NewsBriefs - NYSE Arca confirms approval to list spot Ethereum ETFs from Grayscale and Bitwise

07/22/2024 22:39

NYSE Arca certified its approval to list and trade spot Ethereum ETFs from Grayscale and Bitwise. Issuers await SEC's final sign-off for reg...

Editor-curated news, summarized by AI

NYSE Arca confirms approval to list spot Ethereum ETFs from Grayscale and Bitwise

NYSE Arca certified its approval to list and trade spot Ethereum ETFs from Grayscale and Bitwise. Issuers await SEC's final sign-off for registration statements, expected Monday. Cboe disclosed five spot Ethereum ETFs, including Fidelity's, will launch Tuesday. This follows the SEC's approval of 19b-4 forms in May, marking a significant step for crypto ETFs in the US market.

Latest

-

Boden trader loses $8M as memecoin season gains momentum

A trader lost nearly $8M trading the Biden-linked BODEN token, with the investment down 99%. Despite this, the memecoin sector shows signs of growth. MOG reached a new all-time high with an $820M market cap, while MEW surged 39% in 24 hours. Traders anticipate a potential memecoin season, with many tokens expected to hit new highs. The memecoin index against Bitcoin suggests the next leg of the bull cycle may be approaching for these crypto assets.

Expand

-

ETH price may fluctuate as spot ETFs launch on July 23

Spot Ethereum ETFs are set to launch on July 23, potentially impacting ETH price. Kaiko reports initial inflows could affect crypto valuation. Grayscale plans to convert ETHE trust into a spot ETF with a $1 billion seed. Most issuers offer competitive fee waivers. ETH implied volatility increased, indicating uncertainty around the launch. The market anticipates quick asset accumulation, but a full demand picture may take months to emerge.

Expand

-

NYSE Arca confirms approval to list spot Ethereum ETFs from Grayscale and Bitwise

NYSE Arca certified its approval to list and trade spot Ethereum ETFs from Grayscale and Bitwise. Issuers await SEC's final sign-off for registration statements, expected Monday. Cboe disclosed five spot Ethereum ETFs, including Fidelity's, will launch Tuesday. This follows the SEC's approval of 19b-4 forms in May, marking a significant step for crypto ETFs in the US market.

Expand

-

Bitcoin may experience breakout before US elections according to QCP Capital

QCP Capital analysis suggests Bitcoin could rally before US presidential elections. Recent volatility in crypto markets, influenced by political events, has seen Bitcoin fluctuate between $61,000 and $67,000. Institutional interest in $100,000 call options for December remains strong, indicating confidence in a potential year-end surge. Increased options market volatility points to expectations of extreme market movements. QCP Capital favors trades with upside potential, offering a "BTC ETF Win-Range" trade with 5x returns for Bitcoin settling between $90,000 and $110,000 by December 27.

