NewsBriefs - Coinbase teases cbBTC product amid wrapped Bitcoin market shakeup

08/14/2024 20:08

Coinbase hints at launching cbBTC, a new wrapped Bitcoin product. This move could challenge BitGo's WBTC dominance within six months. The an...

Editor-curated news, summarized by AI

Coinbase teases cbBTC product amid wrapped Bitcoin market shakeup

Coinbase hints at launching cbBTC, a new wrapped Bitcoin product. This move could challenge BitGo's WBTC dominance within six months. The announcement comes amid controversy over Justin Sun's involvement with WBTC management. Coinbase aims to build a significant Bitcoin economy on its Base network, potentially converting Bitcoin holders into Ethereum users. Industry experts view cbBTC as strategically crucial for Coinbase, predicting rapid adoption and market impact.

Latest

-

Coinbase teases cbBTC product amid wrapped Bitcoin market shakeup

Coinbase hints at launching cbBTC, a new wrapped Bitcoin product. This move could challenge BitGo's WBTC dominance within six months. The announcement comes amid controversy over Justin Sun's involvement with WBTC management. Coinbase aims to build a significant Bitcoin economy on its Base network, potentially converting Bitcoin holders into Ethereum users. Industry experts view cbBTC as strategically crucial for Coinbase, predicting rapid adoption and market impact.

Expand

-

Defi hacks reveal offchain attack vectors as primary threat

Offchain attack vectors account for 57.5% of financial losses in the top 100 DeFi hacks. Compromised private keys were responsible for 52.2% of attacks and 55.7% of value lost in 2024. While smart contract vulnerabilities remain a concern, lack of investor awareness is becoming a bigger vulnerability. The top 100 DeFi hacks resulted in $7.35 billion worth of stolen crypto assets. Crypto hacks in 2024 could surpass 2023 due to growing TVL in DeFi, with three hacks already in the top ten for value lost.

Expand

-

dYdX Chain will allow users to list 'virtually unlimited' markets by fall upgrade

DeFi platform dYdX announced its biggest upgrade, dYdX Unlimited, coming this fall. Users can list virtually unlimited new token trading markets without governance approval by depositing USDC into MegaVault. The upgrade introduces MegaVault as a master liquidity pool and market maker. dYdX Chain, a Cosmos app chain for crypto derivatives trading, currently handles over $900 million in daily trading volume. Additional updates include a referral program and enhanced wallet security features.

Expand

-

Kamala Harris signals continued crypto crackdown with advisor choices

VP Kamala Harris is likely to maintain the Biden administration's strict crypto regulation stance. She's working with former economic advisors Brian Deese and Bharat Ramamurti, who opposed the Clarity for Payment Stablecoins Act. Harris plans to unveil her economic policy agenda soon. These advisors were allegedly involved in "Operation Chokepoint 2.0," suggesting a continued tough approach to crypto. Ramamurti, known as the "White House's top crypto critic," further indicates a potential hardline stance on crypto regulation under Harris.

Expand

-

PlayFi launches ai-powered protocol to revolutionize live content interaction

PlayFi introduces a blockchain protocol using AI to transform live content into structured data in real-time. The system processes various content types and stores data across a decentralized network, accessible through cross-chain Oracles. PlayFi's ZK hyperchain rewards all participants and offers a four-in-one AI node network. The project is transitioning from a centralized testnet to a community-driven decentralized infrastructure, starting with a Genesis Node sale on August 14th. This innovation aims to enhance monetization and engagement opportunities in the rapidly growing live content sector.

