Bitcoin Risk-Reward Remains Compelling Even After Price Doubles in a Year

08/02/2024 17:06

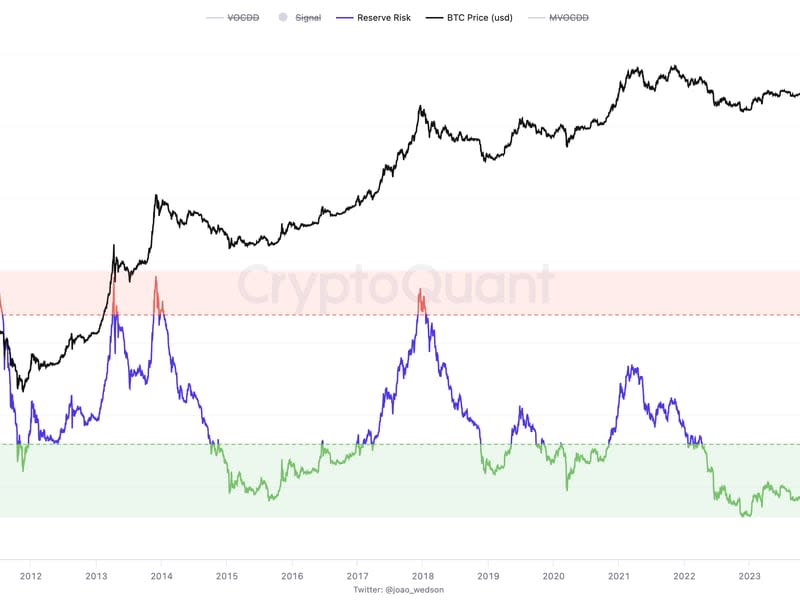

Long-term holders are motivated to hold at bitcoin's going market rate, implying an attractive risk-reward for existing or potential investors, according to the "reserve risk" indicator.

BTC's reserve risk indicator shows conviction among long-term holders, offering an appealing risk-reward ratio to existing or potential investors.

Other indicators based on inactivity of supply also point to strong holding sentiment.

While bitcoin's {{BTC}} price has more than doubled in the past year, the largest cryptocurrency continues to offer an appealing risk-reward ratio for those eyeing an investment, according to an on-chain indicator that successfully predicted the bull run in early 2023.

Bitcoin's "reserve risk," an indicator that gauges the confidence of long-term holders based on their willingness to defer spending coins, remains entrenched in the so-called green zone below 0.002, according to data tracked by CryptoQuant. The measure can range between 0 and 1.

The low reading is a sign long-term holders are motivated to hold at bitcoin's going market rate rather than sell, implying favorable demand-supply dynamics and an attractive risk-reward ratio for those looking to make additional or fresh investments.

"The reserve risk continues to remain in the green zone, which means buying BTC at the current levels still offers an extraordinary reward to risk. Investing in bitcoin during periods where the reserve risk in the green zone has produced outsized returns over time," MintingM, a crypto research firm based in India, told CoinDesk.

Reserve risk tends to oscillate in sync with bullish and bearish trends. Historically, the green zone below 0.0027 has marked a slow transition from the final stage of a bear market into a bull market. Readings above 0.02 have marked bull-market tops.

Other indicators measuring the percentage of supply that is inactive over a specific period also show a return to a holding strategy after some profit-taking at record highs early this year.

"Bitcoin bull markets naturally attract sell-side pressure, as higher prices incentivize long-term holders to take profits on some of their holdings. We can observe this phenomenon through the significant decline in the Supply Last Active 1y+ and 2y+ metrics throughout March and April," blockchain analytics firm Glassnode said in a weekly report. "The rate of decline across these curves has slowed of late, suggesting a gradual return to HODLing dominant investor behavior."

On-chain indicators' persistent bullish messaging is consistent with the market consensus that the impending interest-rate cuts by the U.S. Federal Reserve would see bitcoin make a bullish escape from its prolonged range play between $60,000 and $70,000.

Bitcoin changed hands at $64,420, a 0.3% gain over 24 hour, according to CoinDesk data.