Expand

-

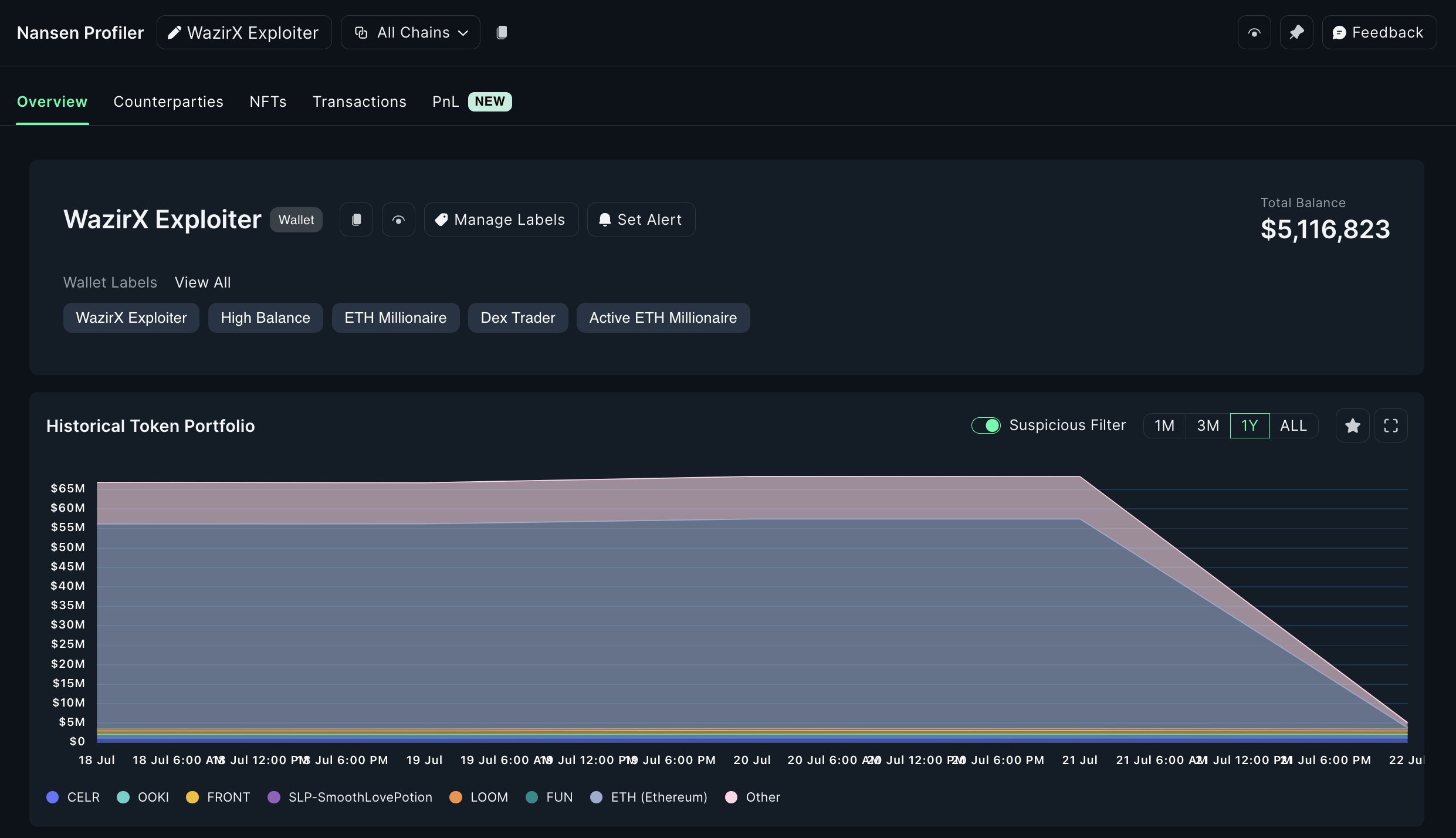

WazirX exploiter moves and sells $8.7 million worth of stolen crypto

The WazirX exploiter has resumed fund movements, selling $8.7 million in stolen crypto assets. They moved and liquidated 21.16 billion BOB ($800,000) and 6.7 million CHR ($1.6 million), converting proceeds to 2,501 ETH. The funds were transferred to a new address. The exploiter still holds $5 million in various tokens, including CELR, OOKI, and FRONT, which may be sold soon given recent activity.

Expand

-

SEC chair Gary Gensler likely to resign in early 2025 says research firm

10X Research predicts SEC Chair Gary Gensler will likely resign in early 2025 after Biden's term ends. The firm's founder, Markus Thielen, cites Biden's withdrawal from the presidential race as a key factor. Thielen also suggests potential bullish catalysts for crypto, including rumors of Trump announcing Bitcoin as a strategic reserve asset at an upcoming conference. Analysts remain optimistic about Bitcoin's outlook despite recent US political turmoil.

Expand

-

Keplr wallet adds EVM support to serve modular community

Keplr, the top Cosmos wallet app, is integrating Ethereum and Layer 2 support. This move aims to strengthen its multi-chain position, attract users active across Cosmos and EVM chains, and support modular projects. The beta release is expected within weeks, implementing EIP-6963 for multi-injected providers. This expansion aligns with Keplr's cross-chain vision and targets existing users who also use EVM wallets.

