Bitcoin price rose on Tuesday, Aug. 6 as some investors bought the dip and a sense of calm spread in the crypto and stock market.

Bitcoin price nears a death cross

Bitcoin (BTC) rose to an intraday high of $56,000 on Aug. 6, where it found substantial resistance. This price action occurred as some investors, including those in the Exchange Traded Fund sector, bought the dip.

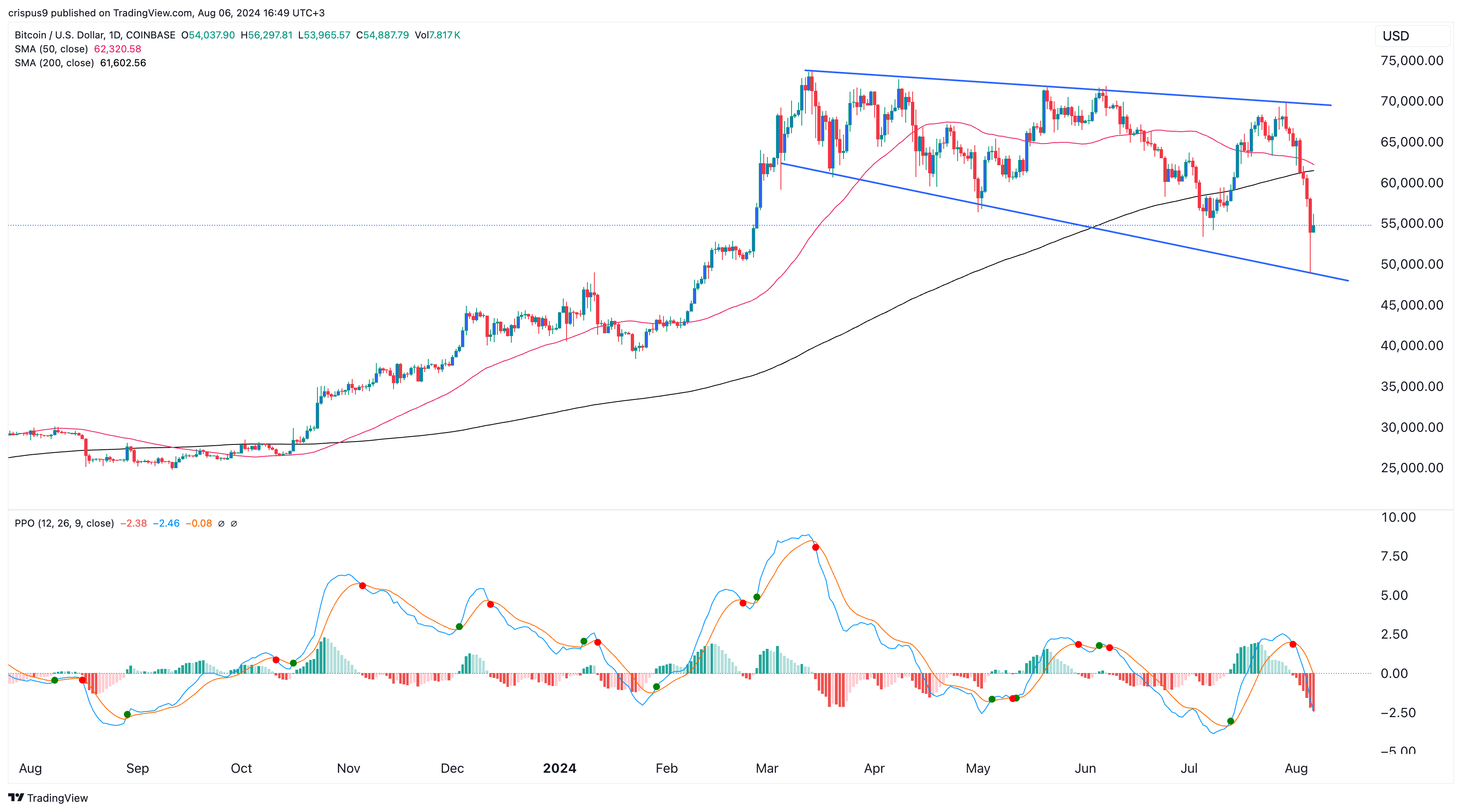

However, it is too early to predict whether these gains will hold in the longer term. On the daily chart, the 200-day and 50-day Simple Moving Averages are about to form a death cross pattern, which is mostly followed by further downside.

Bitcoin also remains below the Ichimoku cloud, while the Percentage Price Oscillator (PPO) is below the neutral point. The PPO measures the difference between two moving averages and closely resembles the MACD, but it calculates the difference in percentage terms.

These technical indicators point to more downside in the near term. A complete bearish breakout will be confirmed if the price drops below Monday’s low of $49,000, which is the lower side of the hammer candlestick.

Meanwhile, the role of Bitcoin is being questioned by key opinion leaders. In a CNBC interview, Nassim Taleb, the author of “The Black Swan,” warned that Bitcoin was not a hedge against anything.

He noted that the coin was a “speculative thing that behaves like high-value real estate in Manhattan.”

Taleb has been a well-known Bitcoin critic for years. In 2022, he attributed the coin’s popularity to the Federal Reserve’s decade-long near-zero interest rates, which he claimed created bubbles and tumors like Bitcoin.

Taleb is not the only prominent person to warn about Bitcoin. Peter Schiff continues to assert that Bitcoin is worthless and that it made no sense to make it a reserve asset by the government.

The bill proposed by @SenLummis, which requires the U.S. government to create a "Bitcoin Reserve" by purchasing 1 million #Bitcoin to HODL for 20 years, mandates the Federal Reserve to print the money to pay for it. Thus, the Senator's plan is to create #inflation to buy Bitcoin.

— Peter Schiff (@PeterSchiff) August 5, 2024

On Aug. 6, Kathleen Breitman, the co-founder of Tezos (XTZ), chimed in and warned that Bitcoin’s role as a store of value was being decimated.

Time will tell whether Peter Schiff’s and Nassim Taleb’s Bitcoin price predictions will work out. However, the two—and other critics—have missed a generational asset that moved from near zero in 2009 to $55,000 today. Gold, which Schiff favors, has moved from $1,000 to $2,400 over the same time period, a 115% increase.