Ethereum price bounced back on Tuesday, Aug. 6 after forming a big hammer candlestick pattern and as some investors, including ‘7 Siblings,’ bought the dip.

Ether (ETH) was trading at $2,445, up by over 15% from its lowest point this week. This price action was in sync with that of Bitcoin (BTC), Cardano (ADA), and Bittensor (TAO).

Ethereum whales are buying

There are signs that some big investors bought the dip on Black Monday , hoping that the token will bounce back. One of the buyers was an entity known as ‘7 Siblings,’ which has over $1.57 billion in assets. 7 Siblings bought 56,093 ETH tokens worth over $129 million.

— Lookonchain (@lookonchain) August 6, 2024While you guys were panic selling due to the market crash, the entity"7 Siblings" with $1.57B assets quietly bought 56,093 $ETH($129M) at the bottom!

7 Siblings started buying when the price dropped to $2,600 and continued until the price dropped to $2,191, a total of 12 hours… pic.twitter.com/t5fsVu28gH

There are also signs that Exchange Traded Funds investors bought the dip. According to Bloomberg, these investors bought assets worth $49 million, in a sign of increased investor optimism.

Still, the crypto industry is being cautious, with some big holders selling their tokens. Jump Trading, a prominent player in the industry, has sold Ether tokens worth over $609 million in the past few weeks. Another big holder known as Longling Capital moved 20,000 coins after being dormant for almost 2 years.

Ethereum’s recovery faces additional risks. For one, not every analyst believes that the Federal Reserve should cut interest rates in September. In a CNBC interview, Komal Sri-Kumar, founder of Sri Kumar Global Strategies, said that the Fed should wait for inflation to fall before cutting interest rates.

Still, he seems to be in the minority as the CME Fedwatch tool has a 76.5% probability of a 50bps rate cut in September followed by another one in November and December.

Another positive for Ethereum is that its staking yield has risen by 6.3% in the past 24 hours to 9.46%. This rebound happened as the staking market cap dropped by 26% to $81.95 billion.

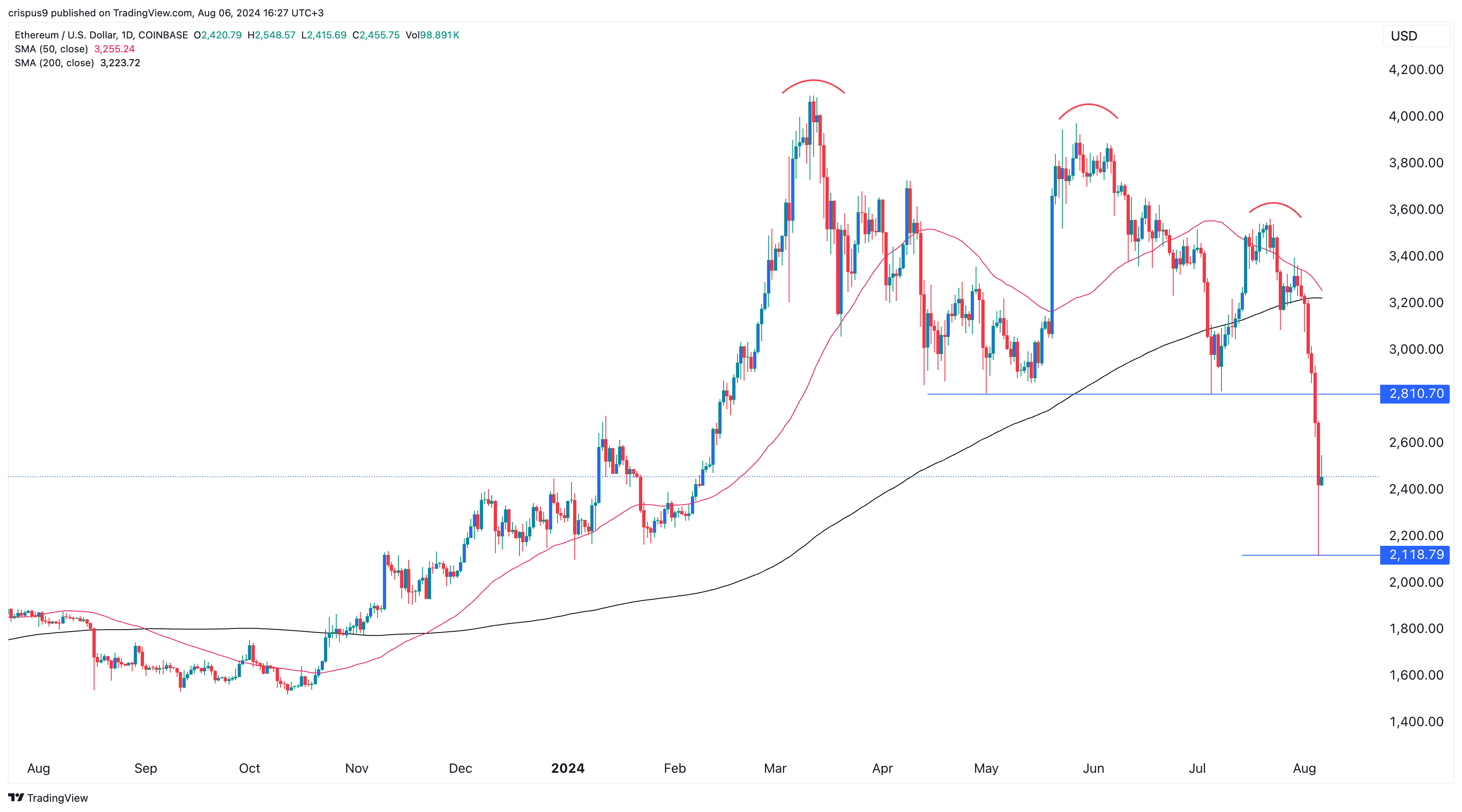

Ethereum price has some technical risks

The other potential risk for Ether is technical. On the daily chart, the coin formed a triple-top pattern whose neckline was at $2,810. It has now dropped below this neckline, meaning that bears have prevailed.

Ether is also about to form a death cross as the 50-day and 200-day Simple Moving Average are about to make a bearish crossover. Also, as was previously noted about Bitcoin, any rebound after a sell-off could prove to be a dead cat bounce.