Expand

-

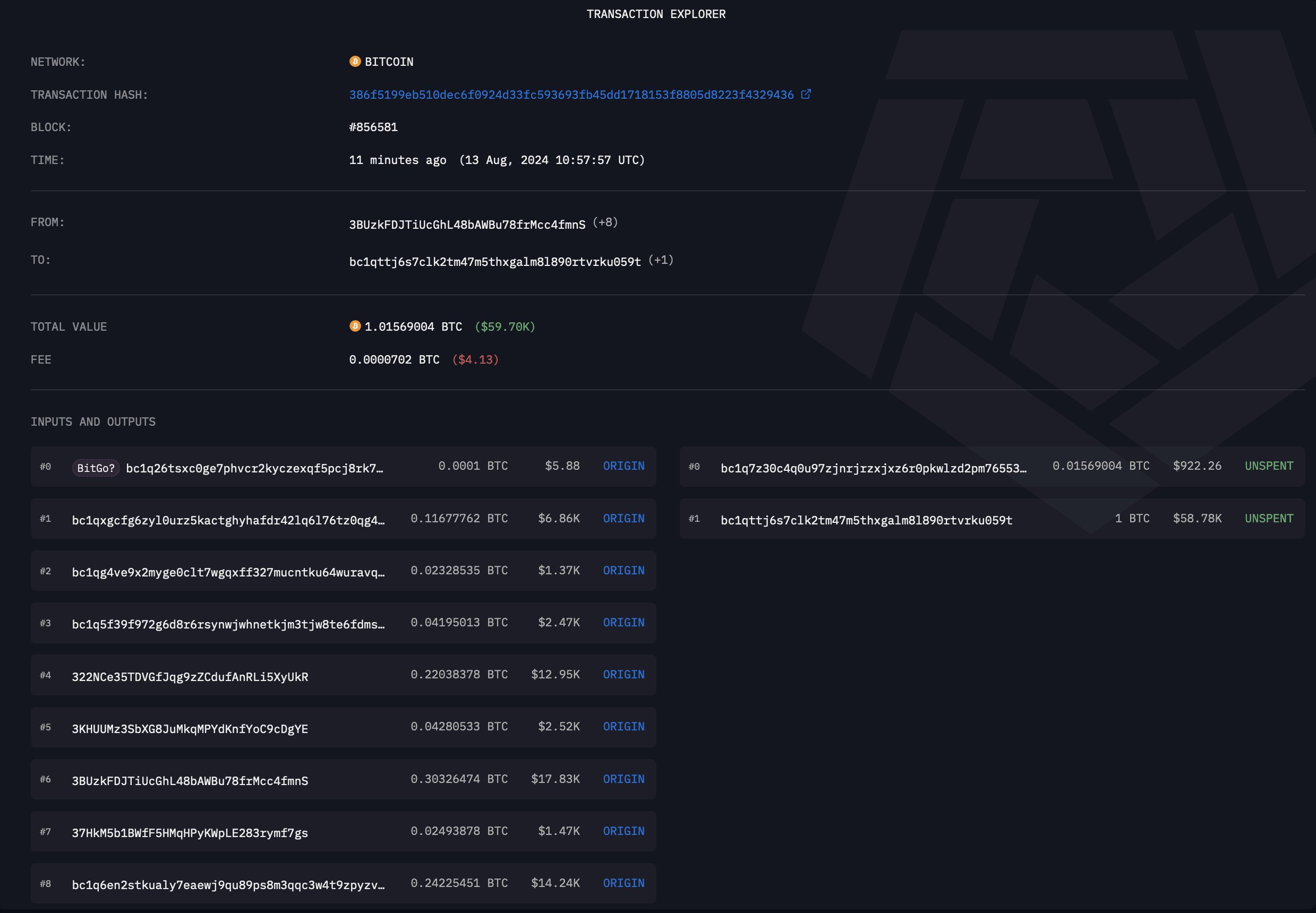

Mt gox bitcoin wallet initiates test transactions for creditor distribution

A wallet linked to Mt. Gox has begun test transactions for potential creditor distribution. The wallet, believed to be Bitgo, received $2.19B in Bitcoin from Mt. Gox and is likely the final exchange working with the Mt. Gox Trustee. This movement signals progress in the long-awaited distribution of funds to Mt. Gox creditors, marking a significant development in the crypto industry's largest bankruptcy case.

Expand

-

Bitcoin charts signal potential new wave of sell-offs

A "death cross" formation between Bitcoin's 50-day and 200-day moving averages suggests possible further downside in the crypto market. Despite a brief rebound, analysts predict more volatility and a potential trading range of $49,000 to $69,000 for Bitcoin. US monetary policy and the upcoming presidential election are cited as key factors that could impact the crypto market. Altcoin recovery may depend on improved narratives, liquidity trends, and addressing potential selling pressure from early investors.

