Rollercoaster US Election Floods Crypto-Betting Site With Wagers

07/24/2024 20:39

(Bloomberg) -- The turbulent US presidential election has flooded crypto betting site Polymarket with so many wagers that it’s upgrading the platform to handle soaring volumes of incoming funds. Most Read from BloombergWhat Initial Polling Data Show About the Trump-Harris MatchupTesla Slumps as Musk Tethers Its Future to Delayed RobotaxisA Six-Second Decision Shows How Harris Snapped Up DelegatesTrump Files Complaint Over Harris Getting Biden’s $96 Million War ChestSingapore Has World’s Most Pow

(Bloomberg) -- The turbulent US presidential election has flooded crypto betting site Polymarket with so many wagers that it’s upgrading the platform to handle soaring volumes of incoming funds.

Most Read from Bloomberg

What Initial Polling Data Show About the Trump-Harris Matchup

Tesla Slumps as Musk Tethers Its Future to Delayed Robotaxis

Trump Files Complaint Over Harris Getting Biden’s $96 Million War Chest

Singapore Has World’s Most Powerful Passport After Unseating Europeans

Polymarket will start incorporating software from Miami-based MoonPay that will allow users to pay for their bets using bank transfers and credit cards, the companies said on Wednesday. Bettors currently buy stablecoin USDC on a crypto exchange and transfer it to Polymarket before making wagers.

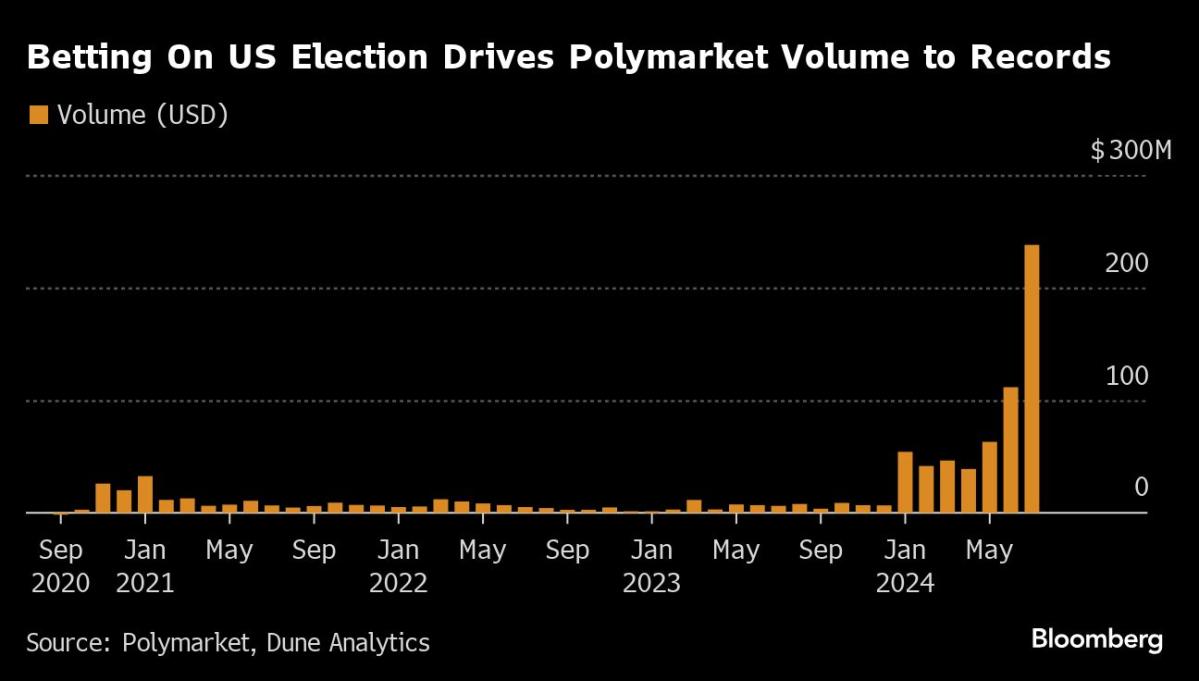

Driving the frenzied betting is an election that’s already seen one candidate — Donald Trump — survive an assassination attempt, shortly before incumbent Joe Biden bowed out of the race after a revolt in the Democratic party. Betting volumes on Polymarket have reached a record $260 million so far in July, more than a third of this year’s total, according to data from Dune Analytics.

“We’ve really found an insane amount of product-market fit recently, as we’re currently in the US going through probably the most unpredictable and volatile election in living memory,” said Polymarket Vice President of Strategy David Rosenberg in an interview.

More than $366 million has been wagered so far this year on the winner of the November election, where Trump now likely faces Vice President Kamala Harris.

Polymarket isn’t available in the US. Its rapid growth comes as the US Commodity Futures Trading Commission weighs a proposed ban on trading of derivatives that bet on political contests and sports games, a category known as event contracts.

Polymarket was fined by the CFTC in early 2022 after the regulator alleged it had offered illegal trading services. As part of a settlement, the company promised to wind down services in the US while continuing to operate abroad. J. Christopher Giancarlo, a former CFTC chair during the previous Trump administration, joined Polymarket’s board months later.

A $1.4 Million Bet on Trump

The most popular contract on New York-based Polymarket currently indicates a 61% chance of Trump beating Harris. His odds increased somewhat after Biden’s disastrous debate performance in late June, then shot up following the July 13 shooting at a campaign rally in Butler, Pennsylvania. Volumes likewise trace the arc of the election campaign, surging after Trump’s speech at the Republican National Convention and Biden’s historic decision to exit the race.

The biggest single bet on the election winner so far is one worth some $1.4 million as of Wednesday that Trump will become president again.

Polymarket allows users to bet on the outcome of a range of events from politics to sports. Punters buy what Polymarket calls “yes” or “no” shares tracking a particular event, and the buying and selling of those instruments then determine the odds of the outcome at any point in time.

The deal with MoonPay may also allow Polymarket to accept other cryptoassets than USDC for bets, Rosenberg said. For users not familiar with digital assets, the aim is to make payments so seamless that they don’t even know crypto is the underlying means of transaction, he added.

“You shouldn’t have to be a deep crypto native to get something out of this,” he said.

Other popular betting events have included the debuts of US exchange-traded funds tied to Bitcoin and Ether this year and the brief leadership crisis at Sam Altman’s OpenAI last November, according to Rosenberg.

Polymarket has raised $70 million across two funding rounds, Bloomberg News reported in May, with its most recent stock sale led by Peter Thiel’s venture-capital firm Founders Fund.

(Updates number in fifth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.