Dispersion Is Defining the Current Crypto Market

07/25/2024 02:11

The range of returns available across digital asset markets offers unique opportunities for investors, says Alex Botte, Partner at Hack VC, a crypto-native venture capital firm.

One of the most interesting features of the current crypto markets is the elevated level of dispersion, or range of returns across different parts of the market.

In today's liquid markets, sectors focused on infrastructure and technology have significantly outperformed more consumer-oriented categories like gaming, metaverse, and entertainment-related tokens.

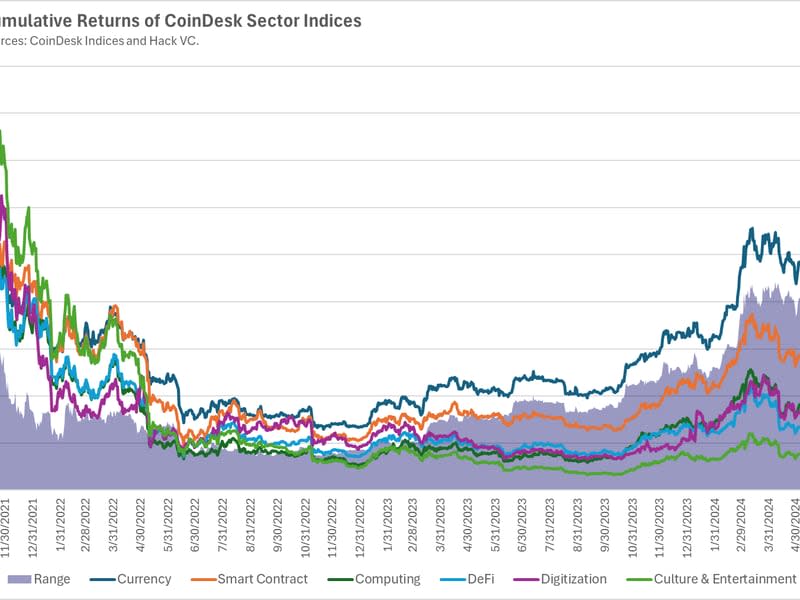

CoinDesk sector indices' performance since November 2021 (the peak of the last bull market) reveals this trend.

You're reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

The "range" value, which shows the difference between the maximum and minimum cumulative returns at each point in time, highlights the level of dispersion. Dispersion started high in the fourth quarter of 2021 due to a surge in culture and entertainment-related developments. It then dropped in 2022 as the market collapsed, correlations rose, and assets largely traded in sync.

However, dispersion has been rising since 2023, picking up meaningfully in the fourth quarter of last year, with Currencies and Smart Contract Platforms (infrastructure) breaking away from the rest of the market. In 2024, dispersion is at a high over this period, with tokens in the Culture & Entertainment sector continuing to draw down, while BTC, ETH, and other smart contract platform tokens are outperforming.

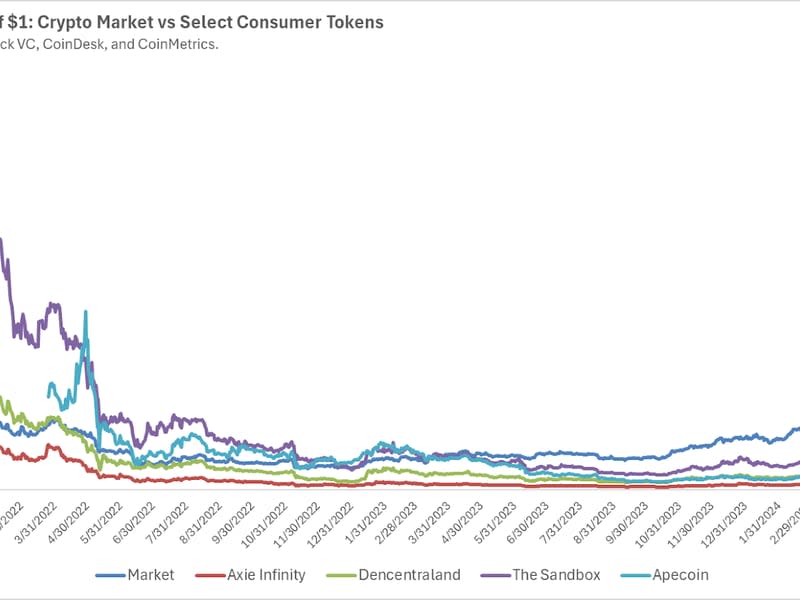

Take a few examples to illustrate this last point. The overall market’s current maximum drawdown (using the CoinDesk Market Index) was -33% over this period. Compare that to some of the largest consumer tokens in the Gaming and Culture & Entertainment sectors, including Axie Infinity (game), Decentraland and The Sandbox (metaverses), and Apecoin (token associated with the NFT collection Bored Ape Yacht Club). These tokens’ maximum drawdowns were -96%, -94%, -96%, and -96% respectively. They have not participated in the market’s recovery this cycle.

