Crypto traders are bracing for the next altcoin season as Bitcoin forms an extremely bullish pattern on the weekly chart.

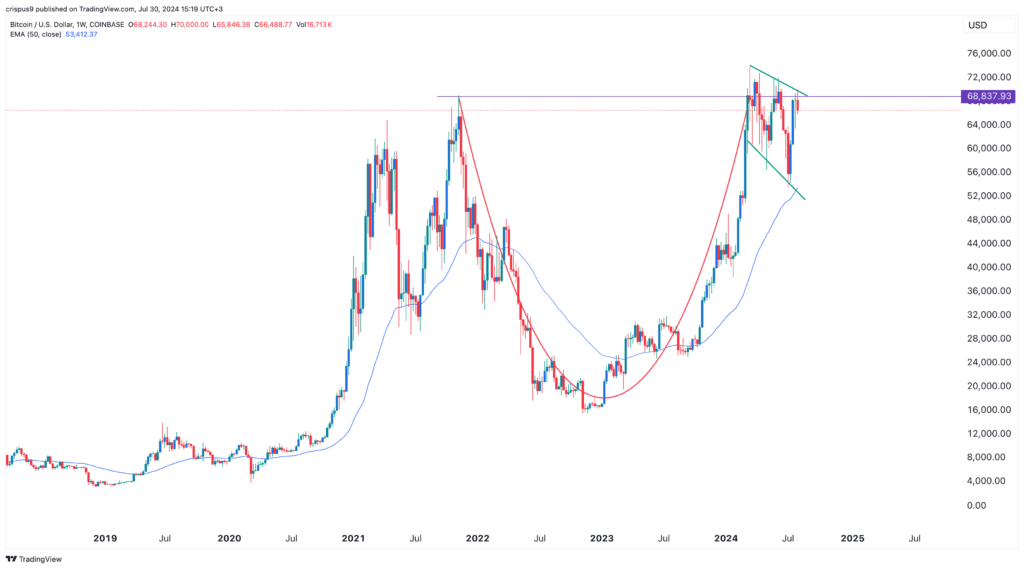

Bitcoin (BTC), the largest cryptocurrency by market cap, has formed a cup and handle chart pattern. This pattern is characterized by a rounded bottom forming the cup and either a consolidation or a pullback to form the handle. The upper part of this pattern was at $68,837, while the handle section has been forming since March this year.

Importantly, it has formed a falling broadening wedge pattern in its handle section. It has also found a strong support level at the 50-week moving average, where it failed to move below in July.

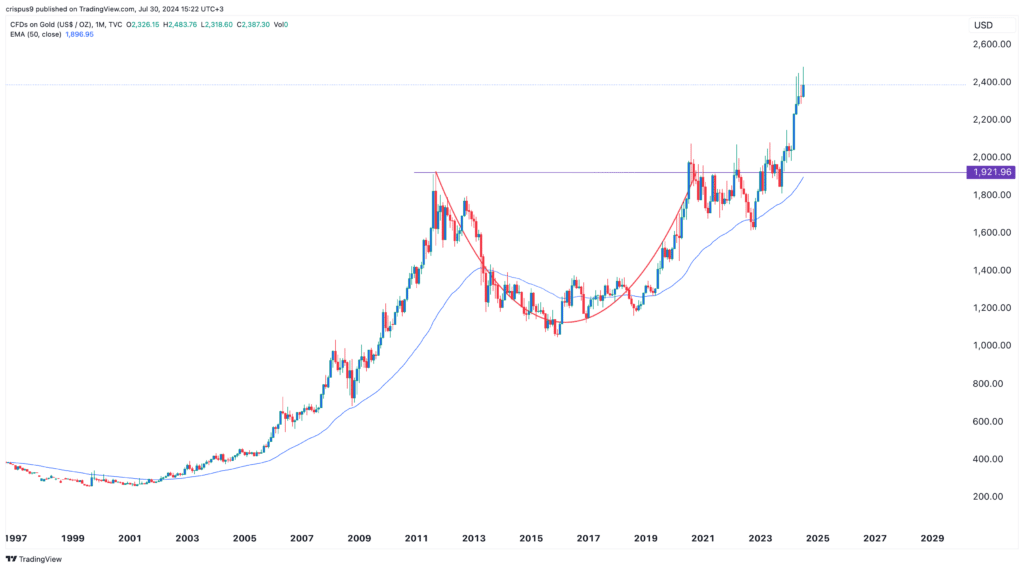

A good example of the cup and handle pattern in action happened in gold. On the monthly chart, it formed the cup section between September 2011 and July 2020. It then formed the handle section and made a bullish breakout to a record high of $2,485 this month.

Bitcoin and gold have some relationship. In a recent statement, Larry Fink, the founder, and CEO of Blackrock, said that he views Bitcoin as a digital gold that will do well because of the rising geopolitical issues and soaring US public debt.

Additionally, Bitcoin has some solid fundamentals. Demand is rising as institutional investors buy through ETFs, while the Federal Reserve is expected to start cutting interest rates as soon as in September. Supply has been hampered by April’s halving event.

Fed rate cuts are positive for Bitcoin and other altcoins because they lead to a risk-on sentiment among investors. In this case, some of the $6 trillion invested in money market funds will likely rotate to riskier assets like stocks and cryptocurrencies.

Analysts are also bullish on Bitcoin. Michael Saylor, the biggest Bitcoin buyer, expects that the coin will rise to $13 million in his base case and to $49 million in his most optimistic case. In a recent note, Ki Young Ju, the founder of CryptoQuant, noted that the bull cycle may continue into 2025.

— Ki Young Ju (@ki_young_ju) July 26, 2024#Bitcoin Bull Cycle Likely Until Mid-2025

Old whales take profits during bull markets. Their selling brings new capital into accumulation addresses, raising realized prices.

Past cycles had profit realization periods of about 18 months. It started 4 months ago this time. pic.twitter.com/zkc8XxkmHi

Bitcoin to stir another altcoin season

A strong Bitcoin bullish breakout will likely stir another altcoin season. Historically, altcoins, including meme coins, do well when Bitcoin is rising.

For example, an altcoin like Solana (SOL) rose to a multi-year high of $210 in March when Bitcoin soared to its record high. Similarly, Cardano (ADA) reached $0.81 while Polygon (MATIC) jumped to $1.2887.

Recent performance shows that meme coins outperform their bigger peers when there is an altcoin season. Meme coins like Pepe (PEPE), Dogwifhat (WIF), and Popcat have done better than bigger coins this year.

Many traders love these meme coins because of their low prices vs. Bitcoin. In this case, it is always cheaper to buy a token like Book of Meme (BOME) that was trading at $0.011 instead of Bitcoin that trades at $66,000. Meme coins are also highly volatile and have a lot of volume.

— Michaël van de Poppe (@CryptoMichNL) July 26, 2024I've long been a day trader, and memes are great for that perspective.

A ton of volume.

And there is a ton of volatility.When it comes to $BRETT, I'd like to search for longs here from this area at $0.125-0.1325 to $0.170 as a clear identification for a potential upward run. pic.twitter.com/hWmSjCZGJa