Grayscale Unveils Bitcoin Mini Trust ETF

08/01/2024 02:45

The new product offers bitcoin exposure with a 0.15% fee.

Grayscale Investments’ Bitcoin Mini Trust began trading Wednesday with an expense ratio of 0.15%, offering a lower-cost option for bitcoin exposure in an increasingly competitive market for crypto-focused funds.

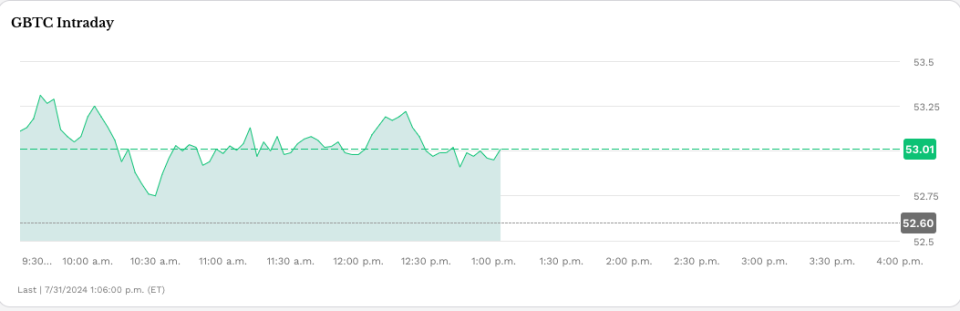

The Mini Trust, which has the ticker BTC and is trading on the NYSE Arca, is structured as a spin-off of the Grayscale Bitcoin Trust (GBTC). New shares will be distributed to existing GBTC shareholders with the trust contributing a portion of its bitcoin holdings to the new product. According to a press release from the company, BTC's S-1 registration statement became effective last week.

"The Grayscale team has believed in Bitcoin's transformative potential since GBTC’s initial launch in 2013, and we are excited to launch Grayscale Bitcoin Mini Trust to help further lower the barrier to accessing Bitcoin in a SEC regulated investment vehicle," said David LaValle, senior managing director, head of ETFs at Grayscale.

The debut of the Bitcoin Mini Trust comes amid surging interest in ETFs based on the ongoing price of the two largest cryptocurrencies by market capitalization, bitcoin and ether. Spot bitcoin ETFs have netted nearly $18 billion in inflows since the first ones began trading Jan. 11, although GBTC has shed almost $19 billion in assets.

That fund differs from other funds in that it is a conversion from an existing trust and carries a 1.5% fee, the highest among the spot bitcoin products that have received SEC approval this year.

Mini Bitcoin Trust's Low Fee

In an X post Wednesday, Bloomberg Senior ETF Analyst Eric Balchunas noted the Bitcoin Mini Trust's "category-low fee..."

"[Important] to recognize how crazy cheap 15bps is- about 10x cheaper than spot ETFs in other countries and other vehicles," Balchunas wrote, adding that this pricing strategy reflects the competitive nature of the U.S. ETF market, which he referred to as the “ETF Terrordome.”

“This is what the Terrordome does to fund [cost]. Come in at 1.5% [and] end up at 0.15%, like going from [a] country club to the jungle. But that's why all the flows are here, paradise for investors,” he noted.

Read More: Spot Bitcoin ETF Inflows Hit One-Day High of Over $1B

Bitcoin was recently trading at about $66,350, roughly flat since U.S. markets opened Wednesday.

Grayscale also offers two spot Ethereum ETFs, the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum Mini Trust (ETH), whose performance is based on ETHE. ETHE outflows topped $1.8 billion in its first six trading days, while ETH has added more than $181 million over the same period, according to Farside. The remaining seven ETFs have generated about $1.2 billion in inflows.

Read More: Spot Ethereum ETFs Approved to Start Trading