Aptos defies altcoin trends as trading volume increases by 148% – Why?

08/13/2024 22:30

APT surges on weekly charts by 22.29%. Amidst 148% rise in trading volume, Aptos market cap has increased by 10%

- APT surged by 22.29% on the weekly charts.

- Amidst a 148% rise in trading volume, Aptos’ market cap has increased by 10%.

Aptos [APT] has defied the current altcoin trend and reported massive gains. Although Bitcoin [BTC] has experienced a significant decline, altcoins have suffered the most.

The overall altcoin market cap has declined by 60% compared to BTC’s 15%. However, APT has defied this massive decline by reporting gains in market cap, trading volume, and prices.

Apt sees increased demand

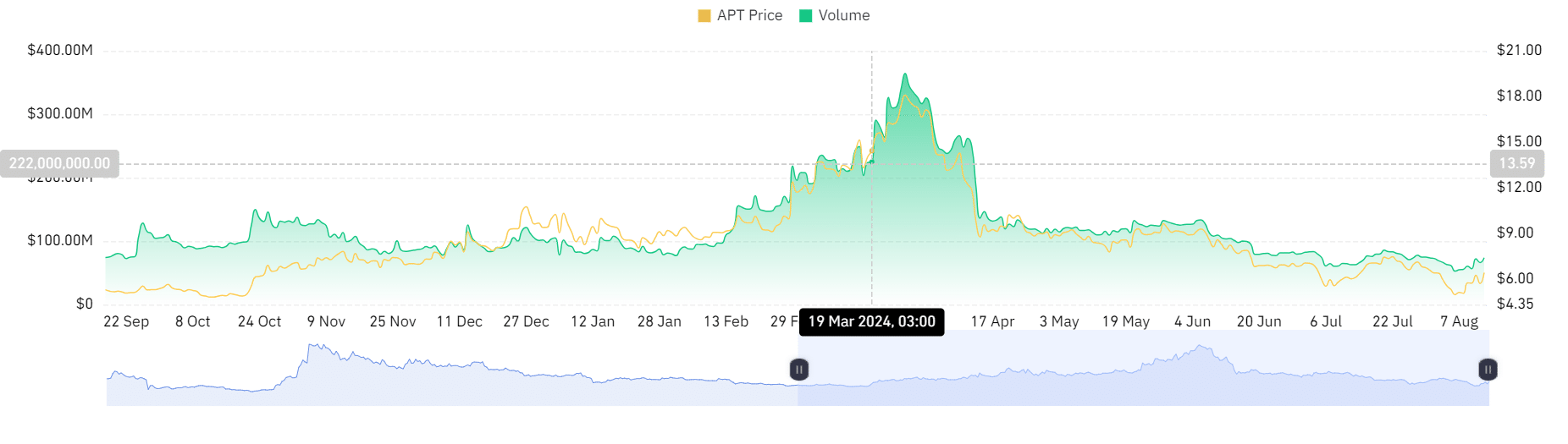

Over the past 30 days, APT has reported considerable gains on price charts. Its trading volume has surged by 148% over the last 24 hours to $219.8 million at press time.

According to Coinglass, the last 24 hrs have seen APT trading volume increase from $66 million to $73 million. The gains on daily charts show increased demand and market frenzy around APT.

Equally, Apt’s market cap has increased by 10% over the past 24 hours to $3.022 billion. The rise in market cap showed increased adoption and interest around APT as the altcoin market attempted to recover.

What price charts indicate

As of this writing, APT is trading at $6.26 after a 7.49% increase on daily charts. Equally, Aptos has increased by 22.29% on weekly charts after a month of positive gains.

Therefore, AMBCrypto’s analysis showed that Aptos was enjoying a strong short-term upward movement at press time.

The Chaikin Money Flow (CMF) was positive at 0.03, suggesting that APT was experiencing more buying pressure than selling pressure.

With the buyers dominating, it signals accumulation or a potential continued upward price movement.

Equally, the Relative Strength Index (RSI) at 51 has moved from below the neutral zone over the past 48 hours.

This showed that APT has enjoyed substantial buying pressure from the market over the past few days, favoring buyers.

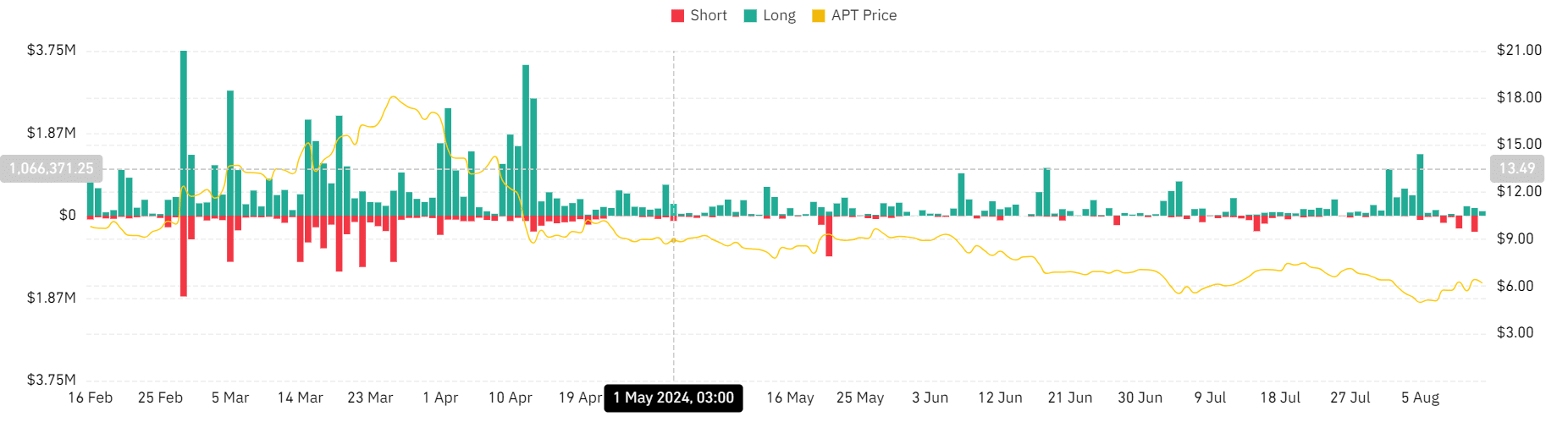

Looking further, AMBCrypto’s analysis of Coinglass showed that long-positioned liquidation has declined from a high of $1.4 million to $101k over the past week.

This reduction showed that investors were willing to pay a premium to hold their positions.

Read Aptos’ [APT] Price Prediction 2024-25

Therefore, in the short term, APT had a strong upward movement. Additionally, the altcoin was enjoying positive market sentiment.

Thus, if the current market conditions are maintained, the crypto will challenge the next resistance level around $6.9. A breakout from this resistance level will position the altcoin for a long-term rally to $9.8.