Crypto Markets See Major Recovery Amid Speculation of September Fed Rate Cut

08/06/2024 12:39

Anticipation of the Fed rate cut in September boosts crypto markets, driving significant recovery of Bitcoin and other major cryptocurrencies.

On Tuesday morning, Asia time, Bitcoin (BTC) momentarily exceeded $56,000, following a global market risk aversion spike that led to significant declines across the wider crypto market. CoinGecko data shows that BTC is trading at $55,713 at the time of writing, a 3% increase over 24 hours.

Other major cryptocurrencies like Ethereum (ETH) have also shown remarkable recovery. Analysts suggest that the anticipated rate cut could provide the necessary boost to sustain the market’s upward momentum.

Will the Federal Reserve Cut Rates in September? Experts Weigh In

A week ago, Federal Reserve Chair Jerome Powell minimized the need for interest rate cuts this year. At that time, there was only an 11% chance of a 50 basis point rate cut by the Fed’s September meeting. However, Monday’s massive sell-offs have increased speculation about the possibility of an emergency cut.

Read more: What Causes Bitcoins Volatility?

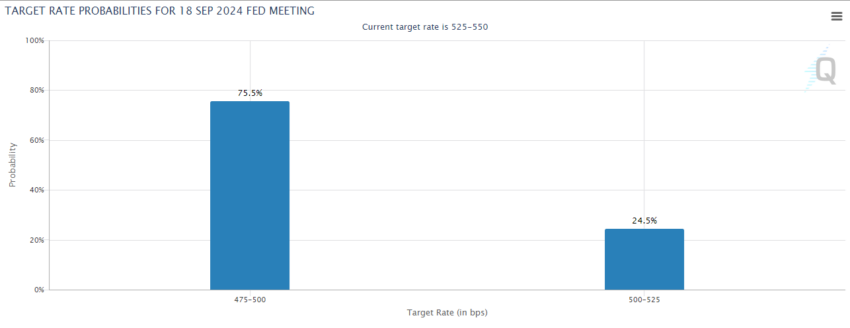

CME’s latest data indicates a 75.5% probability of the US Federal Reserve cutting interest rates by 50 bps on September 18. Financial analyst Robert Prechter expects the Fed to implement an emergency rate cut before its September meeting.

“The Federal Reserve had a wonderful opportunity last Wednesday to lower their Fed funds rate by a quarter point; they didn’t take it. I think that was a big mistake,” Prechter said.

Despite the speculation, it is important to note that emergency rate cuts by the Federal Reserve are rare. The last instance occurred during the peak of COVID-19.

Thus, with current market conditions, many economists argue that such a move is unlikely. It would signal severe economic distress and suggest the Fed made a major miscalculation, further spooking investors.

BeInCrypto reported yesterday that the crypto market experienced serious turmoil. Coinglass data showed the liquidation amount in the last 24 hours had reached $1.06 billion, with $901.33 million from long positions and $159.41 million from short ones. The figure was a swift increase in just five hours, which was only approximately $800 million.

Several industry experts attributed the drop to the recent macroeconomic developments. Weak US economic data on Friday spurred concerns about a slowing global economy. Additionally, the rapid unwinding of the yen carry trade pushed Japanese markets lower, compounded by geopolitical risks in the Middle East.

In the crypto market, Jump Trading offloaded large amounts of its Ethereum holdings, adding further pressure. These series of events further strengthened the intense volatility within the crypto markets, shaking investor confidence.

Analysts Advise for Long-Term Strategies to Manage Crypto Volatility

Amid the crypto market’s short-term volatility, experts advise maintaining a long-term perspective. Bitwise CIO Matt Hougan emphasized the buying opportunity presented by recent market fluctuations.

“Emotions aside, history suggests this weekend’s sell-off is a buying opportunity. […] The last time the market melted down like this was March 12, 2020. […] In retrospect, March 12, 2020, wasn’t a time to panic. It was the best buying opportunity for Bitcoin in a decade. […] I see the same setup today,” he stated.

Hougan acknowledged that whether the crypto market has found its bottom has become a critical question in the short term. However, he advised that monitoring liquidation trends can provide insights into whether the market has stabilized.

“It’s also worth keeping an eye on the health of firms in the crypto ecosystem. Very sharp moves can take down firms with overleveraged balance sheets, as we saw in the 2021 crisis,” Hougan added.

Read more: How To Prepare for a Recession: 11 Quick Tips

Furthermore, he advised that observing exchange-traded fund (ETF) flows can indicate market sentiment by revealing whether investors are leaning towards buying during dips or selling off their assets. Hougan noted that the best approach is to overlook short-term fluctuations.

“Bitcoin is a volatile asset, with big ups and big downs. Always has been, and will continue to be for a while. […] Resist the urge to look at intraday prices, and focus instead on where Bitcoin could be next year, in five years, and in ten years,” he reiterated.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.