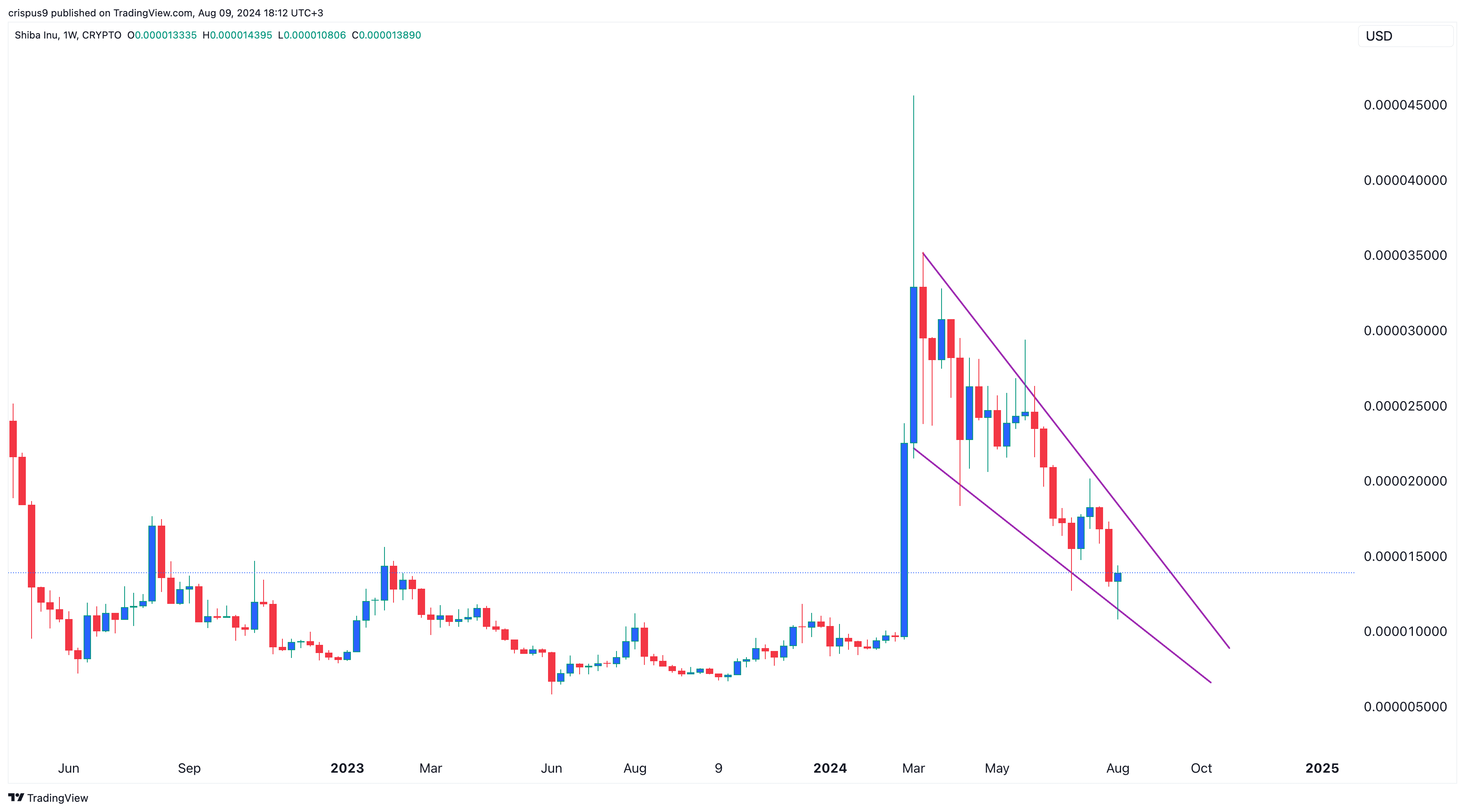

Shiba Inu retreated from the Aug. 9 high of $0.000014 to $0.000032 as the recent rally lost momentum.

Shiba Inu’s (SHIB) pullback happened as Bitcoin (BTC) dropped from the intraday high of $62,000 to below $60,000.

A look at the coin’s volume data shows that its demand has not been strong in the past few days. In the spot market, Shiba Inu had a 24-hour volume of $321 million, a relatively small amount for a cryptocurrency with a market cap of $8.2 billion.

In contrast, Floki (FLOKI), which has a market cap of $1.2 billion had a 24-hour volume of $320 million while Pepe (PEPE) and Dogwifhat (WIF) had $1.7 billion and $1 billion, respectively.

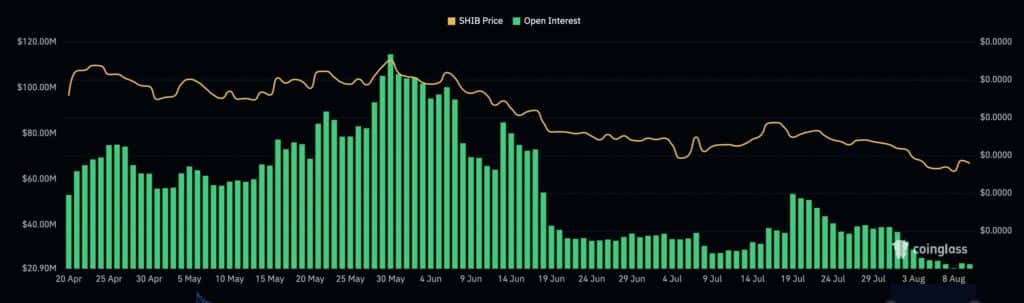

The same trend was observed in the futures market. According to CoinGlass, Shiba Inu’s open interest dropped to just $22 million on Aug. 9, down from the July high of $53 million. At its peak in March, this open interest stood at over $114 million.

Most of Shiba Inu’s futures open interest was in OKX, one of the biggest centralized crypto exchanges in the industry. Unlike other big coins like Bitcoin, CoinGlass does not show Shiba Inu’s open interest from other big exchanges like Binance, Bybit, and Deribit.

Shiba Inu’s interest among traders has faded in the past few years as many have turned to newer tokens like Pepe, WIF, Bonk, and Popcat. As a result, its price remains about 70% below its highest point in March this year and 85% below its all-time high.

Other parts of Shiba Inu’s ecosystem are not doing well either. Shibarium, the network’s layer-2 network, has attracted just $1.2 million in assets, while the total value locked in Shibaswap has retreated to $17.45 million..

Shiba Inu’s performance marks a significant decline for a crypto that was once one of the most popular in the industry. At its peak, it had a market cap of over $13 billion. Its downfall also mirrors that of Dogecoin (DOGE), which has seen its valuation drop from near $90 billion to $15 billion.

On the positive side, there are signs that the SHIB token has formed a falling wedge pattern on the weekly chart, suggesting that it could still stage a bullish breakout later this year.