Binance Saw $1.2 Billion in Net Inflows Against Black Monday Woes

08/07/2024 01:00

Binance reports $1.2 billion net inflows amid market chaos, showcasing investor confidence despite global selling pressures.

Binance recorded $1.2 billion in net inflows over the past 24 hours. The positive flows came despite market turmoil, as traders and investors exited their positions.

August 5 will be remembered as one of the gloomiest days in crypto history, second only to the FTX collapse debacle.

Binance Sees $1.2 Billion in Net Inflows

Binance CEO Richard Teng reported the news, citing transparency metrics on centralized exchanges as reported by DefiLlama. Based on the report, this is one of the highest net inflow days for the exchange this year. It also went down as one of the highest trading volumes on Binance year-to-date.

“Amid the macroeconomic climate and yesterday’s market downturn, Binance recorded a net inflow of US$1.2 billion in the past 24 hours, according to DefiLlama’s CEX Transparency metrics. This marks one of the highest net inflow days of 2024, indicating strong investor confidence. Yesterday also saw one of the highest trading volumes on Binance year-to-date. We are now witnessing a rebound in major token prices, with current market trends validating this,” Teng wrote.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

DefiLlama data corroborates the report, showing that Binance holds over $100 billion in total assets. OKX follows with $17 billion, and Bitfinex with $16 billion. This suggests strong investor confidence in Binance, especially on a crisis-stricken day.

In what went down as the “black Monday” of crypto, over $1 billion in positions were liquidated. On-chain behavior aggregator Santiment likened the crash to what ensued after the FTX saga in November 2022.

“Crypto’s largest dip since the widely documented November 2022 FTX collapse has been met with recognition, but not at the level expected for a near 2-year milestone. Consider this a positive sign, as fear has crept in enough for traders to hesitate on opening their wallets,” Santiment wrote.

The show of confidence comes despite its regulatory woes. As BeInCrypto reported, the exchange is at odds with Indian regulators and faces an $86 million tax claim. Meanwhile, its lawsuit with the US Securities and Exchange Commission (SEC) remains uncertain after the regulator updated the complaint.

Offshore Exchanges Experience Sell-Offs

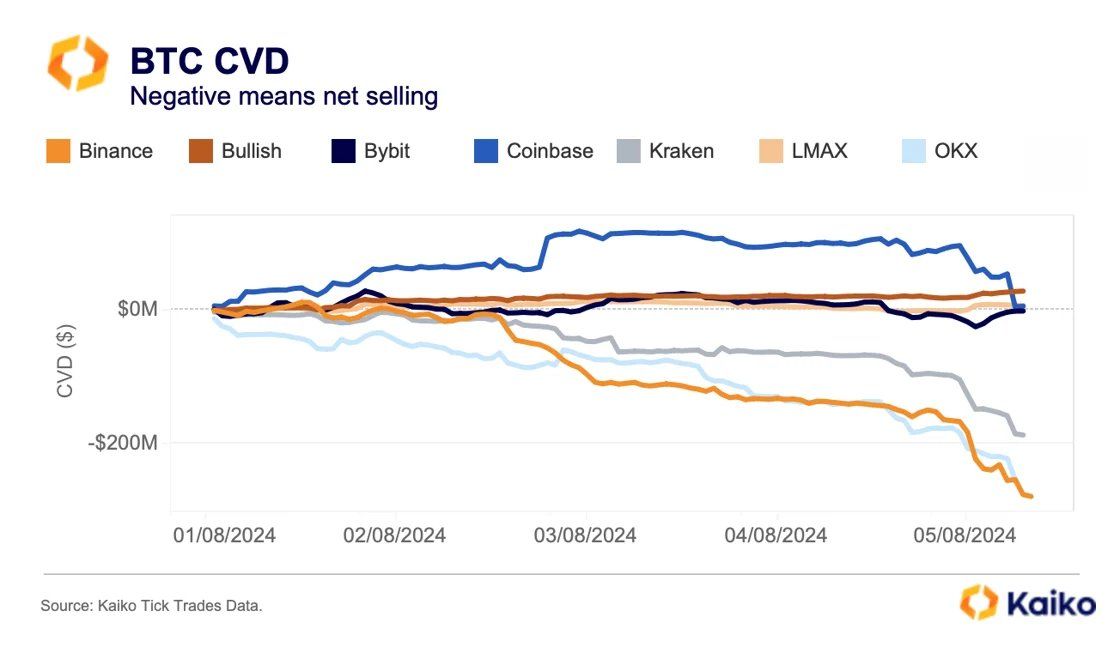

Elsewhere, Kaiko data reveals diverging trends that raise interesting questions about crypto market dynamics. While offshore exchanges like Binance and OKX have experienced strong selling since Friday, Bitcoin’s cumulative volume delta (CVD) on most US platforms remains positive. CVD is a technical indicator used to measure the difference between the total buy volume and sell volume of a particular asset over a specified period.

Offshore exchanges are popular for their global reach and liquidity. However, their susceptibility to regulatory uncertainties and geopolitical factors can sometimes lead to heightened volatility and selling pressure. The recent downturn observed on offshore exchanges relative to US-based platforms like Coinbase highlights the impact of external events on market sentiment.

Traders feel the urge to offload their positions in response to perceived risks. Bitcoin’s cumulative volume delta remaining positive among US platforms shows sustained interest and buying activity among investors.

This resilience in trading volume suggests a more optimistic outlook for US market participants. They may view the current market conditions as an opportunity to accumulate Bitcoin at favorable prices.

Read more: Best Cryptocurrency Exchanges & Trading Platforms in 2024

The significance of these contrasting trends lies in the nuanced interplay between global market drifts and regional factors shaping investor behavior. While offshore exchanges navigate regulatory challenges and external pressures, US platforms appear to maintain a sense of stability and confidence. This promotes a more bullish sentiment among traders.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.