Ethereum's Mt. Gox? $2 Billion ETH from Chinese Ponzi Reawakens

08/07/2024 19:53

$2 billion ETH awakens from dormant wallets in Chinese ponzi scheme twist

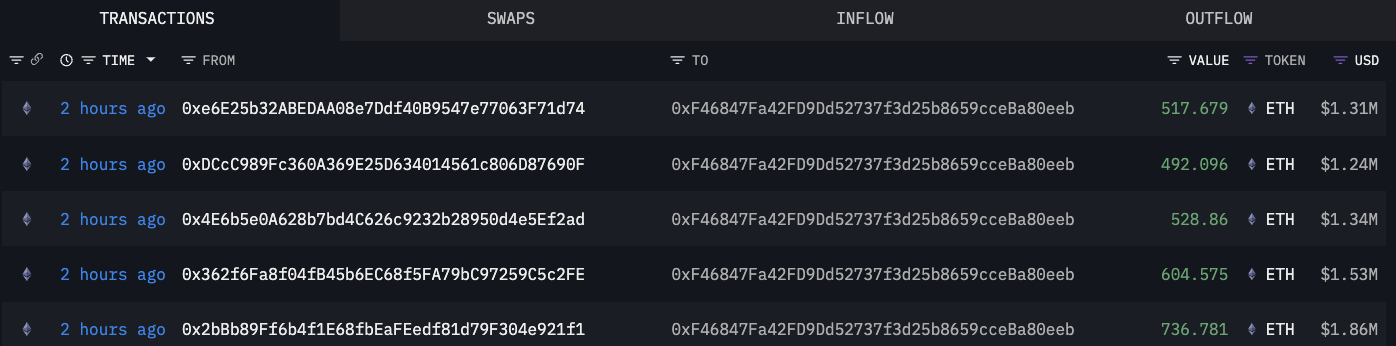

A thunderous shift in Ethereum (ETH) happened today as hundreds of previously inactive wallets have started moving large amounts of the major altcoin. These wallets, as reported by Lookonchain, have not been used for over 3.3 years.

Today, however, they started moving around 789,533 ETH, which is worth almost $2 billion. The funds are traced back to a wallet called PlusToken ponzi scheme, a 2021 story that seemed to be forgotten, but here we are.

The PlusToken ponzi scheme, which started in May 2018, promised big returns through a fake crypto arbitrage trading platform. People had to put in at least $500 in crypto assets, which led to the accumulation of billions in digital currency before the scam was shut down.

It was one of the biggest frauds in crypto at its time. During a crackdown in 2020, Chinese police seized a range of crypto assets, including 194,775 BTC and 833,083 ETH, among others. The latest development raises concerns similar to the impact seen with Mt. Gox's historic Bitcoin movements, potentially affecting market stability.

Speaking about that, Ethereum's price has dropped a little in response to the news, down by about 2% to around $2,480. While this immediate reaction is notable, it is not yet clear what the long-term implications of this "black swan" event will be.

About the author

Gamza Khanzadaev

Financial analyst, trader and crypto enthusiast.

Gamza graduated with a degree in finance and credit with a specialization in securities and financial derivatives. He then also completed a master's program in banking and asset management.

He wants to have a hand in covering economic and fintech topics, as well as educate more people about cryptocurrencies and blockchain.

Advertisement

TopCryptoNewsinYourMailbox

TopCryptoNewsinYourMailbox