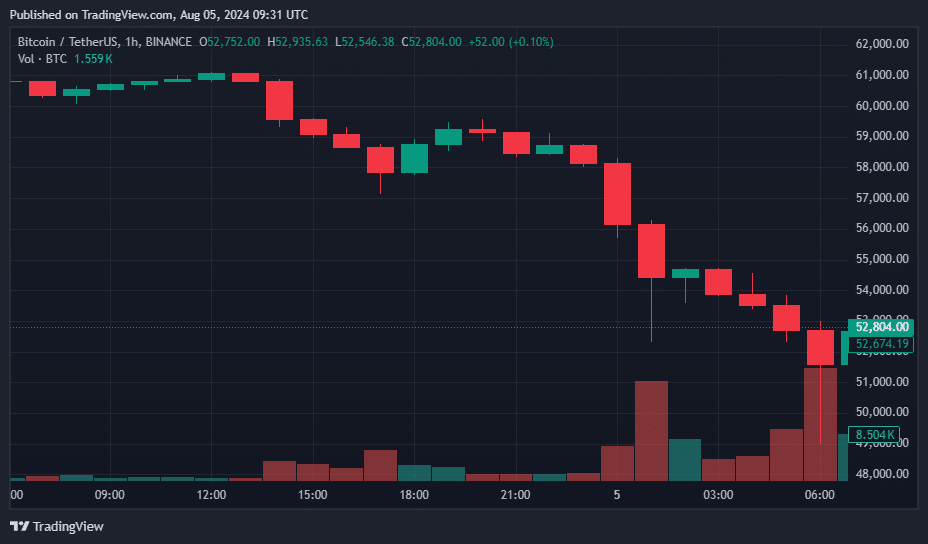

Bitcoin experienced a sharp decline on Aug. 5, plummeting to $49,221 after maintaining a level of around $58,350 for almost two hours.

At the time of writing, Bitcoin (BTC) had a daily trading volume of $79.5 billion, while its market cap had fallen to $1.04 trillion. The crypto asset is still 28.2% down from its all-time high of $73,737, reached on March 14.

The drop was part of a broader market downturn that also saw Ethereum (ETH) fall by nearly 20%, from $2,695 to a low of $2,171, before marginally recovering to $2,321, according to the data from crypto.news.

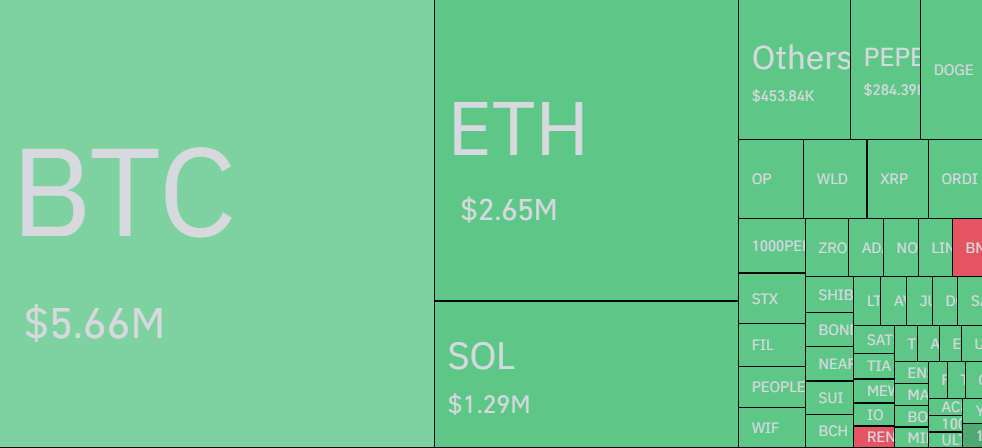

This market turmoil resulted in the liquidation of over $1.07 billion in leveraged positions within the last 24 hours, with the bulk comprising leveraged long positions. Data from CoinGlass reveals that Bitcoin and Ethereum long positions were the hardest hit, suffering losses of $305.49 million and $299.45 million, respectively.

Analysts are linking this sudden market volatility to several external economic factors. Notably, the Japanese stock market saw a 7.1% drop in the Nikkei 225 index, driven by significant losses in Japanese banking stocks following a hike in interest rates by the central bank.

Further pressures came from disappointing job figures in the U.S., a slowdown in the growth of major technology stocks, and reports of extensive liquidations by cryptocurrency trading firms, including Jump Crypto.

This recent downturn marks the most substantial 72-hour drop in over a year, wiping out $200 to $500 billion from the total cryptocurrency market capitalization.

Amidst the market chaos, the Bitcoin fear and greed index took a steep dive to 31, indicating a shift from last week’s high of 74, which suggested a greedy market. Simultaneously, U.S.-based spot Bitcoin ETFs saw significant cash outflows, with a net withdrawal of approximately $237 million on Friday.

Despite the overall market collapse, Bitcoin’s dominance index surged to 56.23%, its highest since May 2021, signaling its increased consolidation compared to other cryptocurrencies.

Meanwhile, market analysts also speculate that the escalating conflict between Iran and Israel could be influencing global market stability, potentially affecting cryptocurrency markets as investors seek safer assets.