Bitcoin Cash (BCH) Price Could Benefit From Easing Selling Pressure

08/08/2024 19:30

Bitcoin Cash's price is aiming to recover the losses it noted in the past few days, with investors playing a crucial role in this.

Bitcoin Cash’s (BCH) price is currently attempting to bounce back after closing above a key support level that supported the altcoin during the July crash, too.

The investors are backing this potential outcome as well after the selling sentiment was noted to be saturated following record losses.

Bitcoin Cash Investors Back Off

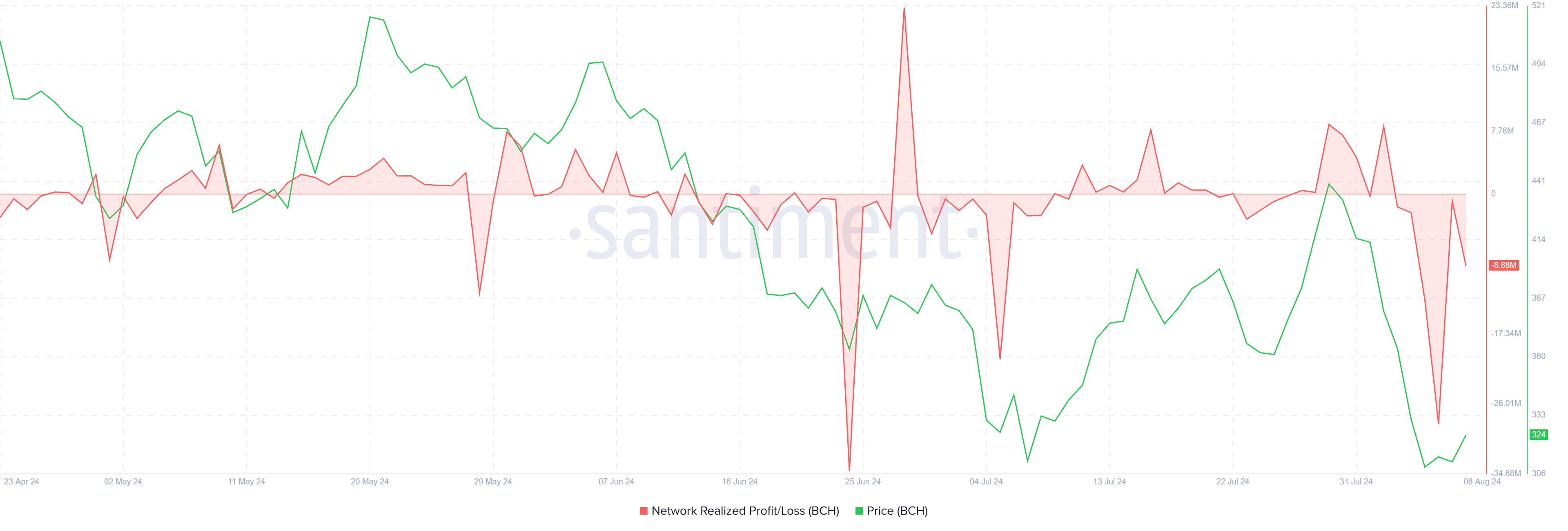

Bitcoin Cash’s price is currently at $324, recovering from a crucial support level after witnessing a drawdown last week. The panic in the crypto market led to considerable sales, and while many made profits, the overall losses superseded the profits.

This resulted in the investors reaching their highest level of realized losses in over a month, indicating a potential shift in sentiment. This surge often signals that the intense selling pressure may be nearing its end, as investors are potentially stepping away from the market to prevent further losses.

Read More: How To Buy Bitcoin Cash (BCH) and Everything You Need To Know

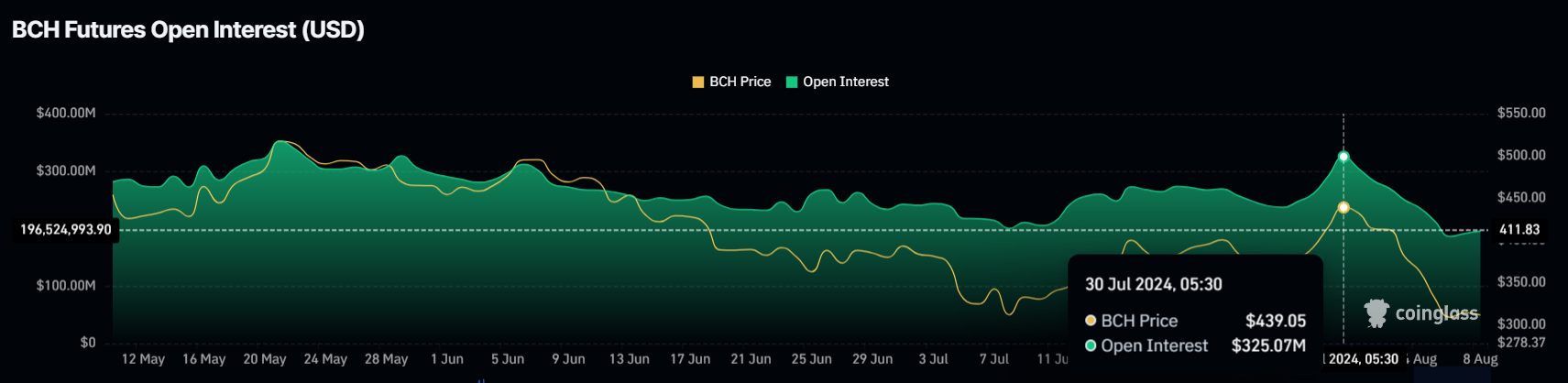

Additionally, BCH’s open interest has experienced a notable decline, dropping from $325 million to $196 million over the past nine days. This significant reduction in open interest reflects a decrease in participation and trading activity.

However, the recent trend shows that this decline in open interest has stalled in the past couple of days. This pause in the downward movement suggests that the selling pressure may be easing and could indicate a stabilization in market sentiment.

The price could note potential recovery as the investors stop pulling money out of the asset and selling BCH for losses.

BCH Price Prediction: Taking Back Control

Bitcoin Cash’s price is above the critical support floor of $310. This support level has also prevented losses in the past, providing confidence in a recovery.

However, a recovery rally would only be confirmed once the 23.6% Fibonacci Retracement level at $343 is flipped into support. This level is also known as the bear market support floor. A bounce-off from this could send Bitcoin Cash’s price to $380, which is above the 38.2% Fib line.

Read More: Bitcoin Cash (BCH) Price Prediction 2024/2025/2030

However, if the breach of 23.6% Fib fails, BCH might end up witnessing consolidation under $343. Treating $310 as the lower limit of the consolidation, the altcoin could invalidate the bullish thesis.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

READ FULL BIO