Bitcoin Dominance Hits Roadblock as Altcoins Gear for Rally

08/20/2024 05:30

Bitcoin's dominance continues to falter, fueling speculation of an upcoming altcoin season as analysts watch for TOTAL2 to break resistance.

Speculation is mounting over whether altcoin season has begun, with Bitcoin’s (BTC) dominance (BTC.D) struggling to break out of its rising wedge.

As Bitcoin faces persistent resistance around the $60,000 mark, analysts suggest that these conditions could set the stage for an altcoin season.

Is Bitcoin Faltering?

As of this writing, BTC.D sits at 56.91%. It failed to breach the upper line of its rising wedge on August 5 and has since trended downward.

The failure to break out of the rising wedge is often seen as a bearish signal, implying that Bitcoin’s dominance might be peaking or declining. As Bitcoin’s dominance weakens, it creates opportunities for altcoins to gain market share. This has been the case with the rising TOTAL2 since August 5.

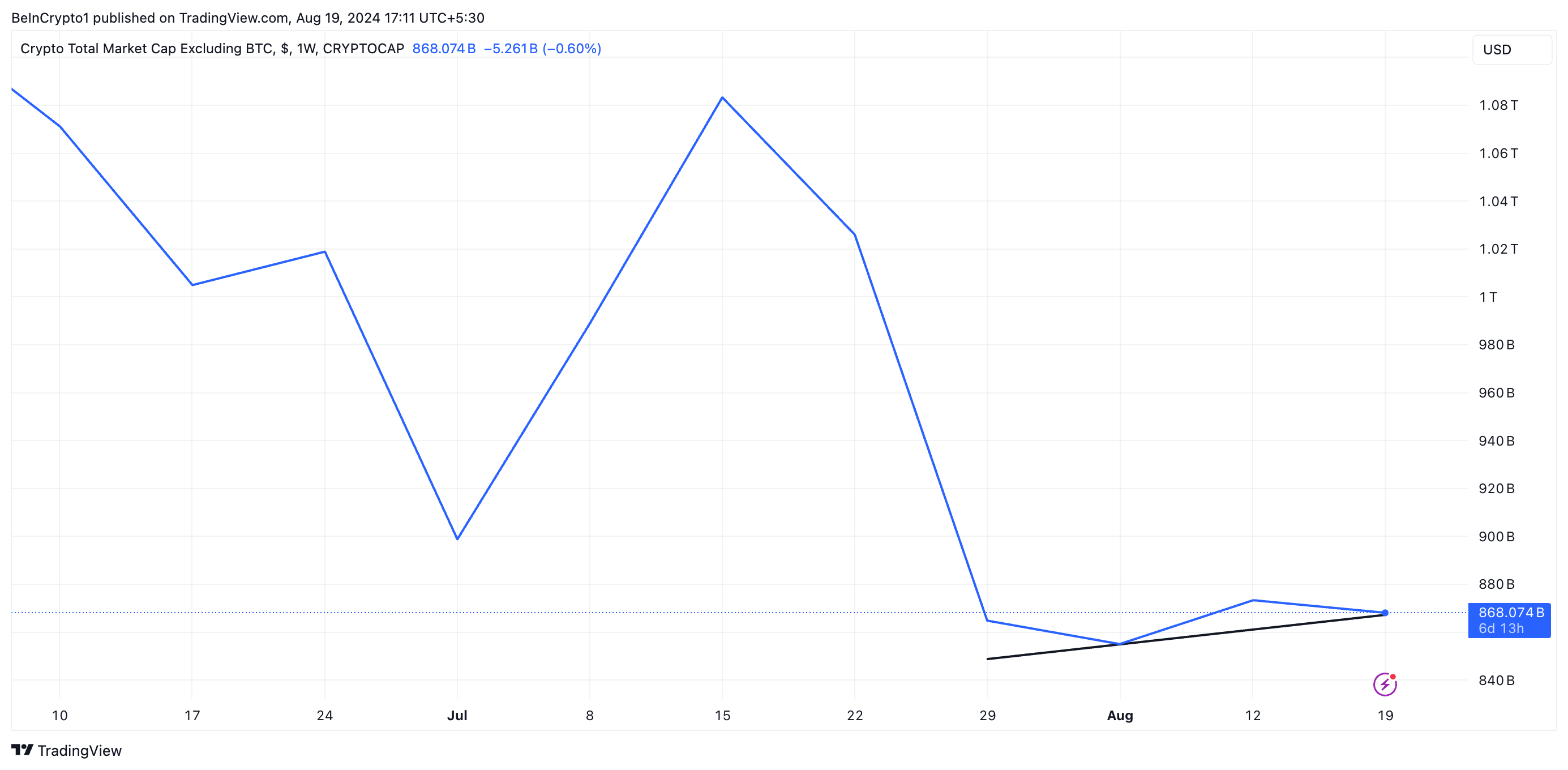

TOTAL2 measures the sum of the market capitalization of the top 125 altcoins. At $870 billion at press time, this has climbed by 2% since BTC.D began to fall.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

BTC.D’s recent trajectory has further fueled the speculation among cryptocurrency analysts. Chris AI noted that Bitcoin dominance faced strong resistance from a downward trend, preventing it from breaking above the wedge, fueling further speculation.

