SEI Price Aims at Recovering 43% Losses as Investors Switch Sentiment

08/08/2024 14:00

SEI's price is showing signs of recovery following a significant drop over the past few days, driven by a shift in market sentiment.

SEI price is noting a recovery just as slow as most other tokens are since the market has not turned explicitly bullish yet.

However, the altcoin holders’ behavior demonstrates that they are doing their best to push the price upwards.

SEI Investors Turn Bullish

SEI price could benefit from the shift in sentiment of the investors who recently were highly bearish towards the altcoin. Signs of the same are coming from SEI’s funding rate turning positive, which is a highly encouraging development for the cryptocurrency.

This shift indicates that investors are optimistic about the altcoin’s potential for price appreciation. This is a strong signal of positive market sentiment and growing interest in the asset. Since positive funding rates result from long contracts dominating short contracts, SEI holders are betting on a recovery.

Read More: Top 9 Safest Crypto Exchanges in 2024

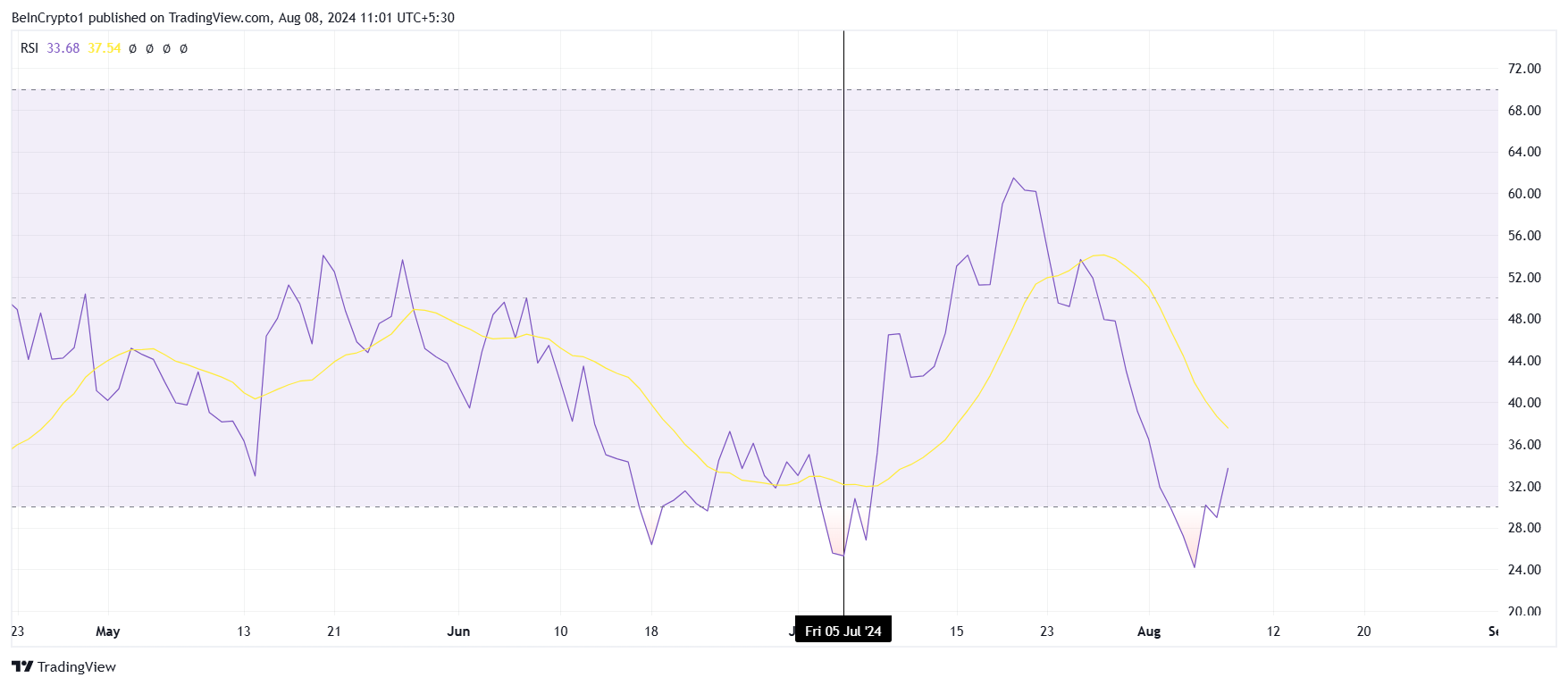

Additionally, SEI’s Relative Strength Index (RSI) is showing an uptick while remaining within the bearish zone. This upward movement is significant as it suggests a gradual recovery and a potential shift in market trends that could lead to a more positive outlook.

The RSI’s recovery from the oversold zone further highlights the rising buying momentum behind the SEI. This recovery suggests that the selling pressure is dissipating completely, and investors may be more willing to buy at the current price.

SEI Price Prediction: Long Road Ahead

The aforementioned factors could aid SEI price recovery since the broader market cues are also favoring a rise. This could push the altcoin towards the next crucial resistance level at $0.3090, up from the trading price of $0.2493.

Flipping this barrier into support would enable the SEI price to bounce towards $0.3952, recovering the recent 43% crash.

Read More: A Guide to the Best AI Security Solutions in 2024

However, if the breach fails, the crypto asset could consolidate as it did in the past, under the $0.3090 resistance and above the $0.2265 support floor. Prolonged consolidation could delay recovery and invalidate the bullish thesis.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

READ FULL BIO