Data Shows Crypto Bear Market May Be a Distant Threat

08/16/2024 06:45

Fears of a crypto bear market have filled the market recently since BTC failed to notch another high. Has the cycle changed?

On average, a crypto bear market lasts about a year, sometimes extending to two. This phase occurs when supply surpasses demand, causing prices to decline over an extended period.

One of the most severe bear markets unfolded in 2022. During this time, FTX, one of the largest crypto exchanges by trading volume, collapsed following a massive bank run. The downfall triggered a ripple effect, leading to the collapse of several hedge funds and lending protocols, marking a significant low point for the industry.

Bear Market Psychology Explained

Recently, there’s been talk about the crypto market heading back into a bear phase. Many cryptocurrencies have struggled since Bitcoin (BTC) hit $73,750 in March. The decline has raised concerns that the market might be entering another long period of falling prices.

The event, which surprisingly happened before the halving, sent shockwaves around the market. At that time, many suggested that crypto prices would hit higher highs.

However, this has not been the case. Instead, BTC’s price, alongside other cryptocurrencies, has either been consolidating, falling, or involved in false breakouts.

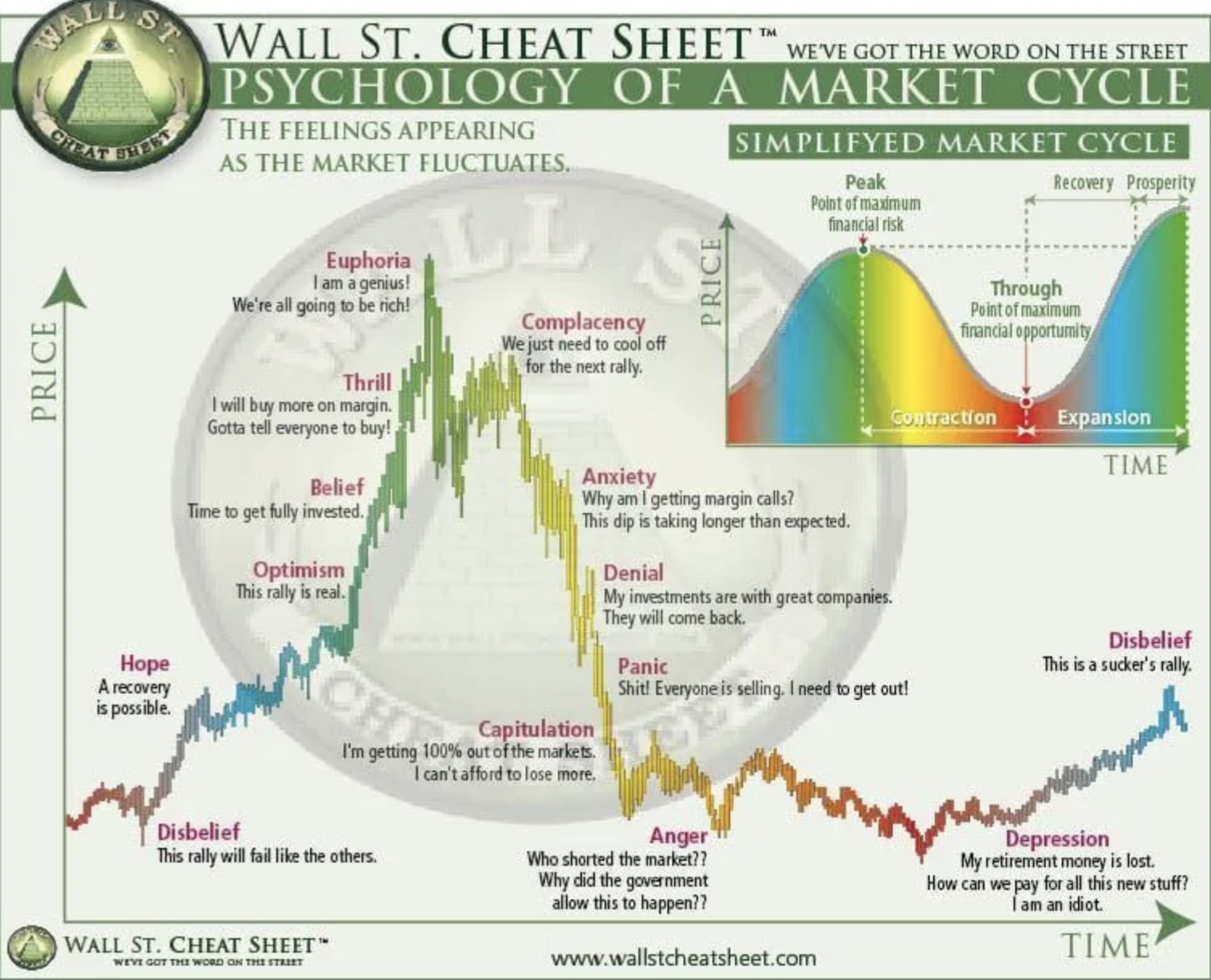

These factors, among others, have led some participants to suggest that the market might be heading into a bear phase. To evaluate this possibility, BeInCrypto examines the market cycle psychology chart for insights.

Read more: How To Make Money in a Bear Market

As seen above, this chart shows 14 different stages. For instance, the disbelief marks the end of the bear market when cryptos begin to move into the bull phase. There are also phases of thrill, anxiety, euphoria, or complacency.

From the look of things, the disbelief stage happened around the first quarter of 2023, when the Bitcoin price began to post gains consistently. Meanwhile, the “Thrill” period probably happened during the ETF approval earlier in January this year, as there were calls for people to double down on buying BTC.