“BTC Dominance stopped by the larger downwards sloping trend line and did not manage to break its rising wedge bullish. This is good news for alts as chances increase that this is rolling over in the near future,” ChrisAI wrote on X.

Another analyst, SenseiBR, noted that the BTC.D is “ending diagonal.” Ending diagonal is a term used in technical analysis to describe a chart pattern that suggests a potential trend reversal.

If BTC.D is forming an ending diagonal pattern, it suggests a major shift in market sentiment. Such shifts typically indicate that Bitcoin’s dominance is nearing an end, often leading to a surge in altcoin activity and price appreciation.

Only a Few Have Outshined the Leading Coin

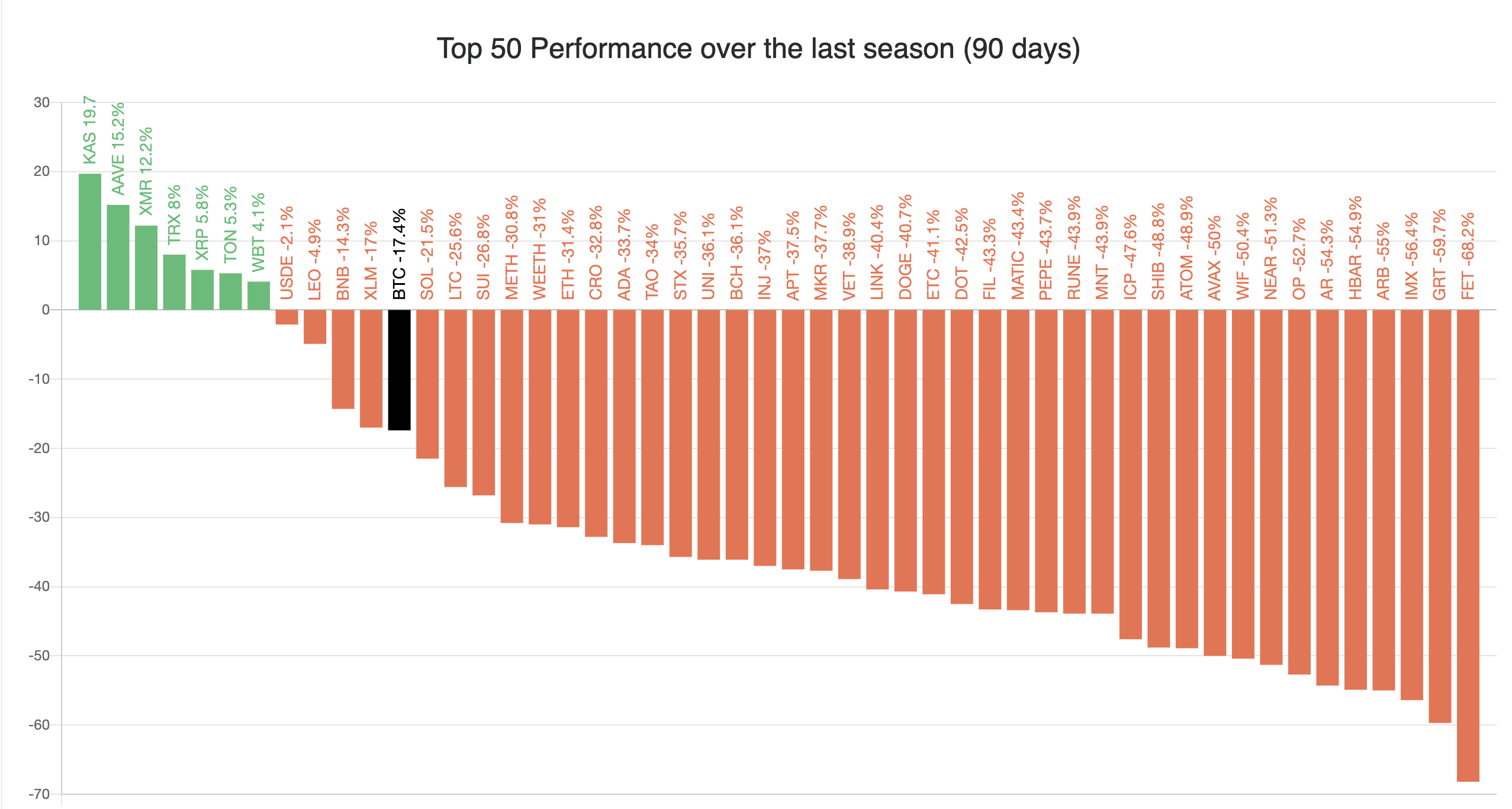

Despite the analysts’ positions, it is key to note that the altcoin season commences when at least 75% of the top 50 altcoins outperform Bitcoin over the past 90 days. Currently, only 14 altcoins, or 28%, have done this.

Also, TOTAL2, assessed on a daily chart, trends within a horizontal channel. This channel is formed when there is a relative balance between buying and selling pressures, preventing its price from trending strongly in either direction.

The altcoin season will begin fully when TOTAL2 successfully breaks above the channel’s upper line, which forms resistance. This breakout would confirm stronger momentum, signaling a shift away from Bitcoin dominance and opening up room for growth across alternative cryptocurrencies.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.