The cryptocurrency market has been wandering in bearish conditions, leading to over $1 billion in liquidations.

According to data provided by Coinglass, total crypto liquidations have reached $1.06 billion, marking a 454% increase over the past 24 hours. Roughly 85%, worth $900.6 million, belong to long trading positions — traders who were expecting a further price hike for their trades.

Data shows that over 278,000 traders have been liquidated over the past 24 hours. The largest single liquidation happened on the Huobi crypto exchange and was worth $27 million.

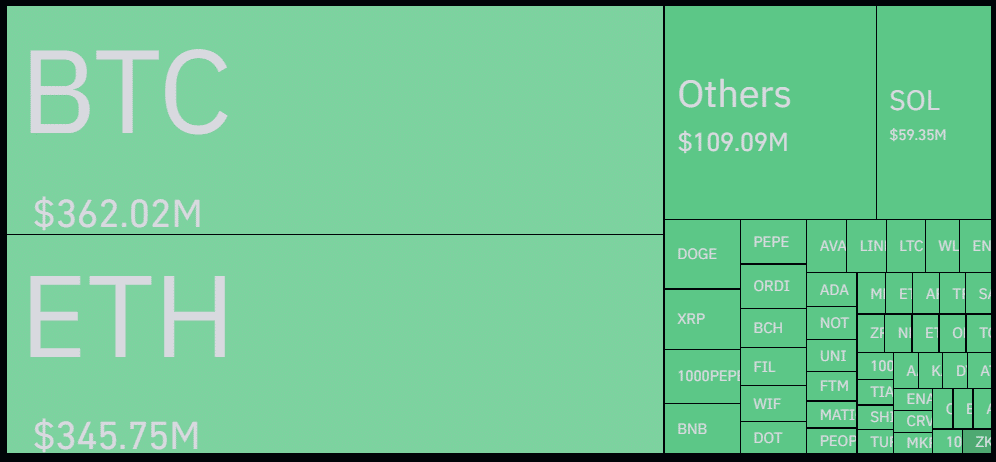

Bitcoin (BTC) accounts for $362 million in liquidations and Ethereum (ETH) is following closely with $345.7 million in liquidations over the past day.

Per data from Coinglass, Binance is leading the charts with $412 million in liquidations —$342.6 million longs and $69.9 million worth of shorts. The OKX crypto exchange came second with $319.4 million in liquidations — $261 million longs and $57.9 million short trading positions.

Consequently, the total crypto open interest decreased by 18.7% and is currently hovering at $47 billion, according to Coinglass.

The increased liquidations come as the broader cryptocurrency market faces a bearish storm. According to data provided by CoinGecko, the global crypto market capitalization plunged by 13.4% over the past 24 hours and is sitting at $1.94 trillion.

On the other hand, the total crypto daily trading volume increased by 155%, reaching the $220 billion mark.

The leading cryptocurrency, Bitcoin, plunged by 12% in the past 24 hours and is trading at $52,880 at the time of writing. The asset’s price briefly slipped to $49,121 and its market cap dropped below the $1 trillion mark earlier today.

Some analysts suggest that one potential reason for the market-wide downturn is the escalation of the Iran-Israel conflict, which could spark wider contagion in markets—including crypto—globally.