Euphoria probably occurred in between March when BTC and many other altcoins and meme coins reached different heights. The cool-off in recent times may suggest that this cycle is between complacency and anxiety, which usually precedes a bear market.

Bitcoin Holders Say a Big No to the Downturn Despite ETH Issues

However, the periods of complacency and anxiety may have been false alarms. According to Glassnode, the Bitcoin Long-Term Holder Sell-side Risk Ratio offers a clue. This metric measures the level of profit-taking compared to past market cycles.

Currently, the ratio remains below the peak seen during the 2021 bull market, indicating that long-term Bitcoin holders are refraining from selling.

Actions like this suggest high conviction among long-term holders. With respect to this, the on-chain analytic platform explains that:

“An elevated percentage of Bitcoin network wealth is held by this investor cohort relative to previous cycle ATH breaks, which suggests there is a degree of investor patience on display, and waiting for higher prices.”

If this holds true, the bear market might not be imminent, and the cycle could still be in its bear phase. However, some market participants remain skeptical due to the underperformance of certain altcoins, particularly Ethereum (ETH).

In 2021, after Bitcoin reached its all-time high (ATH), ETH quickly followed suit and surpassed its previous peak. This time, however, the situation is different, even with the launch of spot Ethereum ETFs.

Currently, ETH trades at $2,657, marking a 45% drop from its ATH. Earlier, many market participants confidently predicted that the altcoin would reach between $8,000 and $10,000, but those expectations have yet to be realized.

Some of those optimistic predictions have faded as ETH continues to underperform, strengthening the belief that a bear market is approaching. However, it’s important to recognize that top cryptocurrencies, including BTC and ETH, recently underwent a period of distribution, which contributed to the recent price correction.

