Nvidia stock crawled back on Monday, Aug. 5, giving all asset class investors hope that a buy-the-dip opportunity exists.

Is this all a big dead cat bounce?

Nvidia stock traded as low as $90.69 on Aug. 5 and investors sensed a buying opportunity as shares quickly reclaimed the $100 level. This rebound happened even as the Dow Jones dropped by over 1,000 points and the S&P 500 and the Nasdaq 100 index experienced its first ever intraday 1,000 point decline.

NVDA’s recovery mirrored a similar comeback seen in several notable altcoin names, both small and big. Dogecoin (DOGE), for example, rose to $0.093, up by over 16% from its lowest point. JasmyCoin (JASMY), the popular Japanese crypto rose to $0.021, 35% higher than the daily low.

Render Token (RNDR), a leading AI cryptocurrency, rose by 25% from this week’s low.

Bitcoin (BTC) also pared back some of its previous losses and was trading at $54,500. Ethereum (ETH) rose to $2,440. Still, it is unclear whether these gains will hold because of the elevated risk in the financial market. Perhaps, the rebound could be a dead cat bounce, a situation where an asset in a freefall bounces back briefly and then resumes its prior downtrend momentum.

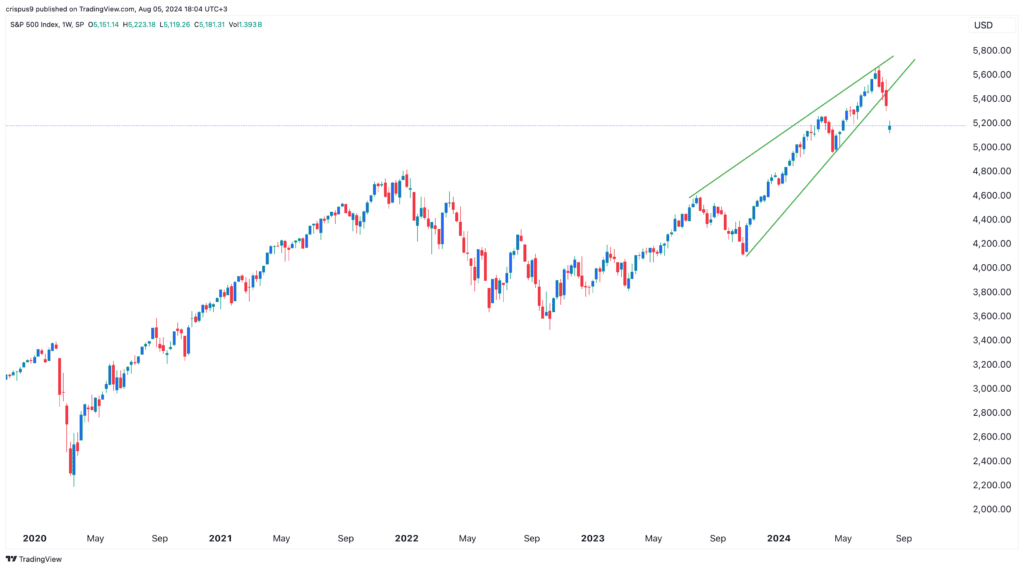

The other risk is that the S&P 500 index formed a high-risk rising wedge chart pattern on the weekly chart. In most cases, this pattern leads to more selloffs, as has already happened.

Technology stocks like Nvidia and cryptocurrencies have some correlation, which explains why altcoins like Render and Jasmy rose during the morning session in the US. These tokens rose as investors bought the dip after they became oversold. On the daily chart, Render’s Relative Strength Index (RSI) moved to 26 while Jasmy and Dogecoin’s fell to 24 and 27, respectively.

The bullish case for NVDA and altcoins

On the positive side, some potential catalysts could push Nvidia and cryptocurrencies higher. The main catalyst is that the US is moving to a recession, according to Goldman Sachs and the Sahm Rule.

If this is correct, then the Federal Reserve will likely intervene by cutting interest rates in its September meeting. Professor Jeremy Siegel has made a case for a super-jumbo 75 basis point cut.

The implied market probability of a 50 basis point cut by the Federal Reserve in September suddenly surged from essentially de minimis to some 80% as traders increased their overall expectation of both the size and the speed of a Fed cutting cycle.

— Mohamed A. El-Erian (@elerianm) August 4, 2024

It is certainly possible that,…

Cryptocurrencies and other risky assets thrive when the Fed is slashing interest rates, as we saw during the Covid-19 pandemic. At the time, global stocks and cryptocurrencies soared even as the Covid-19 pandemic continued.

The other positive factor for stocks and cryptocurrencies is that earnings have been solid despite the weakness from Tesla and Intel. With over 70% of all S&P 500 companies having released their numbers, the blended revenue growth has been 11.5%, the highest level since Q4’21.

For Nvidia, the next important catalyst will come on August 28 when the company publishes its financial results. Analysts expect the numbers to show that revenue rose to $28 billion from $26 billion in Q1.