Dogecoin (DOGE) Price Plummets, Becomes Worst-Performing Coin in Top 10

08/05/2024 21:30

Dogecoin (DOGE)t bearish market structure contrasts sharply with the bullish trend observed some weeks back. What's next?

Last week, BeInCrypto predicted that Dogecoin’s (DOGE) price could fall below $0.10. That has happened today, as the coin trades at $0.08.

While DOGE is not the sole crypto affected by the decline, it registered the highest price decrease out of the assets in the top 10 per market capitalization.

Dogecoin Steep Decline Met With Massive Liquidations

Data shows that the crypto market has had a rough 24 hours. However, it has been far worse for Dogecoin which had a 24.89% fall. This decrease is more dreadful than that of cryptocurrencies, including Binance (BNB), Solana (SOL), and Ethereum (ETH), which also note double-digit declines.

Amid the fall, a whale moved 117.52 million DOGE valued at $11 million to Robinhood, an American-based exchange. This development further panicked the market, as the movement of coins into platforms like Robinhood suggests an additional sell-off.

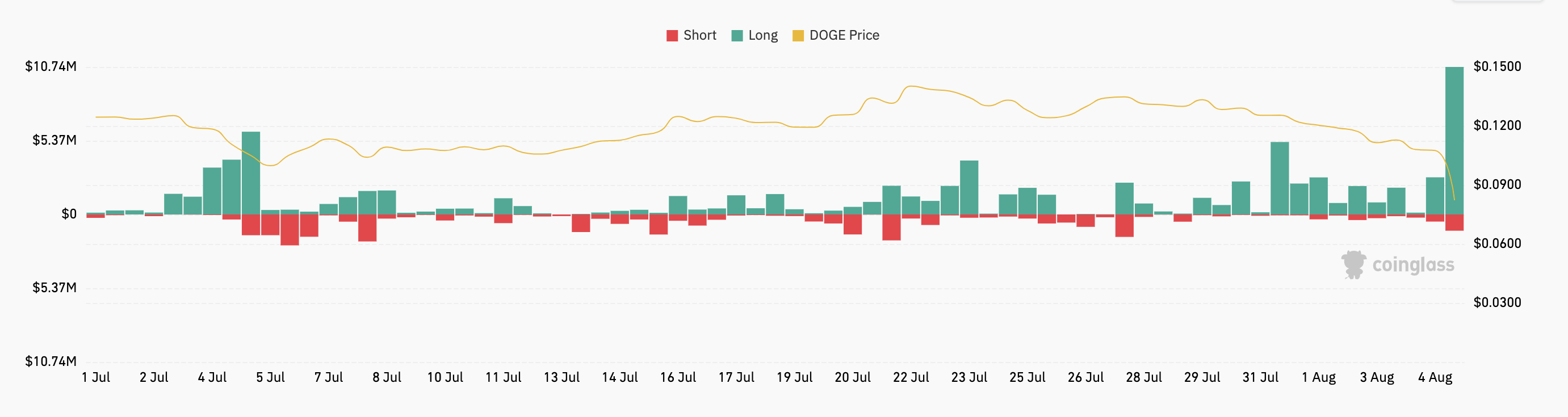

Besides the correction, Dogecoin recorded its highest liquidation value since mid-June. Liquidation occurs when an exchange closes a trader’s open contract due to insufficient margin balance to keep the position open.

It could also happen as a result of high leverage and extreme volatility, as currently seen in the market. According to Coinglass, a total of $14.74 million was liquidated in the last 24 hours. Out of this, longs accounted for 13.08 million, while shorts only experienced a $1.66 million wipeout.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

For context, longs are traders with positions targeted at a price increase. Shorts, on the other hand, are traders betting on a decrease. Therefore, the hike in long liquidations proves that the risk of predicting a price increase was not worth the reward.

DOGE Price Prediction: Coin Oversold, Rebound Next?

