Pepe coin price prediction remains bearish, but can THIS group gain?

08/02/2024 16:00

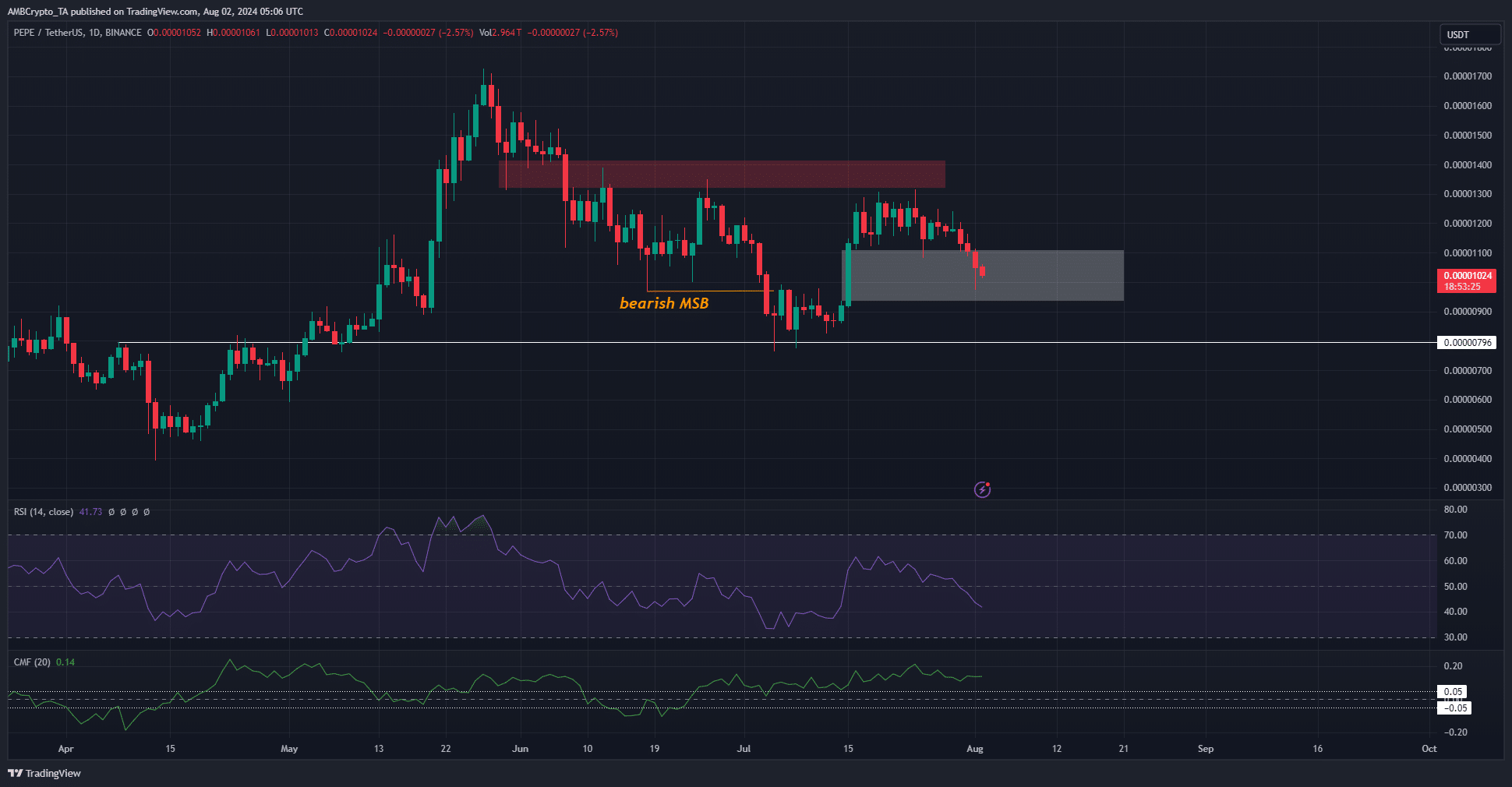

The Pepe coin price prediction saw diverging signals from the CMF and momentum, but the downtrend appeared likely to continue.

- PEPE maintained a bearish structure despite the gains in the second half of July.

- Traders should beware of a short squeeze in the near term.

Pepe [PEPE] was trending downward after a rejection from the $0.000013 resistance zone. A recent report revealed a whale moving 400 million PEPE tokens worth $4.22 million to Binance.

This influx to exchanges is likely for selling purposes. Combined with the price action, the Pepe coin price prediction has a bearish leaning. Yet, bulls have reason to be hopeful of a recovery.

The fair value gap could rescue trapped bulls

In mid-July, PEPE noted a 52% price gain in five days. This rapid resurgence left behind a sizeable imbalance on the daily chart, highlighted in white. At press time, the meme coin was trading within this support zone.

A bearish market structure break was seen in the first week of July. The recent significant lower high from the 26th of June was not breached since PEPE bulls withdrew from $0.000013.

The daily RSI fell below neutral 50 to signal bearish momentum was strong. However, the CMF remained well above +0.05.

It hinted at notable buying pressure, which could see a price reversal from the $0.000009-$0.00001 zone.

The chances of a short squeeze increase

The cumulative liquidation levels were deeply negative, showing short positions well outnumbered the longs. This could see a price move upward to hunt these short sellers.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

To the north, the $0.000011 and $0.0000115 were the two levels with a large amount of liquidation levels.

It is possible that PEPE could climb to these levels before its next price moves downward. Swing traders can also use such a bounce to sell their assets given the higher timeframe bearish structure.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.