THESE mixed signals mean PEPE’s short-term holders should be careful

07/21/2024 01:00

The circulation and velocity metrics of PEPE showed HODLing behavior. This is a bullish combination, but accumulation was not yet...

- PEPE showed bullish signs from a price action perspective

- On-chain metrics yielded mixed results, and a long squeeze seemed possible

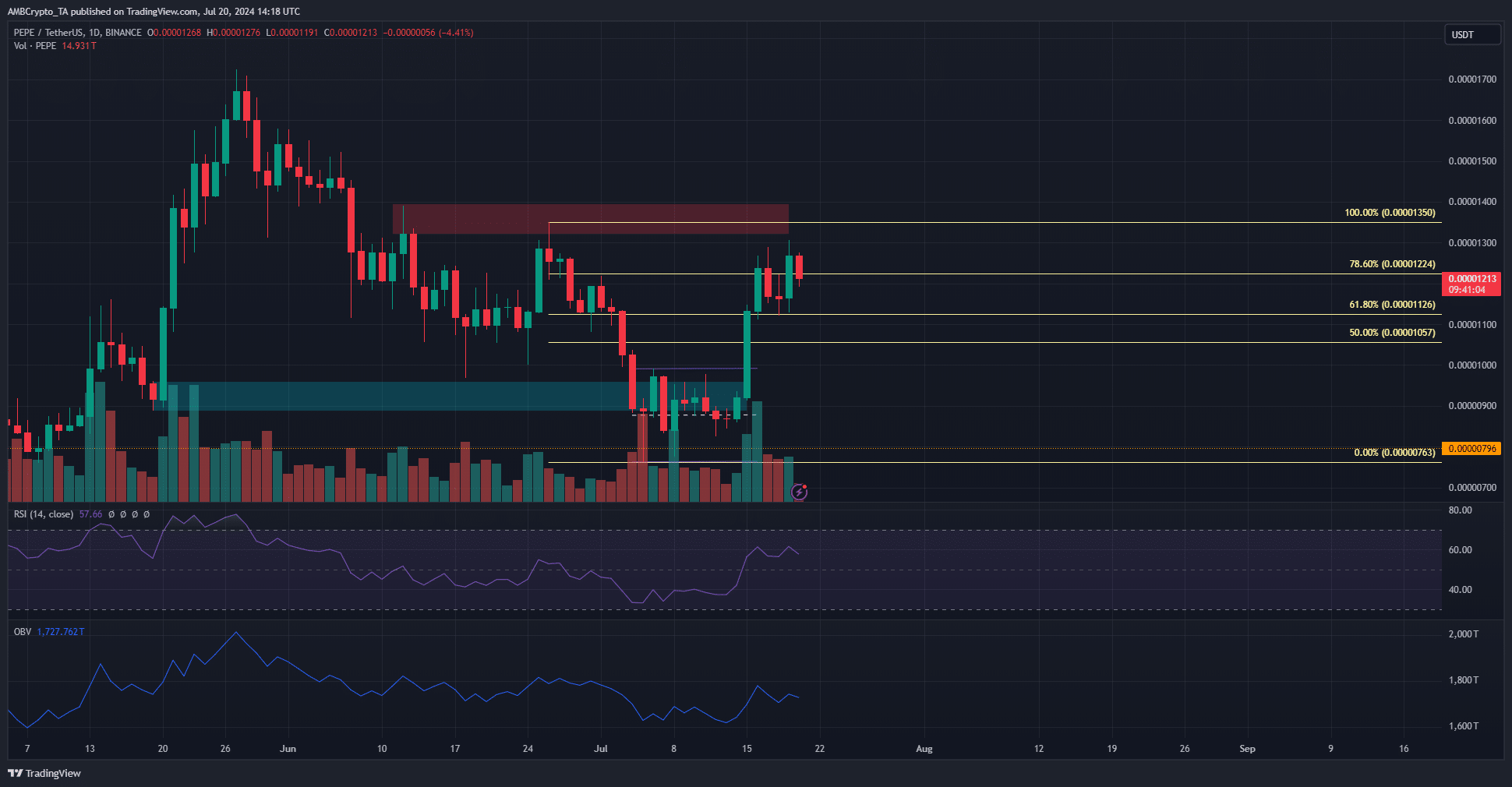

PEPE burst out past a short-term range on 15 July and rose to test the $0.000013-$0.000014 resistance zone. The buying pressure was weak despite the momentum shift, and the higher timeframe market structure remained in place too.

The OBV was unable to clear the recent highs from late June, but the RSI’s jump was an early sign of bullish momentum. Additionally, the price pierced the 78.6% retracement level of the late June drop from $0.0000135 to $0.00000763.

Technical analysis showed bullish signals, and AMBCrypto investigated further to see if PEPE could continue its uptick.

Velocity, circulation metrics give a spark of hope

The supply distribution showed coins of all wallet sizes, except the very largest (1B+ tokens), rose in recent weeks. In fact, there haven’t been any size of holders, whale or shrimp, who have consistently sold their PEPE in the last two months.

The circulation metric trended downwards in June. The reduced circulation indicated scarcity and reduced selling pressure. The velocity was also lower than it was in late May.

Together, low circulation and low velocity seemed to indicate HODLing behavior – Both bullish for the memecoin.

PEPE accumulation is young, but underway

Dormant circulation saw a large spike earlier this month when the price formed its local lows around the $0.00000084-region. It showed a large wave of selling. The 30-day MVRV was positive and highlighted that short-term holders were accruing a small profit.

Meanwhile, the mean coin age has been falling since late May. Over the past week, the mean coin age has risen, but this uptick needs to be sustained to signal network-wide accumulation.

Read Pepe’s [PEPE] Price Prediction 2024-25

The Open Interest has been tepid over the last three days, but the funding rate picked up noticeably. The spate of short liquidations on 19 July was followed by an 8% drop from $0.000013 to $0.00001196.

Overall, the rising funding rate without OI suggested traders can expect volatility. Alas, it could struggle to breach the $0.000014 resistance.