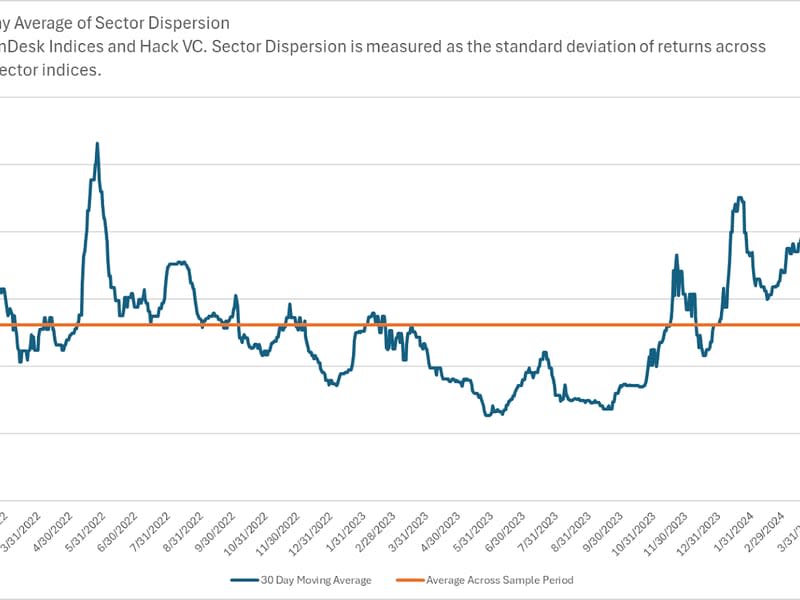

Another way to view dispersion is through the rolling 30-day average of the daily standard deviation of returns across the CoinDesk sector indices. Since the fourth quarter of last year, sector dispersion has mostly been above average. This elevated level of dispersion indicates that the market is no longer moving in unison, and individual sectors are experiencing different growth trajectories based on their underlying fundamentals and investor interest.

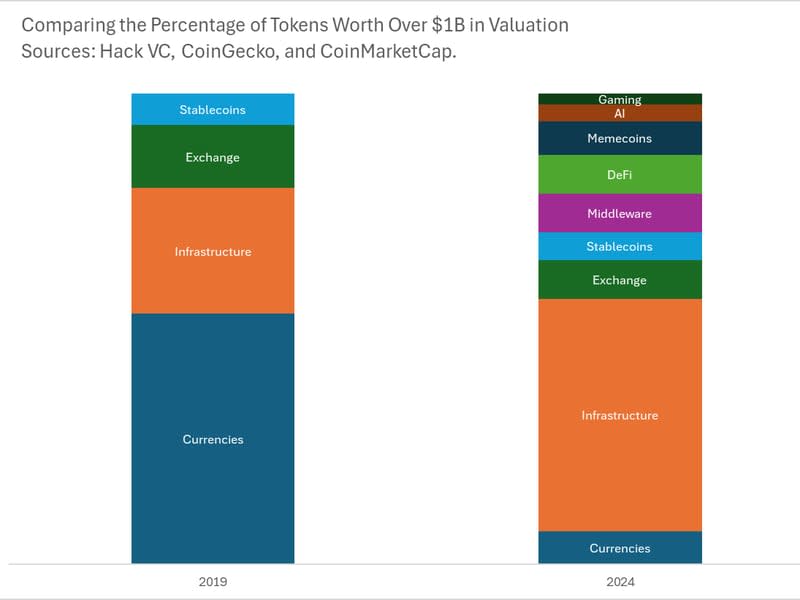

To delve deeper, we examine the number of billion-dollar-valued tokens in each sector (sectors are defined by Hack VC) as of five years ago compared to today. In 2019, Currencies dominated the market: BTC and BTC competitors. Today, half of the tokens are in the infrastructure sector (layer 1 and layer 2 blockchains). This sector has seen massive growth over the past five-plus years. We also see new sectors emerging. AI, for example, is a relatively new part of the market that brings together two of the most exciting emerging technologies: crypto and AI. While there is a lot of hype and promise, real benefits exist today. In the next five years, we expect additional sectors and sub-sectors will emerge.

This dispersion and development of new sectors over time is positive for active managers. It indicates growing market sophistication, with value being rewarded and fundamentals becoming increasingly important. Dispersion also offers significant opportunities for generating alpha. It makes it easier for active managers with alpha to outperform the market, though it also increases the risk of underperformance without a strong strategy.

In this environment, investors must be more selective and knowledgeable about the sectors and projects they invest in. Active management becomes crucial as the market rewards those who can identify and capitalize on trends. These markets are also particularly favorable for investors with a deep understanding of technological advancements and the ability to discern long-term value from short-term hype.

Disclosure

The information herein is for general information purposes only and does not, and is not intended to, constitute investment advice and should not be used in the evaluation of any investment decision. Such information should not be relied upon for accounting, legal, tax, business, investment, or other relevant advice. You should consult your own advisers, including your own counsel, for accounting, legal, tax, business, investment, or other relevant advice, including with respect to anything discussed herein.

This article reflects the current opinions of the author(s) and is not made on behalf of Hack VC or its affiliates, including any funds managed by Hack VC, and does not necessarily reflect the opinions of Hack VC, its affiliates, including its general partner affiliates, or any other individuals associated with Hack VC. Certain information contained herein has been obtained from published sources and/or prepared by third parties and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, neither Hack VC, its affiliates, including its general partner affiliates, or any other individuals associated with Hack VC are making representations as to their accuracy or completeness, and they should not be relied on as such or be the basis for an accounting, legal, tax, business, investment, or other decision. The information herein does not purport to be complete and is subject to change and Hack VC does not have any obligation to update such information or make any notification if such information becomes inaccurate.

Past performance is not necessarily indicative of future results. Any forward-looking statements made herein are based on certain assumptions and analyses made by the author in light of her experience and perception of historical trends, current conditions, and expected future developments, as well as other factors she believes are appropriate under the circumstances. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict.