Ripple v. SEC: XRP ETPs Skyrocket With $500,000 Ahead of Ruling

07/22/2024 23:04

XRP ETPs are surging with cool $500,000 boost as all eyes turn to upcoming Ripple v. SEC showdown — Could game-changing ruling be just around corner?

XRP ETPs are surging with cool $500,000 boost as all eyes turn to upcoming Ripple v. SEC showdown — Could game-changing ruling be just around corner?

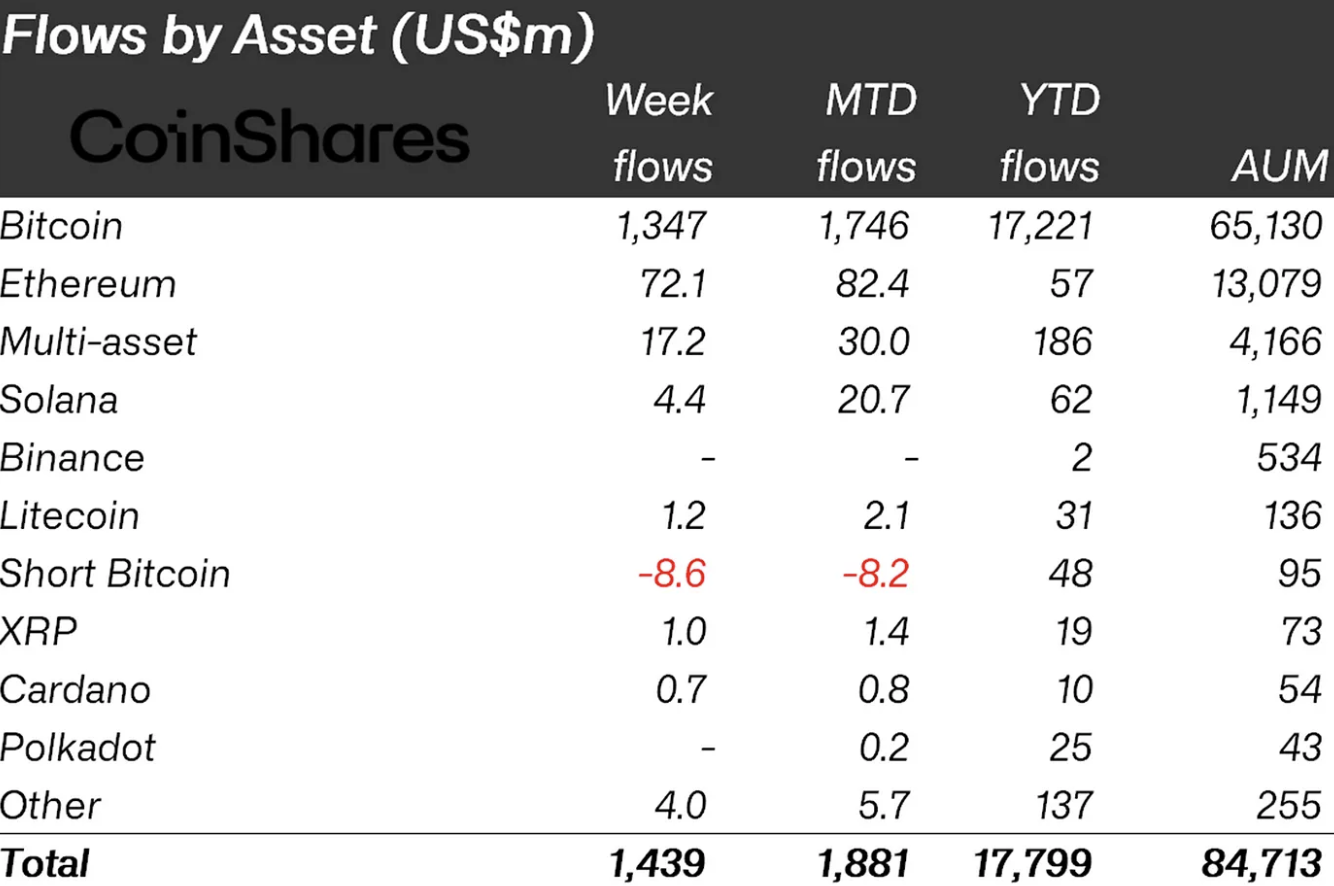

According to the latest report from CoinShares, inflows into XRP-focused investment products surged by $500,000 in the past week. While this is a significant decrease from the previous week's inflow of over $1 million, it still represents half a million dollars of inflows.

This latest surge brings the total net flows into XRP exchange-traded products (ETPs) to more than $19 million since the start of the year.

The rise is likely connected to heightened expectations surrounding the SEC's case against Ripple. The legal battle, which is approaching a pivotal moment, has led traders and enthusiasts to speculate about a potential settlement or resolution on July 25.

Ripple v. SEC

As reported by U.Today, the SEC rescheduled a key closed meeting by a week, further fueling speculation about the case's outcome. Currently, the SEC is demanding billions in compensation, while Ripple is seeking a much lower amount of $10 million.

The anticipation of this ruling has also impacted XRP’s market performance, with the popular cryptocurrency experiencing a price increase of nearly 50% last week. This uptick coincides with the approaching one-year anniversary of the landmark decision, when XRP was officially recognized as a nonsecurity.

Thursday, July 25, is now a focal point, as the closed meeting could potentially finalize the lawsuit and discuss a settlement between Ripple and the SEC. With the ongoing inflows into XRP ETPs, it seems that investor optimism remains high, unless an unexpected development occurs.

About the author

Gamza Khanzadaev

Financial analyst, trader and crypto enthusiast.

Gamza graduated with a degree in finance and credit with a specialization in securities and financial derivatives. He then also completed a master's program in banking and asset management.

He wants to have a hand in covering economic and fintech topics, as well as educate more people about cryptocurrencies and blockchain.

Advertisement

TopCryptoNewsinYourMailbox

TopCryptoNewsinYourMailbox