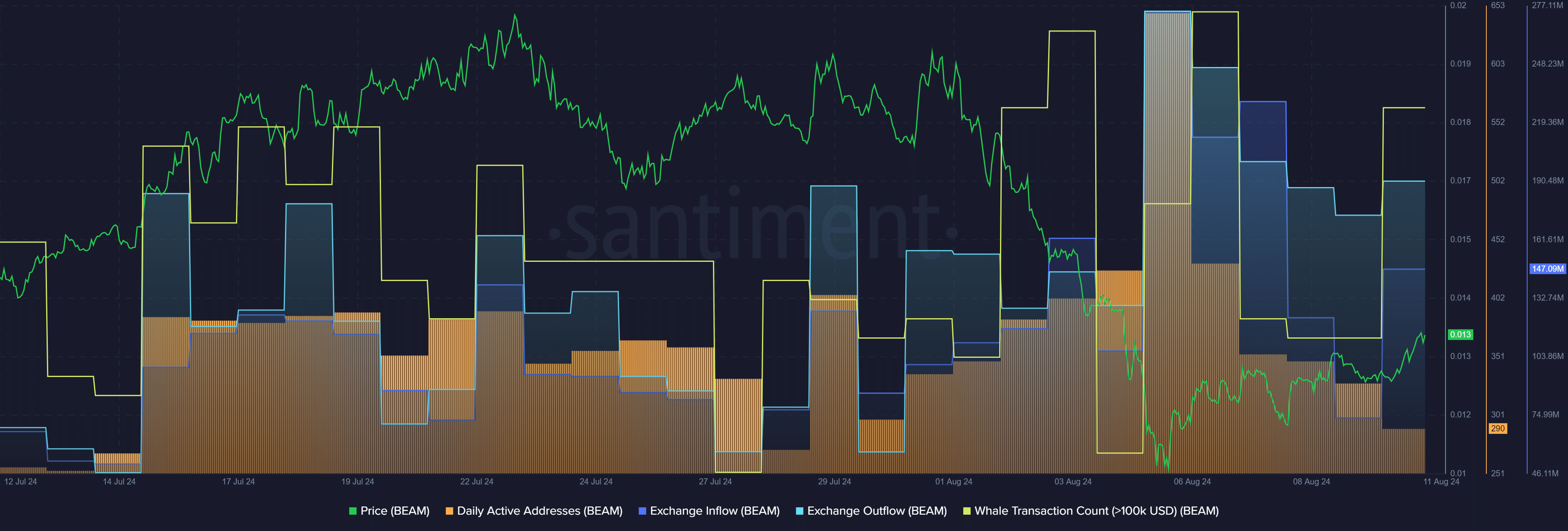

After Beam fell to its December 2023 lows, whales showed increased interest in the asset and started accumulating it.

Beam (BEAM) plunged to $0.0106 on Aug. 5 for the first time since December 2023. Following the market-wide recovery, the native token of the Beam network emerged as the top gainer with a 12.2% surge in the past 24 hours.

Beam is trading at $0.014 with a $700 million market cap at the time of writing. The asset’s daily trading volume recorded a 130% rally, surpassing the $23 million mark.

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of BEAM tokens increased from 15 to 27 unique transactions over the past day.

The heightened whale activity around the Beam token started on Aug. 5 when its price was at a local bottom.

Data from the market intelligence platform shows that the BEAM accumulation from exchanges has also surged following the asset’s price recovery. Per Santiment, over 162.6 million BEAM tokens have left exchanges in the past 24 hours.

The number of BEAM tokens entering crypto exchanges is currently sitting at 147 million.

According to Santiment, the number of Beam daily active addresses has consistently declined over the past week — from 647 on Aug. 5 to 290 active wallets at the reporting time.

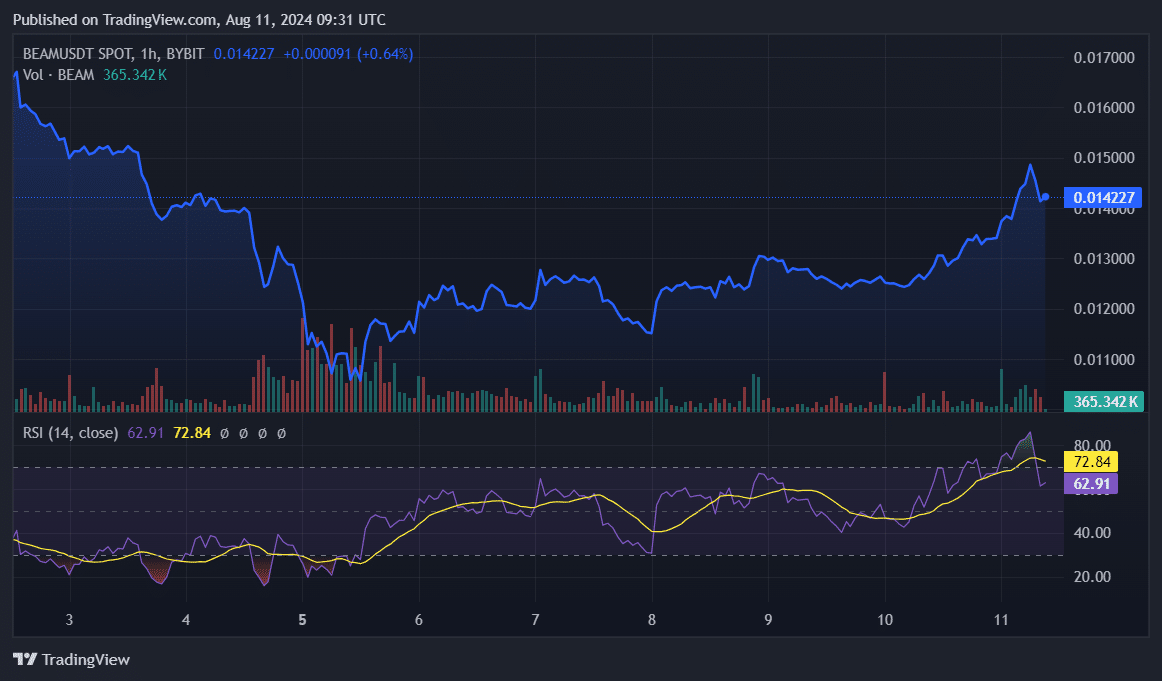

Due to the increased whale activity, the Beam Relative Strength Index also surged to 72. The indicator shows that BEAM is overbought, and a price correction would be expected.

When whale activity around an asset suddenly increases, on-chain data would usually show overheated conditions since the price could be potentially manipulated by large token holders.

In addition, investors would have to take heed of macroeconomic events, since they could suddenly change the cryptocurrency and stock market conditions fast.