Bitcoin Cash surges 13%, becomes top gainer in crypto market today

07/29/2024 14:24

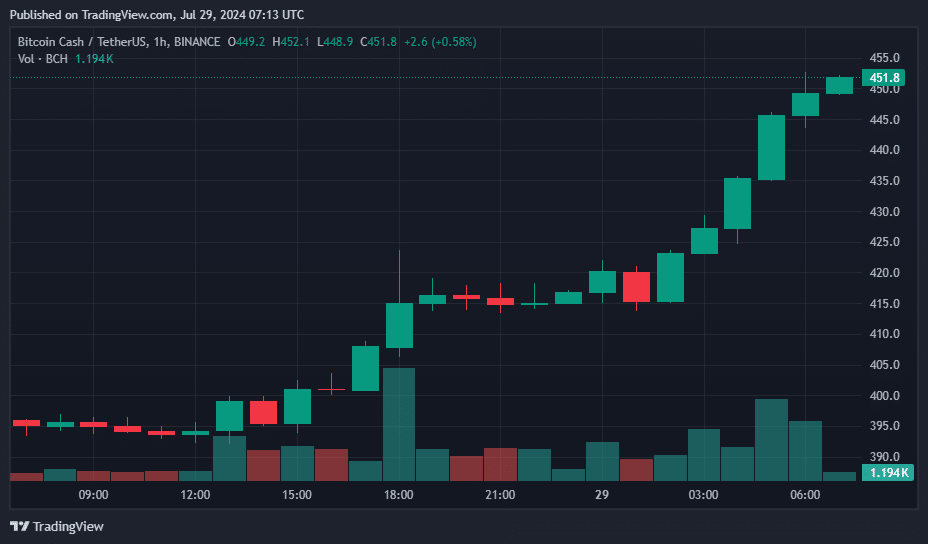

Bitcoin Cash has experienced a notable increase of over 13% in the past 24 hours, making it the top gainer among the leading 100 cryptocurrencies on July 29

Bitcoin Cash has experienced a notable increase of over 13% in the past 24 hours, making it the top gainer among the leading 100 cryptocurrencies on July 29.

At the time of writing, Bitcoin Cash (BCH) had surged by 13.6% over the last 24 hours and was exchanging hands at $451. The crypto asset’s daily trading volume was hovering around $427 million, per data from crypto.news.

Moreover, the cryptocurrency’s market cap stood at $8.75 billion, making it the 16th largest crypto asset, per CoinGecko. Despite the recent price rise, the token is still down 88.3% from its all-time high of $3785.8, reached on Dec. 20, 20217.

Originating from a hard fork of Bitcoin in 2017, Bitcoin Cash was created following disagreements within the Bitcoin community regarding proposed upgrades. Like its predecessor, Bitcoin Cash operates on a Proof of Work (PoW) mechanism, has a capped supply of 21 million coins and undergoes a halving event every four years. The reward for mining Bitcoin Cash is currently set at 6.25 BCH.

A notable distinction between Bitcoin and Bitcoin Cash is the block size; Bitcoin Cash supports blocks of up to 32 MB, significantly larger than Bitcoin’s 1 MB limit. This larger block size enables Bitcoin Cash to process a greater number of transactions within the same time frame.

The recent price rally underscores a rising interest from investors, particularly retail traders, in more economically priced alternatives to Bitcoin, which currently trades around $70,000 per unit.

While Bitcoin remains one of the priciest crypto assets, making full ownership challenging for some investors, Bitcoin Cash and similar hard forks present more accessible investment opportunities due to their lower price points.

The recent surge in Bitcoin Cash (BCH) is partially attributed to Kraken’s successful distribution of Bitcoin and Bitcoin Cash to customers affected by the 2014 Mt. Gox hack. This distribution occurred on July 27, 2024, marking a crucial step in resolving the long-standing Mt. Gox case.

Additionally, significant whale activity has been reported with notable purchases of BCH, as indicated by the whale tracker “FishTheWhales” on their July 29 post.

A trading analyst known as Dz_4L highlighted on X that Bitcoin Cash has emerged from an inverse head and shoulders pattern, suggesting a bullish trend. He predicts that BCH could see a further 15-20% price increase based on this momentum.

Meanwhile, interest in Bitcoin has spiked following former President Donald Trump’s announcement about major initiatives involving digital assets, including a proposal for a national Bitcoin reserve in the U.S.

As of now, Bitcoin (BTC) is trading at $69,716, having increased by 3.23% over the last 24 hours, with a low of $67,314 and a high of $69,804 within the same timeframe.

Other leading altcoins such as Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP), Solana (SOL), and Litecoin (LTC) have also posted modest gains. The overall crypto market sentiment is positive, with the Market Fear & Greed Index displaying a score of 63 (Greed) out of 100.

The global cryptocurrency market capitalization currently stands at $2.48 trillion, reflecting a growth of 3.34% in the past 24 hours.