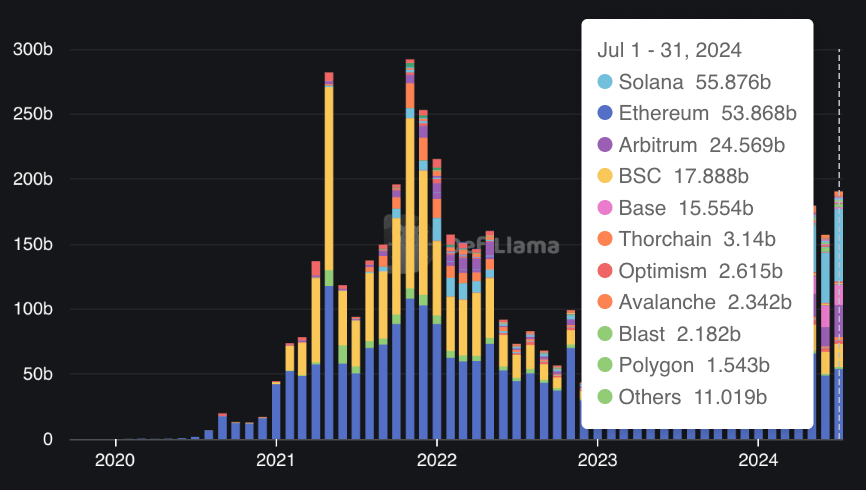

The Solana network outpaced Ethereum in monthly decentralized exchange (DEX) volume in July, according to DefiLlama data.

Solana’s DEX transactions reached $55.8 billion, surpassing Ethereum’s $53.8 billion for the same period. This represents Solana’s second-highest monthly volume, following March 2024’s peak of $60.7 billion.

Solana’s volume spike is mainly due to activity on platforms like Raydium, Orca, and Phoenix. In contrast, Ethereum’s volume is predominantly driven by the Uniswap exchange.

Despite these figures, Ethereum remains the leading DeFi platform, holding approximately 61% of the market and locking $67 billion in assets. In comparison, Solana commands only 4.64% of the market, with a total value locked (TVL) of $5.16 billion.

What is driving Solana’s growth?

Analysts point to a rise in memecoin activity as a key driver behind Solana’s increased DEX volume.

Over the past year, the blockchain has experienced significant growth in various memecoins, from cat-themed to politically inspired tokens. This has led to increased liquidity as traders look to capitalize on these assets.

Institutional endorsements have also fueled interest in Solana, and speculation about a potential Solana exchange-traded fund (ETF) may have contributed to its growth. In June, prominent asset management firms VanEck and 21Shares applied with the US Securities and Exchange Commission (SEC) to create a spot-based Solana ETF.

Further, market analysts have noted increased usage of stablecoins on Solana. Data from Allium on Visa’s stablecoin dashboard shows that the transaction volume for the USDC stablecoin on Solana has exceeded $8 trillion since the beginning of last year, with USDT on the Tron blockchain following at $6.5 trillion.

Wash-trading concerns

Meanwhile, Solana’s recent surge in DEX trading has raised concerns about potential wash trading. A recent report by the pseudonymous crypto analyst Flip Research claims that 93% of transactions on the blockchain are inorganic.

The report indicates that Solana’s daily transactions are heavily influenced by wash trading, MEV bots, and scams, which offer minimal value to retail traders. Flip Research noted:

“Looking at the wallets involved, the vast majority seem to be bots in the same network with tens of thousands of transactions. They generate fake volumes independently, with random amounts of SOL and a random no. of transactions until the project rugs, before moving onto the next one.”