Meme Coin MOG May Lose Critical Support Amid Bearish Sentiments

08/15/2024 16:15

The meme coin MOG's price is currently experiencing a pattern of lower lows due to the bearish market, which could lead to increased losses.

The price of Mog Coin (MOG) is observing the impact of the broader marker’s bearish cues, evident in its recent decline.

The meme coin’s consistently declining network growth is also set to affect investors, potentially increasing their losses.

Mog Coin Is Losing Confidence

MOG’s price has declined 15% over the last 24 hours as Bitcoin dipped to $58,300. The decline in the meme coin raised concerns about investors’ participation.

The waning interest is visible in overall transactions conducted across the network recently. Since the beginning of the month, the volume of MOG moved through the addresses has dropped from $77 million to $8.95 million. This 89% drop in transaction volume brought it down to a two-month low, and there is a possibility of the same falling further.

Read More: What Are Meme Coins?

The chances of this happening are likely since the meme coin is facing bearishness.

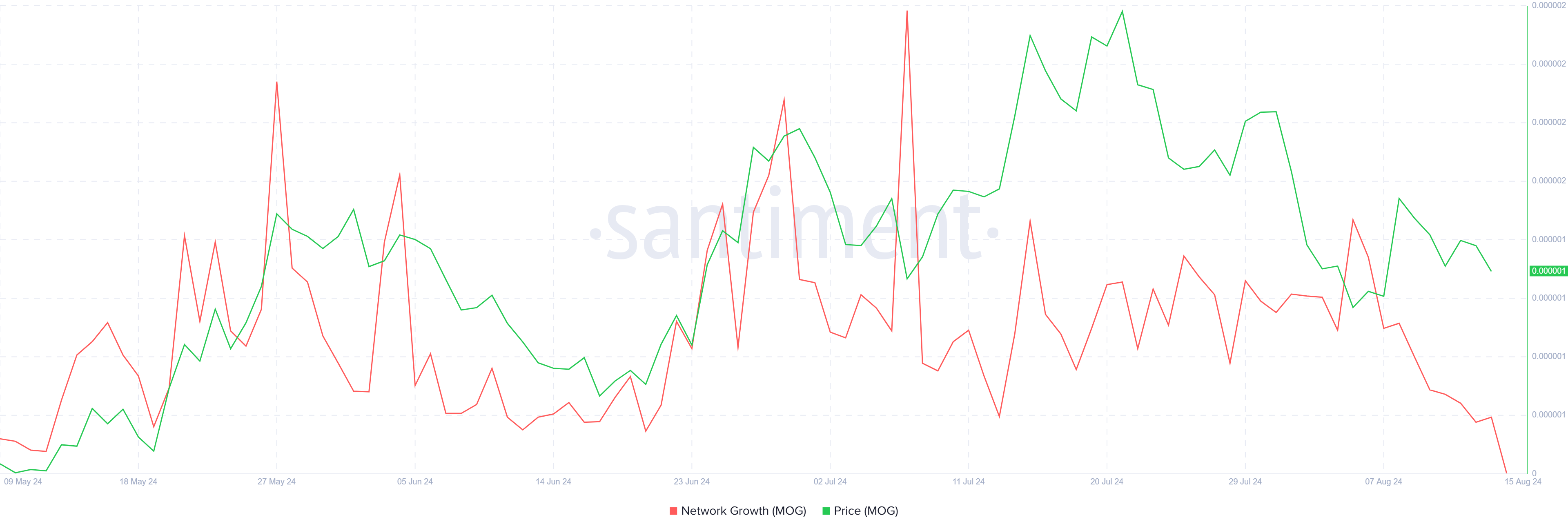

This concern is exacerbated by the lack of confidence among MOG enthusiasts, as noted in the decline in Network Growth. This indicator measures the total number of new addresses formed on the network.

A spike in the metric is a positive sign, while a downtick in the same dictates that the project is losing traction in the market. This could negatively impact the price action, further furthering the ongoing decline in the meme coin’s price.

MOG Price Prediction: Watching the Next Support

MOG price is trading at $0.000001169 at the time of writing after losing the support of $0.000001545. This level has been a key support floor for the meme coin in the past, and a decline below it is concerning since the crypto asset is at the 23.6% Fibonacci Retracement level at the moment.

If the drawdown continues, MOG’s price could end up falling to the low of $0.0000009583.

This level sits below the 23.6% Fib line at $0.000001149. This line is also known as the bear market support floor, and losing it could intensify selling pressure and result in further losses.

Read More: Cryptocurrency Coins vs. Tokens: What’s the Difference?

However, if the MOG price manages to recover and bounce back to close above the support of $0.000001545, the meme coin could change the direction of the ongoing trend to an uptrend. This would also invalidate the bearish thesis, pushing the crypto asset to $0.000001600 and higher.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

READ FULL BIO