also speak at the event. Biden's campaign is engaging with the crypto industry, while prediction markets favor Trump for the upcoming election.

Expand

-

BitMEX pleads guilty to violating Bank Secrecy Act

Crypto exchange BitMEX admitted guilt for violating the Bank Secrecy Act by operating without a proper Anti-Money Laundering program from 2015 to 2020. The US Department of Justice stated that BitMEX facilitated large-scale money laundering and sanctions evasion. The exchange faces potential fines and prison time for responsible parties. This case highlights the importance of crypto companies complying with US laws when operating in the US market.

Expand

-

Biden advisor and crypto leaders discuss industry future at DC roundtable

Crypto leaders, lawmakers, and a Biden advisor met in DC to discuss the industry's future. Key topics included debanking, SEC actions, and crypto custody. Attendees called for White House support of legislation over litigation. The meeting was seen as productive, with the Biden administration showing engagement on crypto issues. Industry leaders emphasized the need for clear support from the administration as elections approach.

Expand

-

Cambodian firm linked to ruling family runs $11B crypto scam operation

A Cambodian online marketplace, Huione Guarantee, is implicated in an $11b crypto scam operation with ties to the prime minister's family. The platform has received over $11b since 2021, with strong indications of illicit activity. Merchants openly offer money laundering services and tools for "pig butchering" scams. Hun To, cousin of PM Hun Manet, is a director in a related company. This development highlights the industrial-scale proportions of crypto fraud in Southeast Asia, with Huione Guarantee acting as a clearing house for thousands of instant messaging app channels.

Expand

-

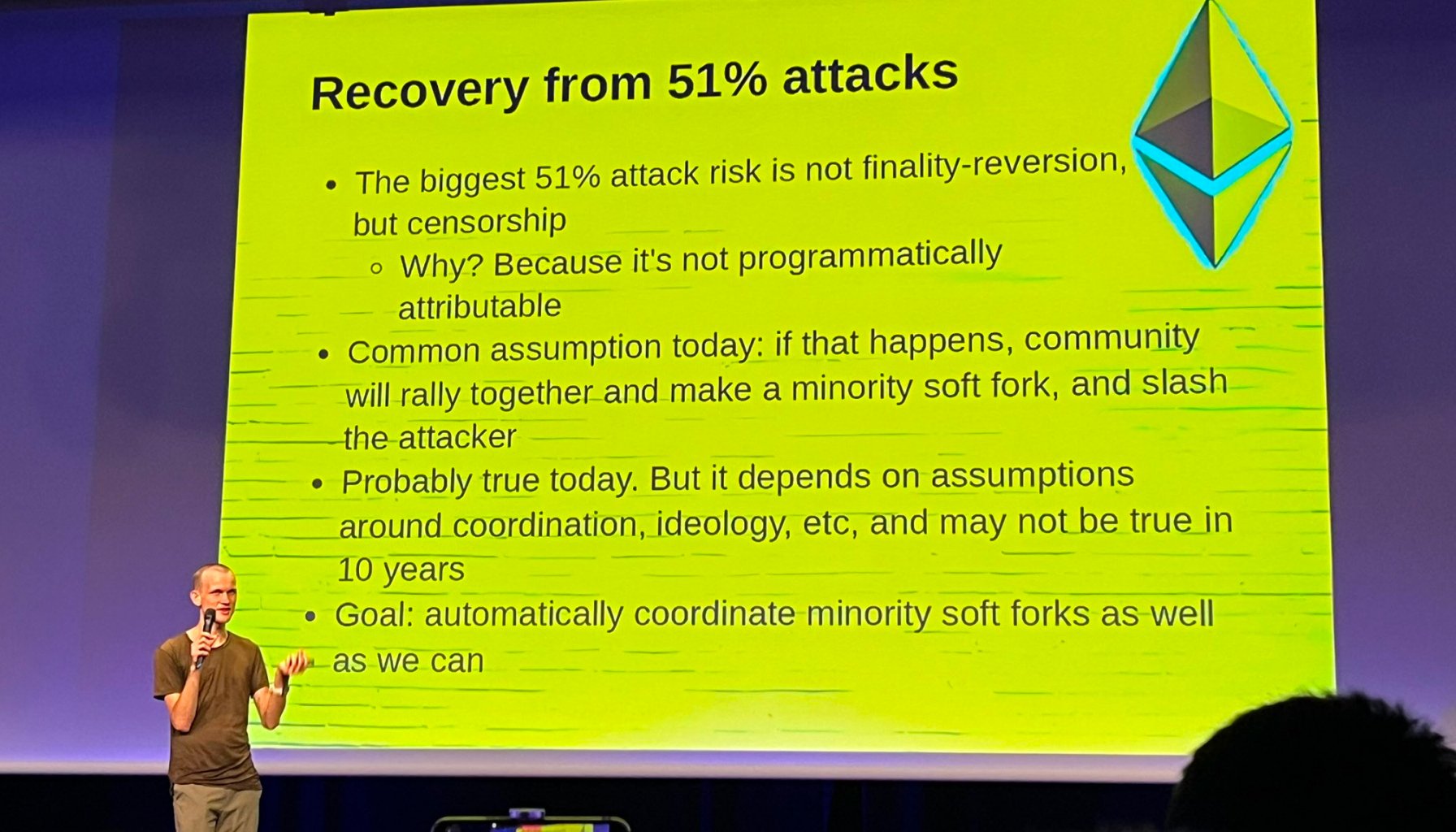

Ethereum co-founder calls for automated defenses against 51% attacks

Vitalik Buterin advocates for Ethereum to develop automated responses to potential 51% attacks and censorship threats. He emphasizes the need for validator nodes to run software capable of detecting and counter-censoring majority chain censorship. Buterin also suggests wider adoption of light clients, support for zk-EVM verification, and addressing quantum resistance concerns. These proposals aim to enhance Ethereum's resilience and improve its functionality for developers and users.

Expand