Bitcoin and Ethereum prices are in a deep bear market amid the ongoing winding down of the Japanese yen carry trade and presidential polls in the US.

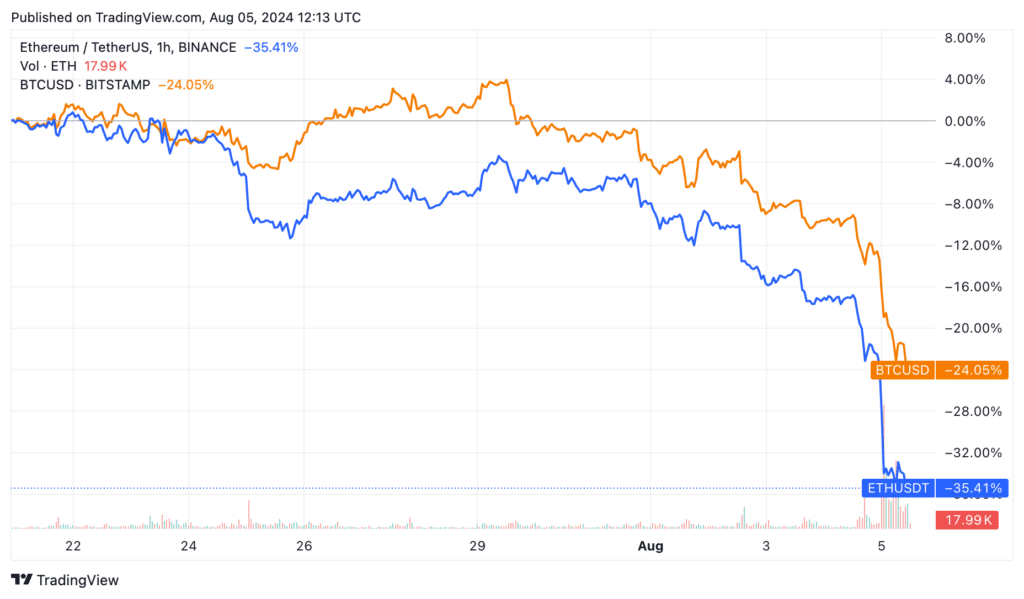

Ethereum (ETH) has dropped by over 22% in the past 24 hours and by 32% in the last 7 days while Bitcoin (BTC) fell by 16% and 26%, respectively.

Japanese yen carry trade

There are a few reasons for the ongoing crypto sell-off. However, the most important one is the ongoing winding down of the Japanese yen carry trade after the country’s central bank hiked interest rates by 0.25% last week.

This was an important decision since Japan has a history of maintaining low interest rates. Most recently, it was the last central bank to exit negative interest rates.

It was also a crucial decision because it came as other central banks are considering rate cuts. The Bank of England, European Central Bank, and Swiss National Banks have all slashed rates while the Fed has hinted that it will cut in September.

Therefore, traders are winding down a carry trade that has existed for years. A carry trade happens when investors borrow from low-interest-rate countries to invest in higher rate countries. Over the years, borrowing from Japan and investing in the US has been a great trade.

Bitcoin, Ethereum, and other altcoins dropped after polls showed that Kamala Harris has a higher chance of beating Donald Trump. While Polymarket has Trump with a 53% chance of winning, Kamala has narrowed his lead in the $500 million bet. PredictIt has Kamala Harris beating Trump.

They have also dropped because of the ongoing geopolitical issues in the Middle East, rising chances of a US recession, and weak technicals.

In a series of X posts, Peter Schiff, a well-known crypto bear and gold bull, warned that Bitcoin and Ethereum Exchange Traded Funds could have a liquidity crisis on Monday.

He argues that the ETFs will have to account for the weekend losses and those happening on Monday. As a result, if ETF investors sell, then liquidations would overwhelm the spot market.

#Bitcoin just sank below $58K. If it takes out it's July low by tomorrow's U.S. #StockMarket open, #BitcoinETFs will gap down by more than 15%, 30% below their Jan. highs. A loss of that magnitude may finally trigger mass ETF liquidations. If so, brace for a #Crypto black Monday.

— Peter Schiff (@PeterSchiff) August 4, 2024

Peter Schiff has a long history of being negative on Bitcoin and Ethereum, which he believes are worthless assets. However, historical data shows that the two assets have outperformed gold – his favorite asset – by far.

Despite the ongoing sell-off, Bitcoin has risen by 21% this year while gold is up by 15%. In the last five years, BTC has risen by 360% while gold is up by less than 80%.