Marathon Digital pivots to ‘full HODL’ with its $100M Bitcoin purchase

07/26/2024 04:30

Marathon Digital has launched a new HODL approach, adding $100 million of BTC to that end and positioning to buy more from open markets...

- Marathon Digital bought an extra $100 million as part of a new HODL approach.

- MARA plans to hold all its mined BTC and buy more from open markets

Popular Bitcoin [BTC] miner Marathon Digital is in the news today after it added $100 million worth of BTC as part of a new strategy. Mara Digital CEO Fred Thiel stated that the firm added the stash over the past month to “strengthen” its treasury strategy.

“Today Marathon is proud to announce that to strengthen our strategy of holding #Bitcoin as our strategic treasury reserve asset…We will now go full HODL.”

The firm added that its new full HODL approach means it would keep all mined BTC and strategically accumulate even more from open markets. That’s a bullish cue from one of the largest BTC miners, reiterating the digital asset’s ‘long-term value’ in the long run.

Marathon Digital’s move: Is BTC miner crisis over?

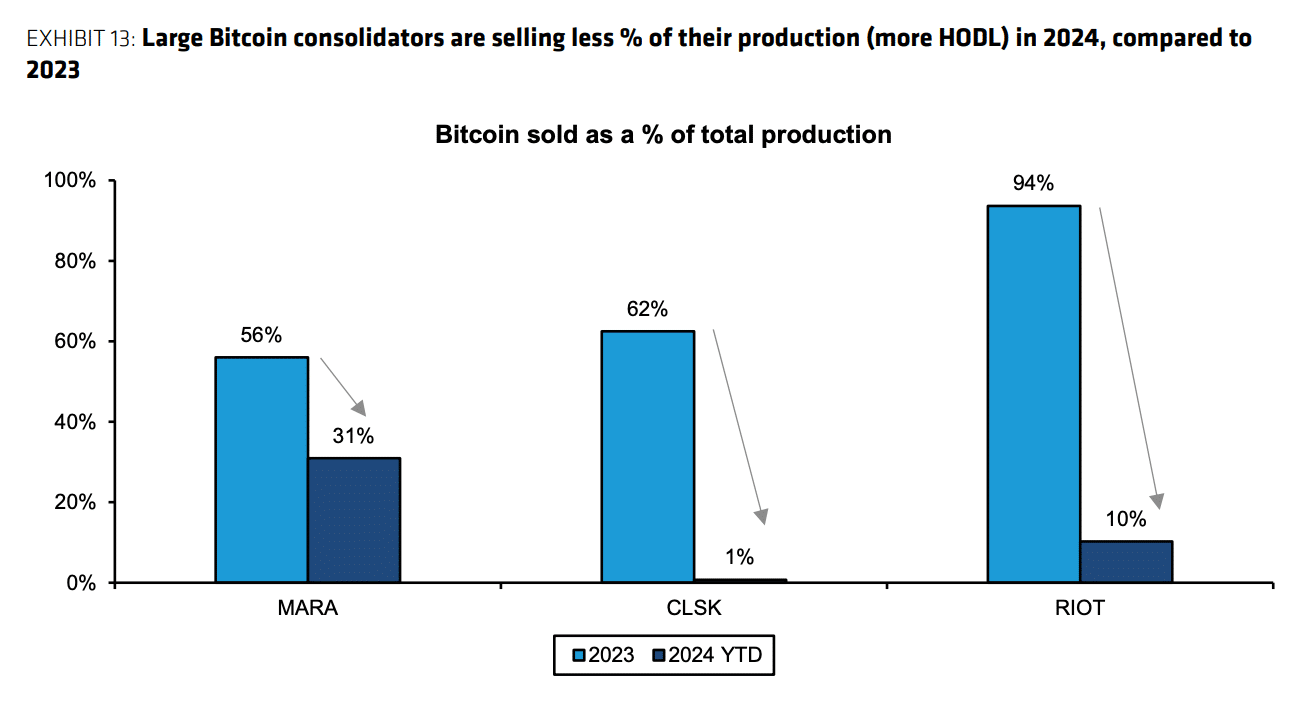

A recent Bernstein report also illustrated MARA’s accumulation spree and HODL approach. The report noted that MARA’s portion of BTC sold as a percentage of production declined from 56% in 2023 to 31% in 2024.

The HODL trend has also been seen across other BTC miners, like Riot platforms and CleanSpark.

In fact, MARA’s CEO and Chairman Fred Thiel is now encouraging others to follow their HODL approach and include BTC as a strategic treasury reserve.

“We believe Bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold bitcoin as a reserve asset.”

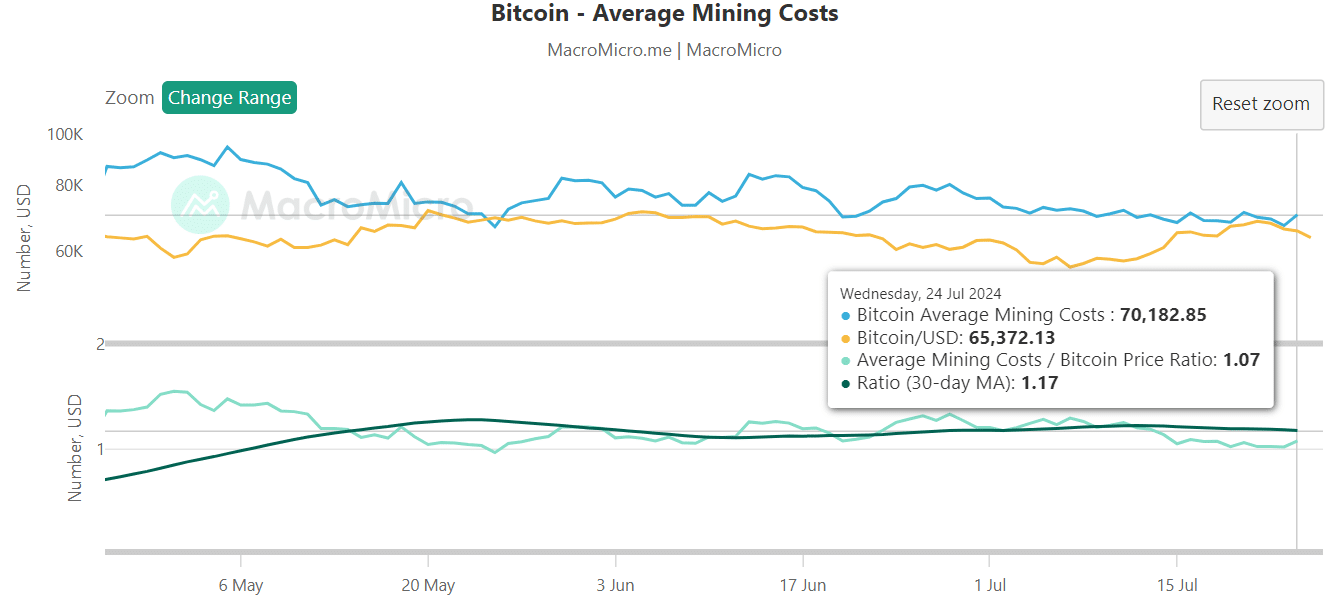

Despite the holding strategy of some large publicly-traded BTC miners, average mining costs remain way above the crypto’s present value though. At press time, the average mining cost stood at $70K, against a press time value of $65K.

This means that BTC miners’ profitability is still a problem, especially for small-scale private firms.

However, according to BTC analyst Willy Woo, this could soon change when miner capitulation ends. The analyst added that the end of the miners’ crisis could rally BTC miner stocks, including MARA.