Neiro Ethereum (NEIRO) Bucks Market Trend, But There Is a Catch

08/06/2024 04:00

Neiro Ethereum (NEIRO) is poised to lose its recent gains. Readings from its chart show that the price rally is not backed by enough demand.

Dubbed the “sister of the OG Doge,” the dog-themed meme coin Neiro Ethereum (NEIRO) has seen a remarkable price surge over the past week. Despite the overall market downtrend in the past 24 hours, NEIRO has continued its upward trajectory, rising by 13%.

However, the token may soon lose these gains, as the price rally is not backed by actual demand for the meme coin by market participants.

Is Vitalik to Blame For the Looming Price Fall?

In a post made on X on August 3, the developer team behind the meme coin announced the airdrop of 4% of the token’s supply, valued at $130,000, to Vitalik Buterin.

— Neiro on Ethereum (CTO) (@neiroethcto) August 3, 2024We are the people's $Neiro, on the people's chain, @ethereum.

And a little fun fact: @VitalikButerin is currently our largest holder. (4% of supply, ~$130k value as of the time of this post)

However, according to data from Etherscan in the early trading hours of Monday, Buterin sold the entire amount in a single transaction, netting 44.42 ETH valued at approximately $241,620.

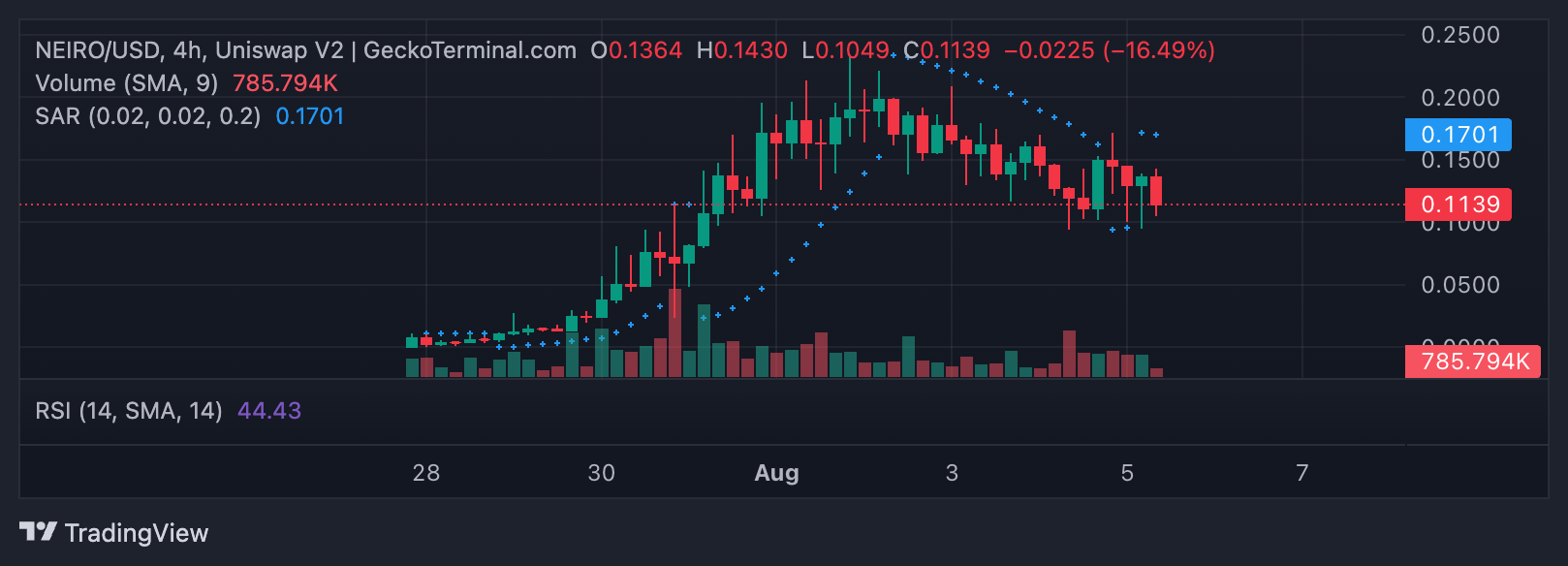

This move has put significant downward pressure on the meme coin’s value as traders begin to offload their holdings. Readings from NEIRO’s price movements on a four-hour chart confirm an uptick in selling pressure among market participants.

At press time, NEIRO’s Parabolic Stop and Reverse (SAR) indicator dots rest above its price. This indicator tracks price trends and identifies potential reversal points. When the dots are above an asset’s price, it signals a downtrend, indicating increased selling activity and the likelihood of continued price decline.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

NEIRO’s Relative Strength Index (RSI) is below its 50-neutral line, sitting at 44.33. This indicator measures oversold and overbought conditions in the market. NEIRO’s RSI suggests that selling pressure currently outweighs buying activity among market participants.

NEIRO Price Prediction: Price May Head to $0.15 or Plunge to $0.09

Additionally, the widening gap between the upper and lower bands of NEIRO’s Bollinger Bands signal increased market volatility.

Bollinger Bands measure an asset’s market volatility and identify potential overbought or oversold conditions. When the gap between the upper and lower bands widens, it indicates increased market fluctuation. This situation puts NEIRO at risk of significant price swings as market trends shift.

If NEIRO sheds its recent gains, its next target is $0.09. This will mark a 25% decline from its current market price.

Read More: Best Crypto To Buy Now: Top Coins To Keep an Eye on in August 2024

However, if the current trend changes course and the demand for NEIRO begins to climb, its price may spike to $0.15.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.