Binance Discusses Crypto Trends: Market Cap Rises, NFT Sales Dip, and DeFi Flourishes

08/12/2024 20:06

Crypto market cap grew 6.1% in July, fueled by regulatory wins and Web 3 gains, but NFT sales dropped 7.1% amid market shifts.

The global crypto market capitalization soared by 6.1% in July, drawing tailwinds from positive industry developments. Among them are value-adding news from regulatory fronts and significant growth among key Web 3 projects.

Nevertheless, concerns remain that could influence industry trends in August. Among them are Mt. Gox’s repayments and the US government’s BTC transfer.

Key Crypto Trends Revealed by Binance Research

The landmark approval of nine spot Ethereum ETFs was among the tailwinds for the 6.1% surge in crypto market value in July. Like the case for Bitcoin in January, this decision delivered Ethereum (ETH) to Wall Street, inspiring a new wave of capital inflows to the market.

Market fears also eased up in July over reports that the German government completed selling its 50,000 Bitcoin (BTC) to centralized exchanges. Donald Trump’s bullish assertions during the Bitcoin 2024 Conference also invigorated the sentiment shift.

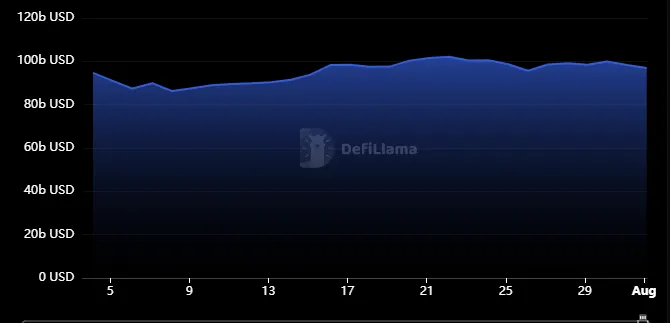

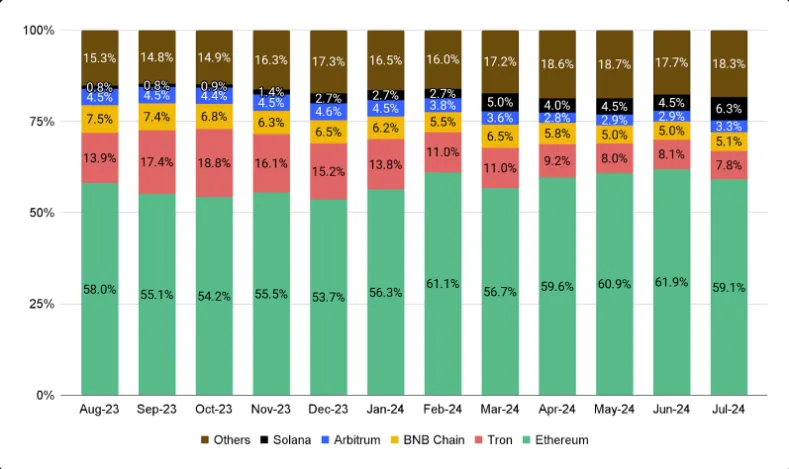

DefiLlama data shows that the decentralized finance (DeFi) space soared 3.5% in July, topping out at $99.93 billion. The DeFi total value locked (TVL) chart is very similar to the one showing crypto market capitalization.

TVL is measured in USD, which is a factor in crypto collateral prices. Therefore, the surge in DeFi TVL may represent an overall increase in collateral value.

Read more: Exploring DefiLlama: An Extensive Guide to DeFi Tracking

CORE, Scroll, and Mantle ecosystems are highlighted for significant gains. Among DeFi protocols, Polymarket witnessed substantial growth, with its July volume surging over 614% higher than January volumes. Similarly, Symbiotic recorded a 283% increase in TVL amid soaring interest in restaking.

The report also highlights Solana (SOL) and Ripple (XRP) as top-performing altcoins. For the Solana ecosystem, this was steered by growth in decentralized exchange (DEX) trading volumes. With a DEX, any project can instantly list its token and provide liquidity as a market maker, and SOL-based meme coins remain a key trend.

For XRP, tailwinds came from the CME and CF Benchmarks announcements and the hype around the Ripple versus SEC (Securities and Exchange Commission) lawsuit. Binance Research also highlights TRON’s (TRX) notable performance, citing Justin Sun’s plans to develop a gasless stablecoin.

Meanwhile, several ecosystems, including Avalanche (AVAX) and Toncoin (TON), dropped in value despite bullish developments in the networks. For example, despite valuable growth in the TON ecosystem, the token’s value fell 12%.

Read more: Which Are the Best Altcoins To Invest in August 2024?

NFT Market Sales Volume Drops 7%

Conversely, the non-fungible token (NFT) market recorded declines across July, suffering a 7.1% drop in sales volume. A key highlight in this sector is the volume increases among SOL-based collections like Solana Monkey Business and Retardio Cousins, relative to major Ethereum collections and top Ordinals collections that reported declines.

“Overall, Bitcoin and Ethereum NFT sales dropped significantly, but Immutable saw a 75.68% increase due to ongoing game development, including the launch of Illuvium,” the report noted.

As BeInCrypto reported in April and May, NFT trading volumes have been reducing on the OpenSea marketplace, revisiting levels last seen in 2021. The downturn in NFT sales and participation across blockchain platforms could stifle innovation in the space. This is because the market shifts from speculative to pragmatic value.

Indeed, while the broader market is in decline, niche collections can still capture significant interest and command high valuations. Creators and platforms may have to prioritize real-world use cases, such as certificates of ownership, digital identities, and gaming assets with meaningful in-game utility.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.