NewsBriefs - Craig Wright misses deadline to appeal UK ruling in Bitcoin case

08/07/2024 19:29

Craig Wright failed to file an appeal against a UK court verdict by the August 5 deadline. The UK's Judicial Office confirmed no appeal was ...

Editor-curated news, summarized by AI

Craig Wright misses deadline to appeal UK ruling in Bitcoin case

Craig Wright failed to file an appeal against a UK court verdict by the August 5 deadline. The UK's Judicial Office confirmed no appeal was submitted, contradicting claims made on Wright's social media accounts. This marks Wright's third unsuccessful appeal attempt in crypto-related cases. The courts also referred Wright to the Crown Prosecution Service for potential perjury and are uncertain of his current location. Wright's legal obligations and injunctions from the July 16 ruling remain in effect.

Latest

-

Craig Wright misses deadline to appeal UK ruling in Bitcoin case

Craig Wright failed to file an appeal against a UK court verdict by the August 5 deadline. The UK's Judicial Office confirmed no appeal was submitted, contradicting claims made on Wright's social media accounts. This marks Wright's third unsuccessful appeal attempt in crypto-related cases. The courts also referred Wright to the Crown Prosecution Service for potential perjury and are uncertain of his current location. Wright's legal obligations and injunctions from the July 16 ruling remain in effect.

Expand

-

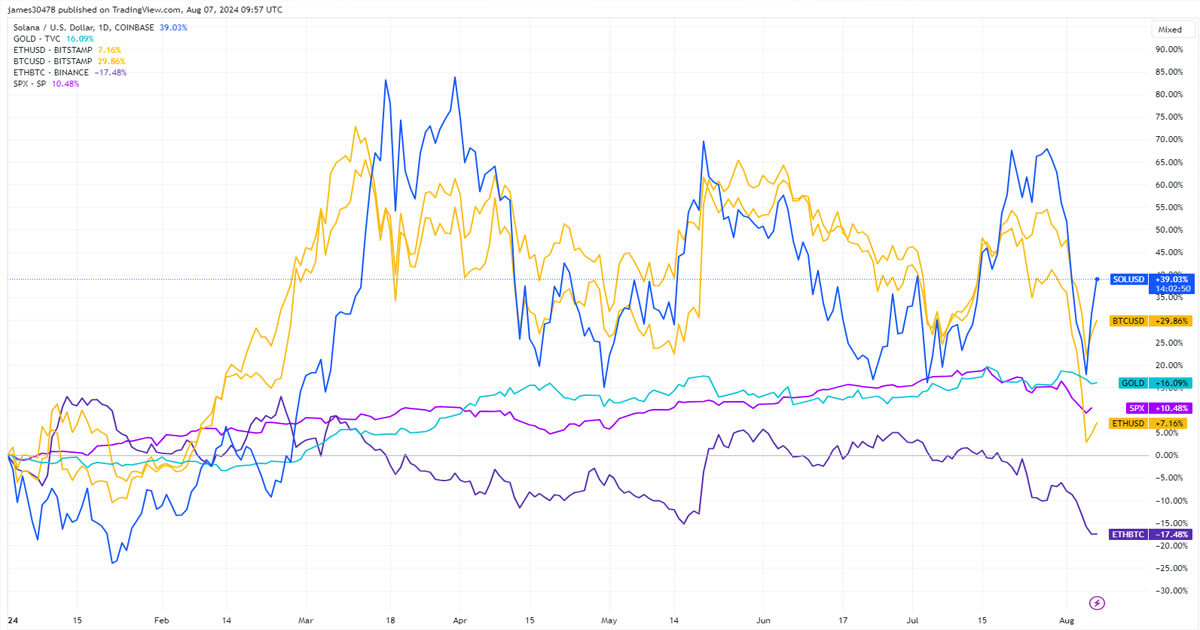

Bitcoin outperforms ethereum as historical data suggests widening gap in second half

Bitcoin maintains its position as a top-performing asset with a 63% CAGR and 30% growth in 2024. Ethereum lags behind, rising only 8% year-to-date. The ETH/BTC ratio has dropped 17% this year to 0.043. Historical data indicates Bitcoin's performance typically improves in H2, while Ethereum's declines, suggesting the gap between the two cryptos may widen further. Solana has surged 40% YTD, outpacing both Bitcoin and Ethereum in 2024.

Expand

-

Arthur Hayes predicts Bitcoin price surge amid global monetary shifts

Arthur Hayes, crypto industry veteran, expects Bitcoin to reach up to $1 million in the current cycle due to global monetary changes and debt rollover needs. He views the crypto industry as maintaining its innovative spirit despite increasing involvement from traditional finance giants. Hayes downplays the importance of US election outcomes and SEC leadership on crypto's trajectory, emphasizing that monetary policies will continue to drive crypto prices upward regardless of who's in power. He remains skeptical about the likelihood of a US Bitcoin reserve but supports the concept theoretically.

Expand

-

Kamala Harris selects Minnesota Gov Tim Walz as running mate

VP Kamala Harris chose Minnesota Governor Tim Walz as her running mate, potentially boosting her Midwest appeal. Walz, who hasn't openly discussed crypto, oversaw legislation regulating crypto kiosks in Minnesota. Harris' team has been reaching out to the crypto industry, and her campaign recently added David Plouffe, who has ties to Binance and Alchemy Pay. The GOP has expressed support for crypto firms in its 2024 platform.