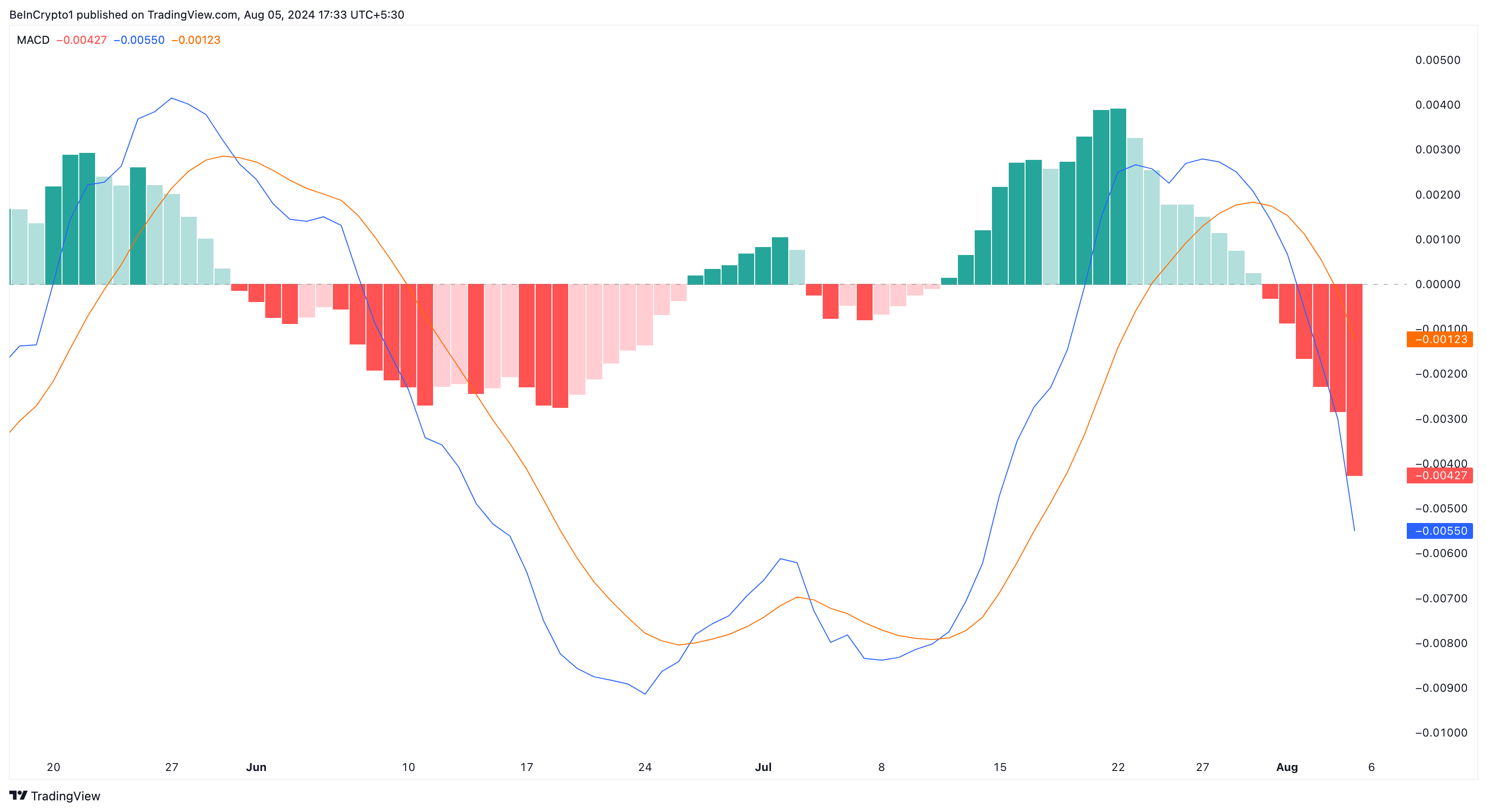

DOGE’s price reached as high as $0.14 about two weeks ago. From a technical perspective, the current market structure is the complete opposite of what happened during that period.

For instance, the Moving Average Convergence Divergence (MACD), which uses two moving averages to determine price trends and momentum, is in negative territory. Usually, a positive reading of MACD indicates bullish momentum.

Therefore, this reading implies that the momentum around DOGE is bearish. If this continues, the meme coin may continue to experience sustained selling pressure, completely fading its bullish recovery.

In the meantime, the Relative Strength Index (RSI), which measures momentum is in oversold territory.

In simple terms, an RSI reading of 70.00 or above indicates that a cryptocurrency’s momentum is overbought, while readings at 30.00 suggest that the crypto is oversold.

Read More: Dogecoin vs. Bitcoin: An Ultimate Comparison

Therefore, DOGE’s RSI, as shown below, shows a potential rebound for the coin if buying pressure comes in at any point. If that happens, DOGE’s price may return to $0.10. However, should selling pressure continue to region, DOGE could slip below $0.08

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.