Lido's New Institutional Staking Platform Boosts Ethereum Liquidity for Big Players

08/03/2024 16:31

Lido Institutional is a high-grade liquidity staking solution designed for large-scale clients such as custodians and exchanges.

Lido Finance, a leading Ethereum liquid staking service provider, has launched Lido Institutional, a high-grade liquidity staking solution designed for large-scale clients like custodians, asset managers, and exchanges.

This development represents a significant step towards making cryptocurrency staking accessible to a more professional and expansive investor base.

Lido’s New Platform to Transform Institutional Ethereum Staking

Lido Institutional merges enterprise-grade staking with the liquidity essential for varied institutional strategies. It offers institutional investors access to robust security, deep liquidity, and attractive staking rewards. The service features extensive counterparty exposure through its diversified network of 109 node operators, enhancing reward potential for investors.

Although Lido already serves a large number of retail stakers, it now positions itself as a top choice for institutions interested in Ethereum staking.

“Trusted by a growing list of prominent institutional partners, Lido already stands out as a premier choice for many institutions looking to engage in Ethereum staking. Its middleware solution combines the reliability and security necessary for enterprise-grade staking with the liquidity and utility required for diverse institutional strategies,” Lido stated.

Read more: 11 Best DeFi Platforms To Earn With Lido’s Staked ETH (stETH)

Experts suggest this move positions Lido advantageously as institutional interest in cryptocurrency rises. Marco Manoppo of Primitive Ventures noted that this strategy aligns with future regulatory changes, such as potential approval for US-based Ethereum ETFs to stake their assets.

Currently, US-based ETFs are not permitted to stake their assets, but industry observers believe the Securities and Exchange Commission (SEC) may eventually reconsider this restriction. If so, it would mark a significant shift from the regulator’s previous stance, which has claimed staking breaches federal securities law.

“In the indexing and regulated space, you won’t find reputable product sponsors who would work with a fully permissionless system. ETH ETFs will eventually get staking (maybe start offshore first), and Lido knows that’s a huge [business opportunity]. If they don’t do this, then they’re pretty much giving all that business away to cbETH and Figment,” Manoppo explained.

Read more: The Ultimate Guide to Lido Staked ETH (stETH)

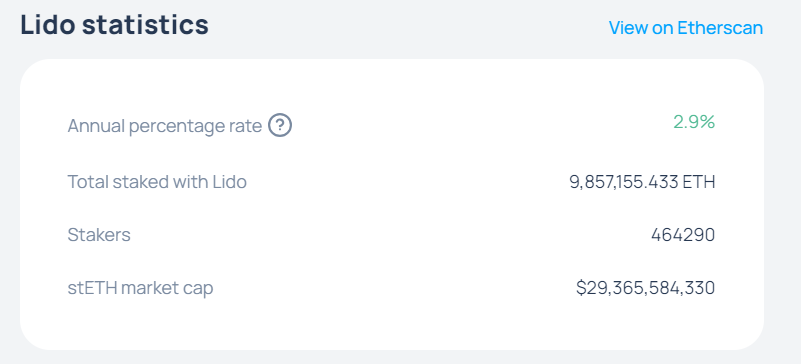

Meanwhile, this new product launch underscores Lido’s continued success in the industry. The protocol, the largest in decentralized finance, controls approximately 28.81% of the Ethereum staking market. DeFillama data shows that investors have staked around 9.9 million ETH, worth nearly $29.4 billion, with Lido. Its liquid staking token, stETH, remains the most utilized collateral in DeFi.

Further, Token Terminal data reveals that Lido achieved its highest quarterly revenue in Q2 of this year, earning about $27.5 million, marking its best performance on record.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.