US Spot Ethereum ETFs Records Lowest Net Inflows Since Launch

08/02/2024 17:00

Spot Ethereum exchange-traded funds saw their lowest inflows on Thursday. Investor interest has gradually declined since these funds launched.

On Thursday, Ethereum (ETH) exchange-traded funds (ETFs) recorded their lowest daily inflows since their launch on July 23.

The nine US-based funds saw net inflows totaling $26 million that day. Although modest, this represents the third time spot ETH ETFs have recorded inflows since their launch ten days ago.

The Waning Interest in Spot ETH ETF

When these funds went live on July 23, they saw a net inflow of $107 million and a trading volume of over $1 billion. However, the hype around them only lasted a day, as the ETFs recorded outflows in the four days that followed.

According to data from SosoValue, daily net outflows from spot ETH ETFs totaled $653 million between July 24 and 29. Daily trading also dwindled during that period, dropping by 22% over the four-day time frame.

While the overall trend indicates waning enthusiasm, there are notable disparities among the Ether ETF providers. For example, Grayscale’s Ethereum Trust (ETHE) bucked the overall trend by being the only fund recording outflows yesterday, totaling $78 million.

In contrast, BlackRock’s iShares Ethereum Trust (ETHA) attracted inflows of $90 million during the period in review.

Read more: Ethereum ETF Explained: What It Is and How It Works

On Thursday, other funds, including the Fidelity Ethereum Fund (FETH) and the Bitwise Ethereum ETF (ETHW), also saw inflows of $12 million and $3 million, respectively.

ETH Price Prediction: Demand For the Leading Altcoin Leans

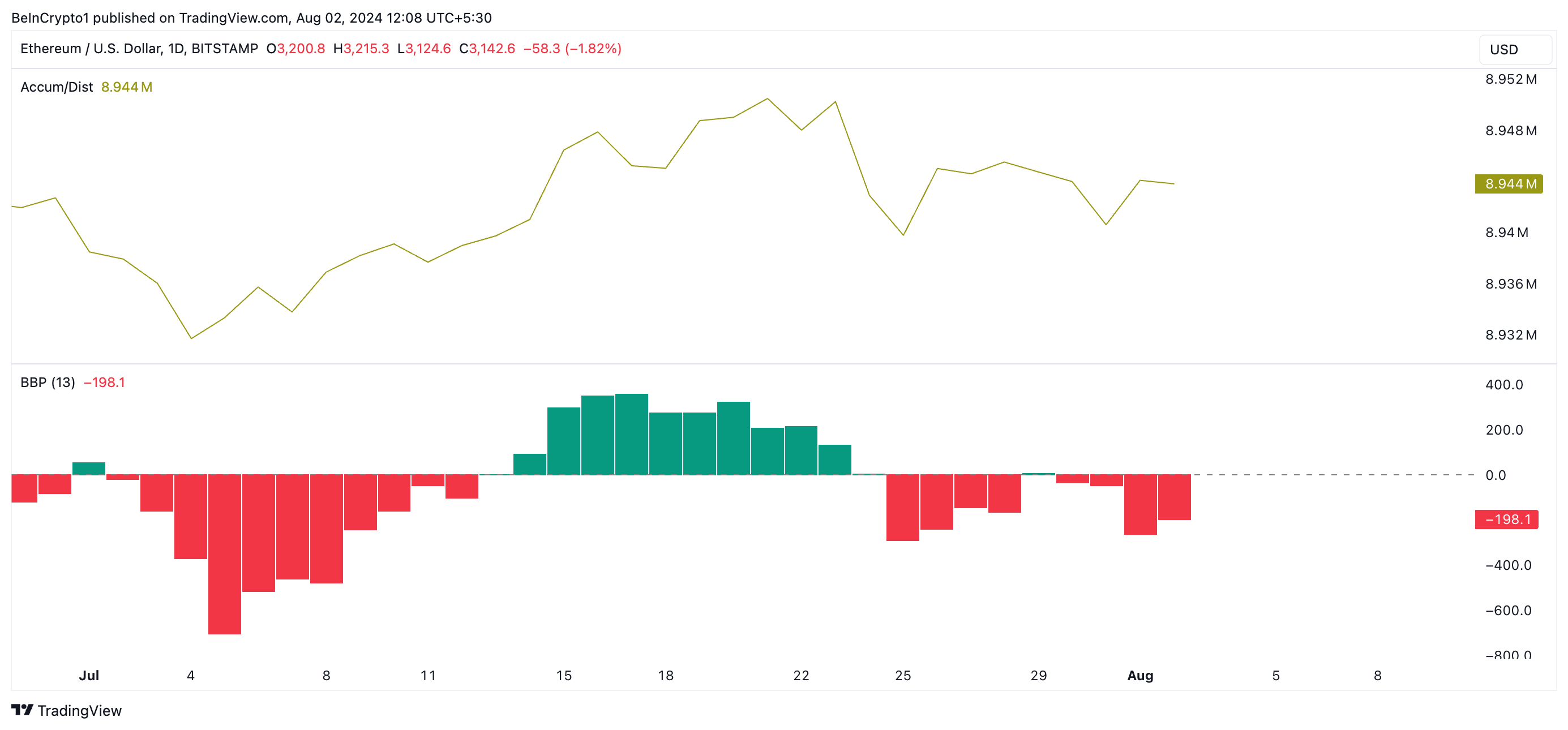

At press time, ETH trades at $3,140. The leading altcoin commenced a new cycle of decline on July 22 and has since formed a descending triangle. This bearish trend is formed when an asset’s price creates a pattern of lower highs and a horizontal support level. Traders interpret it as a signal that selling pressure is increasing.

ETH’s declining Accumulation/Distribution (A/D) Line confirms the surge in selling activity. Since July 22, the indicator’s value has dropped by 6%.

An asset’s A/D Line measures the cumulative flow of money into and out of an asset over a specified period of time. When it declines in this manner, it suggests that liquidity is flowing out of the asset, indicating distribution.

Further, ETH is currently plagued by significant bearish sentiments. This is evidenced by its negative Elder-Ray Index. At press time, the indicator’s value is -198.1.

This indicator measures the relationship between the strength of buyers and sellers in the market. When its value is below zero, it means that bear power is dominant in the market.

ETH’s price may drop to $3,114 if the bearish bias persists. If it breaks below the horizontal support line of the descending triangle ($3,085), its price might fall further to $2,811.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if sentiment shifts to bullish and accumulation climbs, ETH may break above the triangle to exchange hands at $3,301.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.