Expand

-

Solana DEX volume hits 42-day low as meme coin interest wanes

Solana's DEX trading volume plummeted 72% in a week, hitting a 42-day low of $897 million on Sunday. This decline coincides with waning interest in Solana-based meme coins and a 19% drop in daily active addresses. SOL trades at $146.31, up 19% weekly, but the Chaikin Money Flow indicates market indecision. Potential price movements range from $148.27 to $133.64, depending on market dynamics.

Expand

-

SEC subpoenas three crypto VCs, signaling how an industry crackdown is gaining momentum

The SEC has subpoenaed at least three crypto venture capital firms this year, signaling an expansion of its crypto industry crackdown. The investigation focuses on potential violations of federal securities laws, with subpoenas requesting contracts for all token deals. This move suggests the SEC is scrutinizing the initial funding sources for crypto startups. The agency may be examining whether crypto VCs are acting as statutory underwriters or marketers of tokens, potentially distributing unregistered securities to the public market. This development follows recent SEC actions against major crypto entities like Binance, Coinbase, and Uniswap.

Expand

-

Do kwon extradition controversy divides montenegro's government

Former Luna founder Do Kwon's extradition case is causing political turmoil in Montenegro. The ex-justice minister accused the prime minister of trying to prevent Do's extradition to the US, citing potential business ties. The PM's office denied these claims, calling them fabricated affairs. This controversy threatens Montenegro's EU membership prospects and raises concerns about corruption at high levels of government. The situation continues to escalate, putting pressure on PM Spajić's political career.

Expand

-

Trump and Biden memecoins fade as cute animal tokens surge

Memecoins based on US election candidates have plummeted, with attention shifting to animal-themed tokens. A Shiba Inu named Neiro inspired multiple tokens, with one reaching a $300 million market value. Political memecoins like MAGA, Boden, and KAMA have significantly declined. Donald Trump Jr. warned of fake tokens claiming association with a rumored Trump family crypto project. The trend highlights the volatile nature of memecoins and the crypto market's quick shifts in focus.

Expand

-

Tether plans to double staff by mid-2025, focusing on compliance and finance

Tether, issuer of the $115 billion USDT stablecoin, aims to double its workforce to 200 by mid-2025. The expansion focuses on compliance and finance departments. CEO Paolo Ardoino emphasizes lean operations and selective hiring of senior staff. Tether's growth comes amid scrutiny over illicit USDT use. The company has partnered with Chainalysis for transaction monitoring and has invested $2 billion in crypto startups over the past two years.

Expand

-

Donald Trump Jr. plans to launch crypto platform to challenge banks

Donald Trump Jr announced plans for a decentralized finance crypto platform aimed at addressing banking access inequality. The platform, still in early stages, isn't a memecoin but aims to challenge traditional banking systems. Trump Jr emphasized the appeal of DeFi for those who've been debanked. He warned against fake tokens claiming association with Trump projects, stating official announcements will come directly from them. The news follows recent crypto-related tweets from both Donald Jr and Eric Trump, sparking speculation in the crypto community.

Expand

-

Trump and Harris tied on Polymarket polls, MAGA and Tremp meme coins drop 40%

Trump's odds for winning the 2024 election dropped 13 percentage points in the last month on Polymarket, now tied with Harris. This aligns with recent polling showing a statistical tie. Trump-themed crypto tokens have declined more sharply, with MAGA down 38% and Tremp down 40%. The shift follows Biden's withdrawal and Harris' entry as the Democratic candidate.

Expand

-

Robinhood CEO responds to SEC on crypto scrutiny

Robinhood submitted a response to the SEC's Wells notice regarding its crypto business, said CEO Vlad Tenev in a recent interview with Bloomberg with no additional updates. The firm has diversified its offerings beyond trading, expanding into retirement products and credit cards. Robinhood's technology performed well during recent market volatility, with customers primarily buying during the dip. The company reported strong Q2 earnings, beating analyst expectations with $682 million in net revenue.

Expand