Expand

-

WazirX launches bounty program to recover stolen crypto assets

WazirX, a major Indian crypto exchange, has initiated a bounty program to recover assets stolen in a recent cyberattack. The exchange has filed a police complaint, reported the incident to authorities, and is collaborating with over 500 exchanges to block identified addresses. WazirX is also engaging expert groups for transaction tracking and working with law enforcement agencies. The hack resulted in a loss of approximately $235 million, making it the second-largest centralized exchange breach recently. The exchange still holds over $104 million in unoffloaded funds.

Expand

-

Wintermute seeks up to $300 million funding from Tencent and others investors

Crypto trading firm Wintermute is in talks with Tencent and other investors to raise up to $300 million at a $2 billion valuation. The deal includes new stock sales and potential share sales from early investors and employees. Wintermute, a major market maker, is capitalizing on the crypto market recovery and Trump's crypto-friendly agenda. The firm operates on over 50 platforms and has facilitated nearly $5 trillion in trading volume. Wintermute recently secured a role in Hong Kong's spot-crypto ETFs and last raised $20 million in 2021.

Expand

-

CBOE announces July 23 launch for Franklin Ethereum ETF

CBOE set July 23 as the launch date for the Franklin Ethereum ETF, pending regulatory approval. This follows the SEC's May 23 rule changes allowing spot Ether ETF listings. ETH ETF issuers are offering fee waivers to gain market share. Analysts predict up to $10 billion in net inflows for Ether ETFs post-launch. The crypto industry anticipates significant market impact from these new ETF products.

Expand

-

Grayscale plans Bitcoin ETF spinoff from GBTC fund

Grayscale announced plans to spin off 10% of its Grayscale Bitcoin Trust (GBTC) into a new ETF called Grayscale Bitcoin Mini Trust (BTC). The new ETF is set to trade on NYSE Arca, pending regulatory approval. Current GBTC shareholders will receive proportional shares in the Mini Trust, maintaining their total Bitcoin holdings across two funds. This move follows a similar strategy with Grayscale's Ethereum Trust. Industry analysts expect the new Mini Trust to have significantly lower management fees compared to GBTC's current 1.5% annual fee.

Expand

-

Galaxy Digital boosts staked Ethereum to $3.3 billion following new acquisition

Galaxy Digital acquired CryptoManufaktur's assets, adding $1 billion in Ethereum AUS and boosting total AUS to $3.3 billion. The deal enhances Galaxy's blockchain infrastructure and staking capabilities, with CMF's engineering team joining Galaxy. This acquisition strengthens Galaxy's position as a leading technical partner for protocols and builders in the crypto ecosystem.

Expand

-

Binance US gets court approval to invest $40M into treasury bills

A US court approved Binance US to invest $40 million of customer fiat in US Treasury bills. The exchange will make investments through TreasuryDirect in $10 million increments over four weeks. The court also authorized Binance US to use third-party advisors for corporate asset management and transfer custodied assets to a US-based third-party custodian. In related news, Binance assisted the FBI in recovering $2.5 million USDT from a pig butchering scam, a prevalent crypto fraud scheme that caused $2 billion in losses in 2022.

Expand

-

Rho Markets suffers $7.5 million potential exploit on Scroll blockchain

Rho Markets, a Scroll-based money market, experienced a $7.5 million potential exploit. The Scroll blockchain was temporarily halted to assess the situation. An MEV bot reportedly profited from a price oracle misconfiguration. The responsible party offered to return the funds, requesting acknowledgment of the misconfiguration. Blockchain analyst ZachXBT suggests a high probability of fund recovery due to the drainer's exposure to centralized exchanges. Rho Markets' total value locked dropped by $16 million in 24 hours.

Expand

-

Tether ceo calls for decentralized tech investment after global it outage

Tether CEO Paolo Ardoino urged investment in decentralized peer-to-peer tech following a global IT outage caused by CrowdStrike's centralized software. The incident affected various sectors worldwide, highlighting the fragility of centralized systems. Ardoino emphasized that Tether and Holepunch are developing resilient technologies to withstand extreme scenarios. Crypto stakeholders echoed the importance of decentralization in light of the outage.

Expand