The Bitcoin price has seen a constant downward momentum over the past few days as the broader cryptocurrency market faces correction.

Bitcoin (BTC) briefly touched a local high of almost $70,000 on July 29. The flagship cryptocurrency has since been declining and even dropped below the $60,000 mark earlier today.

Bitcoin is down by 1.55% in the past 24 hours and is trading at $60,532.45 at the time of writing. The asset’s market cap is sitting at $1.19 trillion. Moreover, Bitcoin’s daily trading volume plunged by 36%, hovering at $27.4 billion.

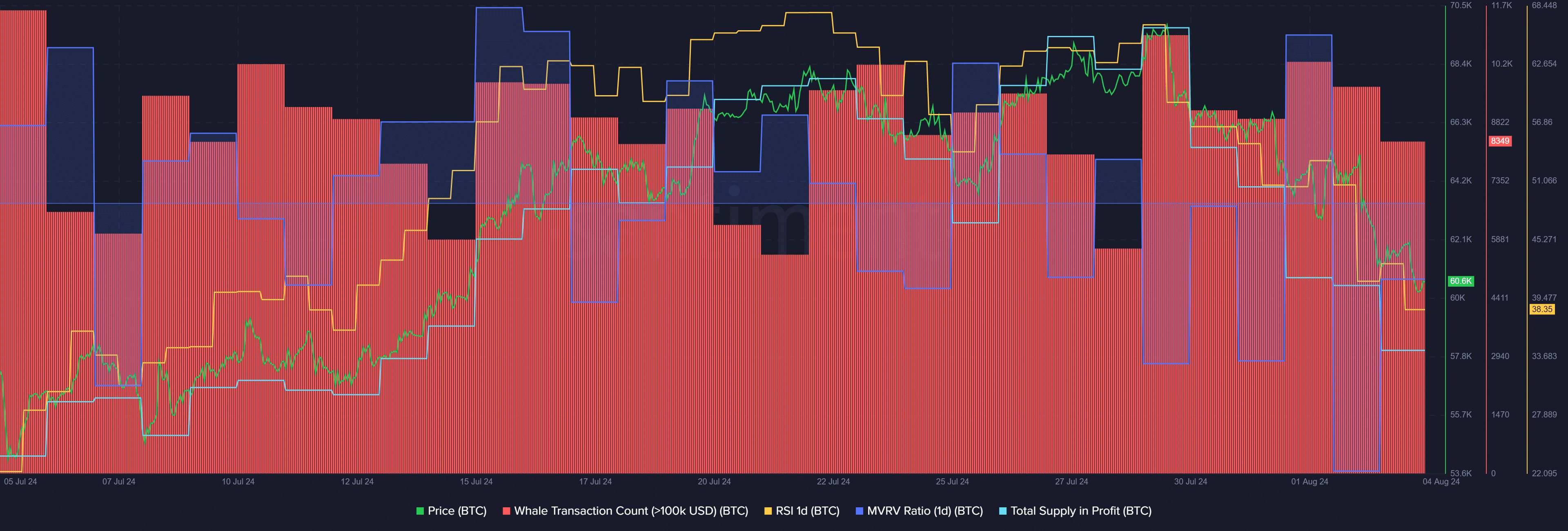

According to data provided by Santiment, the Bitcoin RSI dropped from 66 on July 29 to 38 at the reporting time. The indicator shows that BTC is oversold at this price point and is in good condition for a potential price hike.

Data from the market intelligence platform shows that the Bitcoin MVRV ratio is at negative 0.94%, showing that short-term holders are currently at a loss at this point.

Historically, the BTC price witnessed mild rebounds when the MVRV ratio slightly dropped below the zero mark.

Per Santiment data, the total Bitcoin supply in profit declined from 18.96 million on July 29 to 16.19 million coins at the time of writing. Notably, there are currently 19.73 million BTC tokens in circulation.

The Bitcoin whale activity has also been declining since the start of the month. According to data from Santiment, the number of whale transactions consisting of at least $100,000 worth of BTC dropped from 10,353 on Aug. 1 to 8,349 unique transactions in the past 24 hours.

The decline in the Bitcoin whale activity and trading volume could hint at lower price volatility and even a price rebound due to the low levels of RSI and MVRV ratio.