SHIB price prediction: After outdoing PEPE, will Shiba Inu surge another 15%?

07/16/2024 04:00

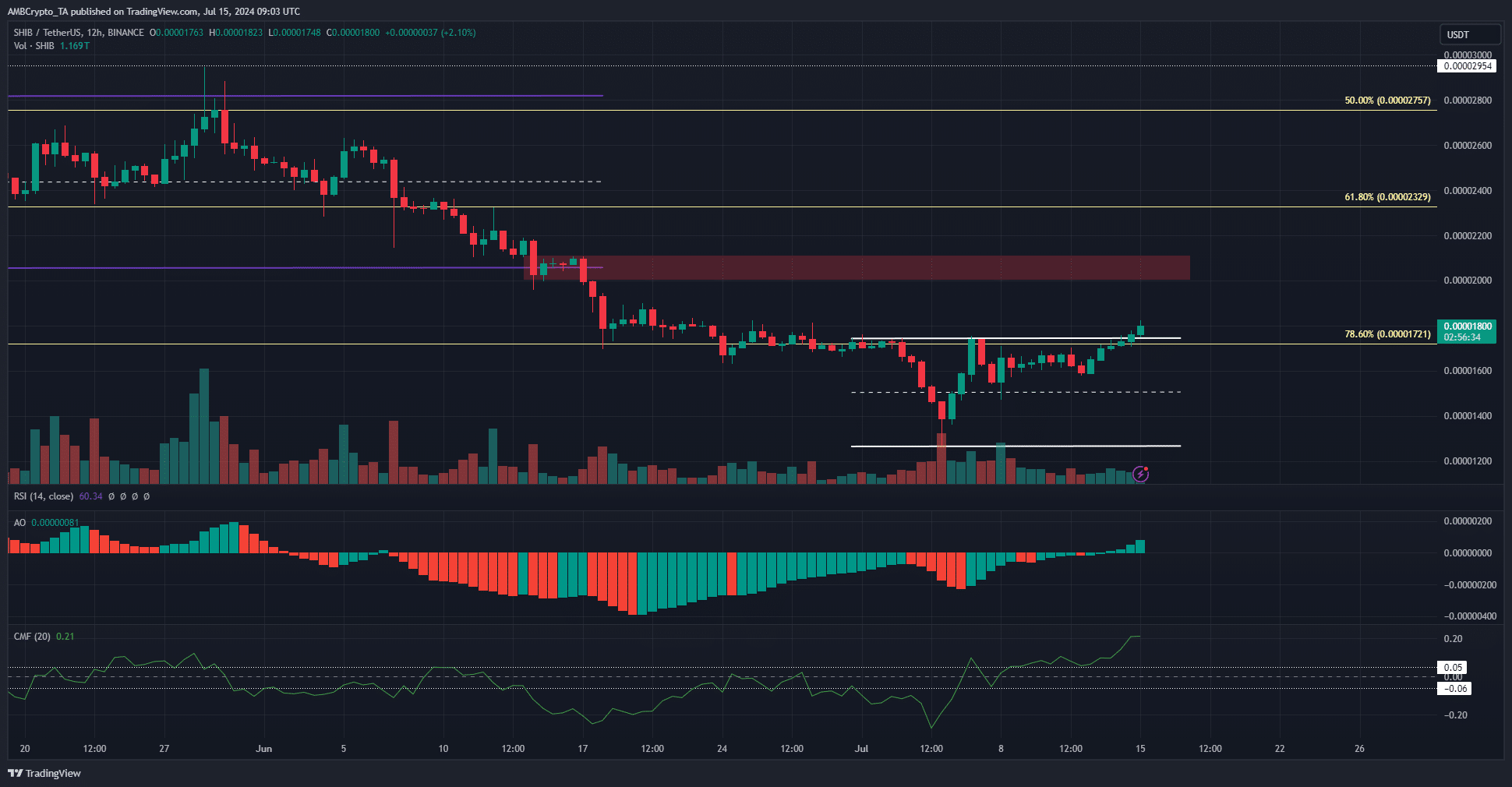

The SHIB price prediction was strongly bullish in the near-term but analysis of futures market data showed traders lacked conviction so far.

- SHIB’s higher timeframe market structure and price trend were in bearish favor.

- The price can climb another 15% this week.

Shiba Inu [SHIB] managed to climb past a short-term range and has gained 15% since the low it posted on Friday the 12th of July.

In doing so, it has outperformed Pepe [PEPE] in the short-term, and its on-chain metrics signaled that more gains were likely.

The week’s trend sometimes gets established on Mondays. What is the SHIB price prediction, and should traders anticipate a strong bullish run soon?

The trend breakout was telegraphed

The recent report highlighted the short-term bullish metrics of SHIB and how they generated a buy signal. On the 6-hour chart, a session close above the range highs at $0.000017 has occurred.

The Awesome Oscillator also noted a bullish crossover and was rising higher to reflect the growing upward momentum. The CMF has been above +0.04 over the past week, a sign that buying pressure was consistent.

This concerted effort has begun to pay dividends. To the north, the $0.00002-$0.000021 supply zone was the immediate bullish target.

The higher timeframe charts such as daily and weekly showed that the memecoin has not bucked the gradual downtrend it has been on since April.

Evidence that traders don’t believe in SHIB

The technical analysis showcased a bullish SHIB price prediction, but data from the Futures market showed participants were wary of the momentum.

The Funding Rate was negative despite the price gains, and the Open Interest did not increase over the weekend.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

The liquidations chart showed short positions liquidated in the late hours of Sunday, which should fuel further price hikes.

Overall, the wider market disbelief might be turned into FOMO if Shiba Inu continues to climb.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.