Toncoin price has staged a strong recovery after retreating to a multi-month low on Monday as investors unwound the Japanese yen carry trade.

The Toncoin (TON) token rose to a high of $6.38 in a high-volume environment. At its peak, the coin was up by over 35% from its lowest point this week. The coin rebounded despite showing some weak on-chain metrics. Data by TonStat shows that the number of Toncoins burned per day dropped to 5,766 from the year-to-date high of 28,000.

While the number of on-chain activated wallets rose to almost 12 million, the number of daily active wallets has slipped to 459,230 from July’s high of 700,000. These numbers imply that Toncoin has not benefited substantially from the popularity of tap-to-earn platforms like Hamster Kombat and Notcoin (NOT).

Toncoin’s recovery has happened as the sentiment among crypto and stock traders has improved.

The Dow Jones index has pared back most of the losses experienced in Monday and was up by 300 points on Aug. 8. Other global indices have also recovered. In crypto, Bitcoin (BTC) and other altcoins were much higher and showed an impressive recovery over the past few days.

Toncoin’s rebound is also notable because it is happening in a high-volume environment. According to crypto.news, its 24-hour volume stood at over $1.3 billion, higher than its historical average. It also happened as open interest in the futures market rose to $236 million, its highest level since August 2.

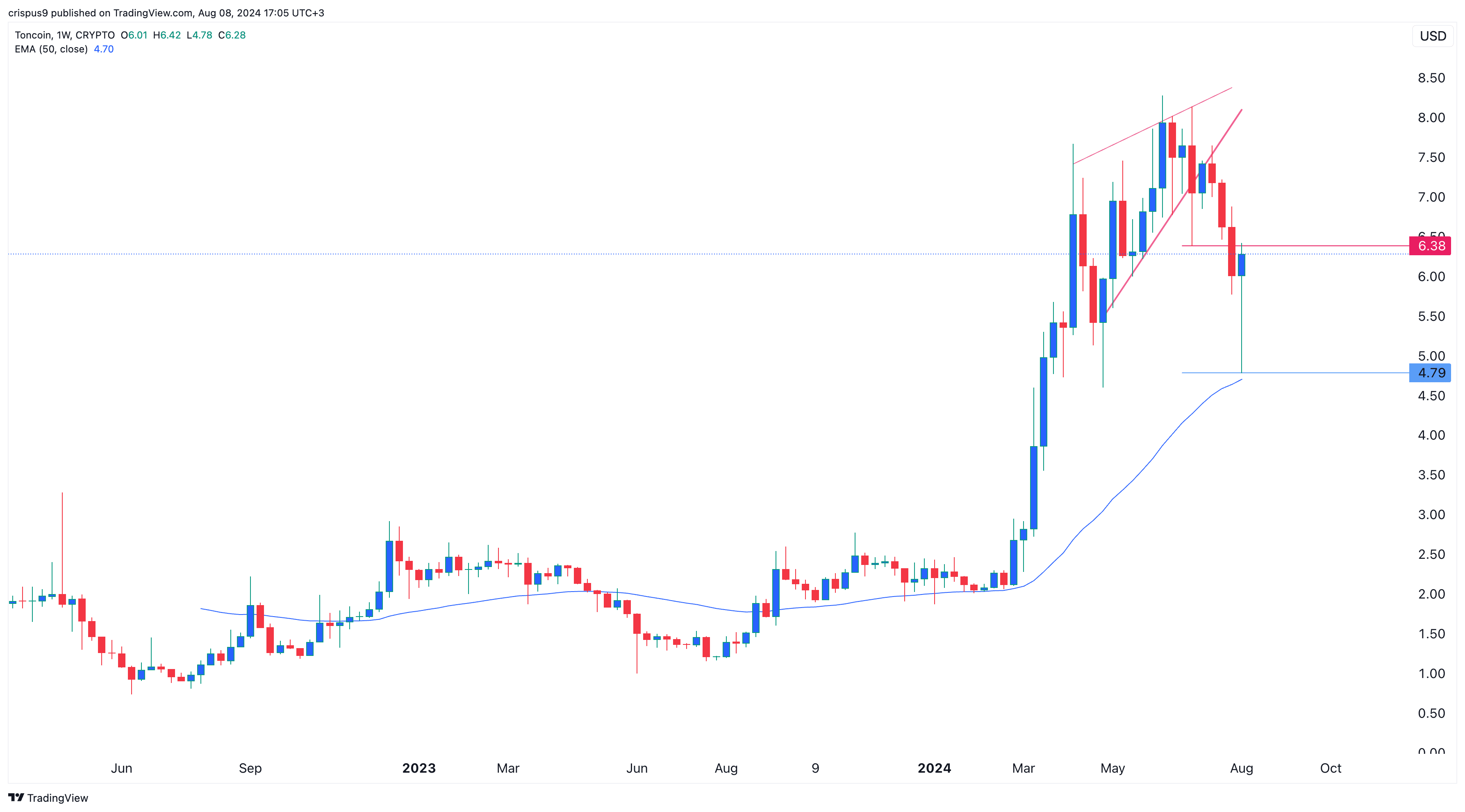

The recent Toncoin retreat happened after the coin formed a rising wedge pattern, which is a popular bearish sign. On the weekly chart, the token was forming a hammer candlestick pattern, which is characterized by a long lower shadow and a small body. In most cases, this is usually a bullish reversal pattern.

Toncoin will need to close above Monday’s low of $4.80. Additionally, the lower shadow will need to be at least twice the size of the body while the upper shadow should be small. If the body size becomes tiny, then the pattern will evolve from being a hammer to a dragonfly doji, which is also a bullish pattern.

If these patterns work in the ongoing high-volume environment, it will point to more upside, as bulls target the resistance at $7.