Expand

-

Bitcoin rebounds to $55,000 as ETF investors hold strong

Bitcoin surged 8.5% to $55,000 after a sharp correction. Spot BTC ETFs showed resilience with zero outflows from BlackRock's IBIT on August 5. Major altcoins like Solana saw even larger gains. The $49,000 support held, but Bitcoin could retest this level if macroeconomic conditions worsen. A potential upside target is between $59,400 and $62,550 due to a CME gap. ETF trading volume exceeded $5 billion, the highest since mid-April, with minimal outflows, surprising analysts who expected larger withdrawals.

Expand

-

SEC asks court to deny Coinbase subpoena for crypto asset documents

The SEC urged a New York court to reject Coinbase's subpoena request for documents related to crypto assets. The agency claims Coinbase's demands are overly broad and irrelevant. Coinbase, facing a lawsuit for operating as an unregistered securities exchange, argues that most cryptos are digital commodities, not securities. The dispute highlights ongoing regulatory challenges in the crypto industry.

Expand

-

Polymarket users bet $1.4 million on federal interest rate cut by September 2024

Polymarket's decentralized prediction platform saw a $1.44 million bet on the Federal Reserve cutting interest rates by September 2024. Users estimate a 58% chance of a 50+ basis point cut and a 40% chance of a 25 basis point cut. This prediction aligns with regulated futures markets, which show an 83.5% probability of a 50 basis point cut. Polymarket's trading volume hit an all-time high of $387.01 million in July, with US political events driving cumulative volume above $1 billion in August.

Expand

-

Aave protocol generates $6 million revenue overnight amid market volatility

DeFi platform Aave earned $6 million in revenue during recent market turbulence. The protocol saw $233 million in liquidations, its highest single-day figure. Aave's founder emphasized the platform's resilience, securing $21 billion worth of value across 14 active markets. The platform remains the largest crypto-lending protocol with $9.8 billion in total value locked. This performance reflects DeFi's strength, with key protocols functioning smoothly despite market volatility.

Expand

-

21Shares exec discusses US crypto ETF adoption and future outlook

21Shares' US head Federico Brokate believes Washington's shifting attitudes could accelerate approval of solana ETFs. He expects US spot Bitcoin ETFs to reach $30 billion in inflows by year-end, with Ethereum ETFs potentially hitting $5-10 billion over 12 months. Brokate sees a future for multi-crypto ETFs and anticipates staking options for US Ethereum ETFs. He remains bullish on crypto's political support, regardless of the 2024 election outcome.

Expand

-

Justin Sun refutes liquidation rumors amid crypto market downturn

Justin Sun denied rumors of his positions being liquidated as crypto prices fell. Bitcoin dropped 13% to $52,864, while Ethereum fell 20% to $2,324. The total crypto market value decreased by 17% to $1.8 trillion. Sun stated his preference for industry-supporting activities over leveraged trading. The market decline coincides with recession fears and disappointing tech earnings. Investors sold off risky assets following weaker job reports and the Fed's decision to hold interest rates.

Expand

-

Polymarket traffic surges past DeFi platforms due to US election betting

Polymarket's website traffic has outpaced major DeFi platforms, driven by US presidential election betting. The platform's daily visits average 296,515, with users spending nearly 7 minutes per visit. Cumulative bet volume reached $1.03 billion in July, up from $672.94 million in June. Betting interest has spiked due to Kamala Harris's potential Democratic nomination and an assassination attempt on Donald Trump. Trump remains the favored candidate with a 53% chance of winning, while Harris's odds for the Democratic nomination have doubled to 44%.

Expand

-

VanEck CEO predicts Bitcoin to hit $350k amid quantitative easing

VanEck CEO Jan Van Eck forecasts Bitcoin reaching $350,000 as central banks start quantitative easing. He suggests Bitcoin's market cap could reach half of gold's, currently at $16.8 trillion. VanEck's research projects Bitcoin hitting $2.9 million by 2050 in a base case scenario, assuming adoption for global trade and as a reserve asset. Challenges include scalability issues, energy demands, regulatory hurdles, and competition from other cryptos. Bitcoin currently trades at $62,900, facing resistance after recent US jobs report.

Expand

-

US stocks and crypto tumble on disappointing July jobs report

July's US jobs report showed slower growth and higher unemployment, causing stocks and crypto to fall. The S&P 500 and Nasdaq dropped over 2%, while Bitcoin and Ether declined 2.8% and 1.7% respectively. The unemployment rate rose to 4.3%, exceeding Federal Reserve projections. The Sahm rule recession indicator is now signaling a potential economic downturn, though its reliability in the post-pandemic environment is questioned. Market uncertainty persists due to complex labor market factors and inverted yield curves.

Expand

-

Coinbase analysts predict seasonal crypto slump in August

Coinbase analysts forecast a potential crypto market downturn in August, citing historical trends of reduced activity and token value slumps. Bitcoin spot volumes dropped 19% in August 2023 compared to June, with futures volumes down 30%. Bitcoin has averaged a 2.8% decline during August over the past five years. Lower liquidity and trading volumes may lead to increased volatility. Bitfinex's Head of Derivatives expects Bitcoin to range between $61,000 and $70,000, providing an accumulation zone.

Expand

-

MicroStrategy plans $2B ATM equity offering as Bitcoin holdings grow

MicroStrategy's Q2 2024 results show its Bitcoin holdings reached 226,500 BTC. The firm raised $800M through convertible notes, called $650M of 2025 notes, and announced a 10:1 stock split. A $2B ATM equity offering is planned. The Bitcoin per share ratio is 0.012, with BTC holdings up 20% since December 2023. MicroStrategy's "BTC Yield" is 12.2% year-to-date, targeting 4-8% through 2027. The company has $3.8B in debt at 1.6% average interest, with $2.2B due in 2030 or later.

Expand