Solayer Gains Binance Labs Backing to Enhance Solana Restaking Infrastructure

08/08/2024 15:37

Solayer receives funding from Binance Labs to expand team, tackle Solana’s network congestion, and enhance restaking infrastructure.

On August 7, Binance Labs announced an undisclosed amount of investment in Solayer, one of the prominent restaking projects on the Solana (SOL) network.

With the backing of Binance Labs, Solayer is gearing up to strengthen its position within the Solana blockchain ecosystem.

Solayer’s Expansion Plans Unveiled: Tackling Network Congestion

After securing these funds, Solayer reveals its plans to expand its team and onboard new protocols into the ecosystem. Additionally, the team will prioritize researching solutions to address Solana’s network congestion issues using restaking infrastructure.

Read more: Top 7 Projects on Solana With Massive Potential

Solayer also aims to launch the full system soon, allowing stakers to use SOL to secure Solana and decentralized applications (dApps) to ensure network bandwidth and transaction throughput. Moreover, Solayer will focus on general asset restaking to secure actively validated services (AVS) external to Solana.

“By converting SOL into sSOL, users contribute to network security and efficiency while receiving higher yields through a combination of native staking, maximal extractable value (MEV)-boosts, and AVS rewards,” the Solayer team wrote on their X (Twitter).

According to data from DefiLlama, Solayer’s total value locked (TVL) is nearly $155 million at the time of writing. This figure makes it the fifteenth largest decentralized finance (DeFi) protocol in the Solana ecosystem.

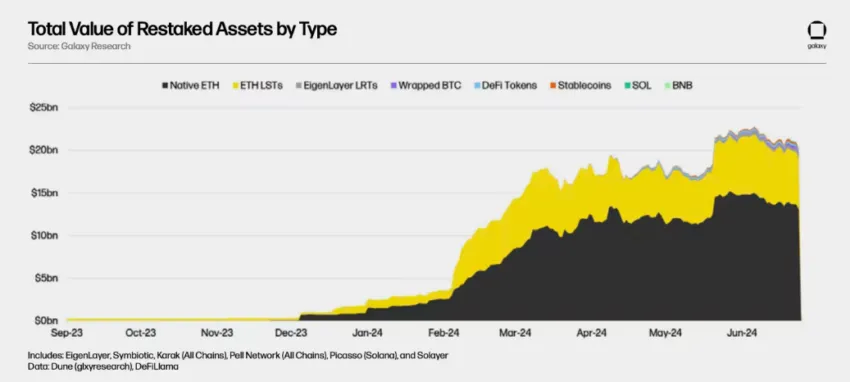

This investment aligns with the rising trend in the restaking segment. Restaking leverages the economic and computational resources of one blockchain to secure multiple others.

Specifically, in proof-of-staking (PoS) systems, restaking enables the stake weight and validator set from a single chain to be utilized across various chains. These circumstances create a unified and efficient security mechanism for multiple blockchain ecosystems.

According to a recent report by Galaxy Digital, as of June 25, 2024, $20.14 billion worth of assets is being restaked across several blockchains. Notably, $58.5 million is restaked on Solana via Picasso and Solayer.

Read more: Restaking: What Is It And How Does It Work?

Despite the potential, restaking also presents challenges. In an April report, Coinbase highlights concerns about AVS selection, potential slashing, and token financialization as emerging risks for the restaking sector.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.