Bears Are Still Lurking for a Crypto Winter

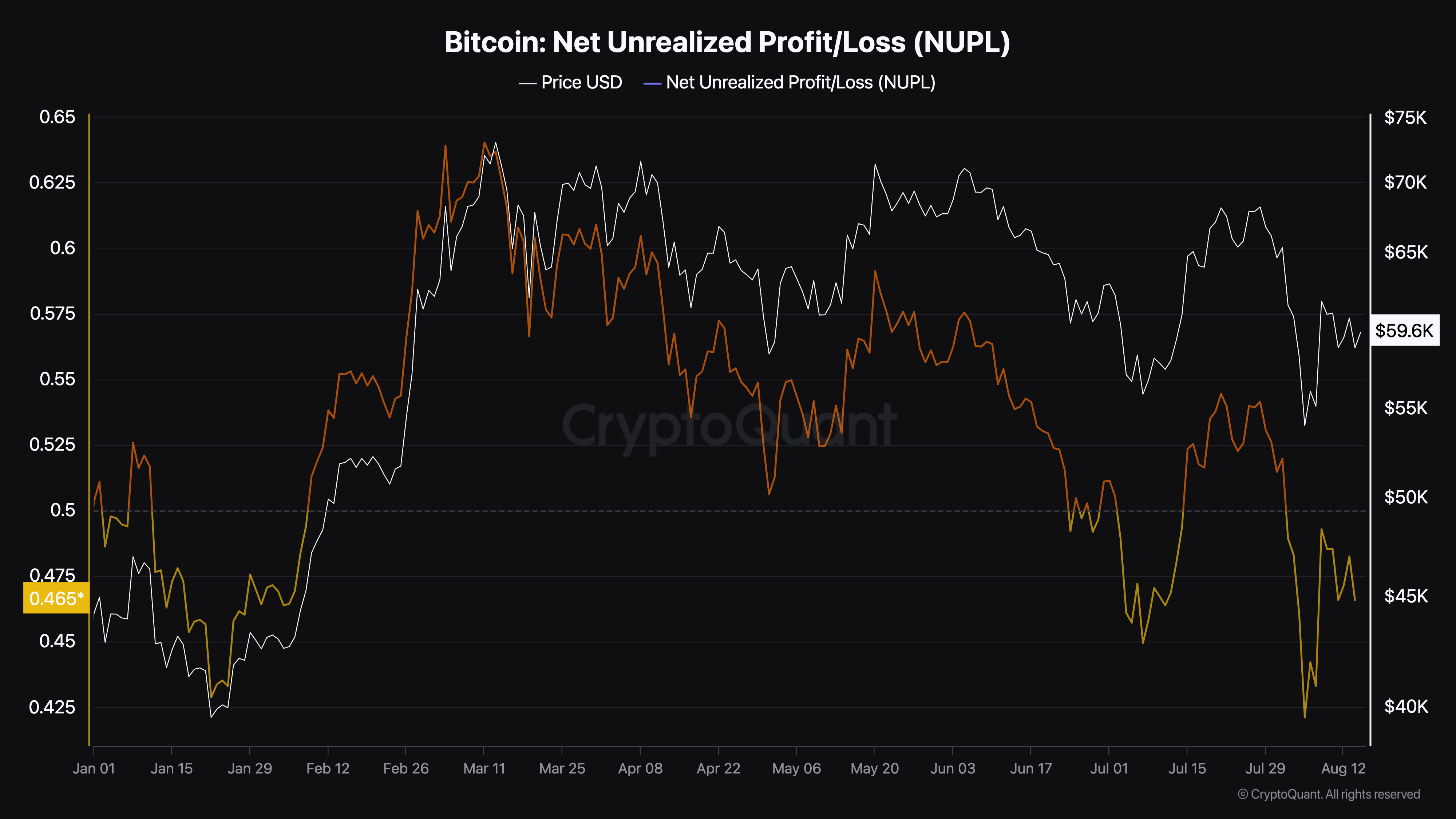

Market participants might also worry that crypto whales have slowed down on buying BTC. However, these pauses are typical during a bull cycle. Despite this, caution is advised, as indicated by the Net Unrealized Profit/Loss (NUPL).

The NUPL measures whether investors are in profit or loss. When the reading increases, it shows that more investors are seeing higher profits. Conversely, a decrease signals declining gains.

This metric also helps determine whether the market has entered a bear phase. An increase points to a stronger bull cycle, while a significant decrease raises the likelihood of a bear market.

Read more: Bitcoin Halving History: Everything You Need To Know

At press time, Bitcoin’s NUPL stands at 0.46. In July, a similar drop in this range led BTC’s price to decline to $55,857. The last time the indicator hit this level, Bitcoin’s price fell to $42,576.

This makes the current reading a critical point for the market. If the NUPL continues to decrease and reaches 0.40 or lower, bears could take control. According to Grizzly, a pseudonymous analyst on CryptoQuant, if that happens, BTC could potentially drop to $40,000.

“If the index continues its downward movement, it’s reasonable to anticipate that the bears could take full control of the market. In such a scenario, the price could drop to around $40,000,” Grizzly wrote in his analysis.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.