Dogecoin (DOGE) Presents Buying Opportunity as Volatility Fades

08/20/2024 18:30

Dogecoin has traded between $0.09 and $0.10 since August 8. This sideways movement signals a drop in market volatility.

Since its value plummeted to a seven-month low of $0.08 on August 5 during the broader market downturn, leading meme coin Dogecoin (DOGE) has consolidated within a range.

This signals a decline in market volatility, lessening the possibility of price swings in the short term.

Dogecoin Stabilizes Within a Range

DOGE has traded within a horizontal channel since August 8. This channel is formed when an asset’s price moves within a range for some time. This sideways movement happens when a relative balance between buying and selling pressures prevents its price from trending strongly in either direction.

The upper line of the channel acts as resistance, while the lower line serves as support. In DOGE’s case, resistance has formed at $0.10 and support at $0.09. When an asset’s price stays within a narrow range like this, it signals low volatility, as there are no significant fluctuations.

Indicators confirm this for DOGE, with its Average True Range (ATR) on a downtrend since this sideways movement began. Currently at 0.0072, DOGE’s ATR has dropped by 27% since August 8, reflecting reduced market volatility.

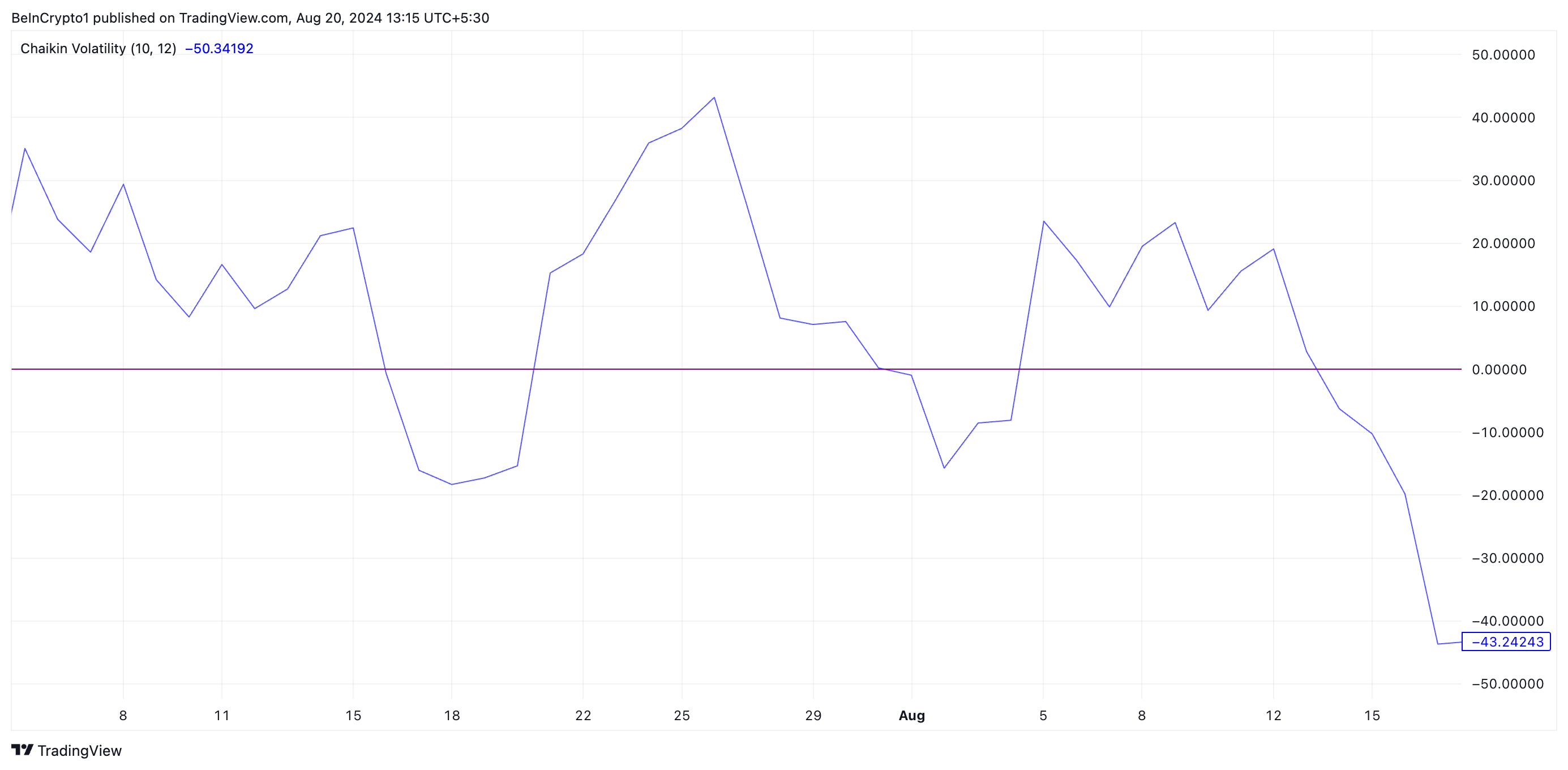

Following a similar trend, the coin’s Chaikin Volatility has also declined. At press time, the indicator is below its center line at -43.24.

Read more: Dogecoin vs. Bitcoin: An Ultimate Comparison

When this indicator also falls, it suggests that the market is experiencing smaller price swings. It is a sign of consolidation or a marker of reduced market activity.

DOGE Price Prediction: Coin Flashes Buy Signal

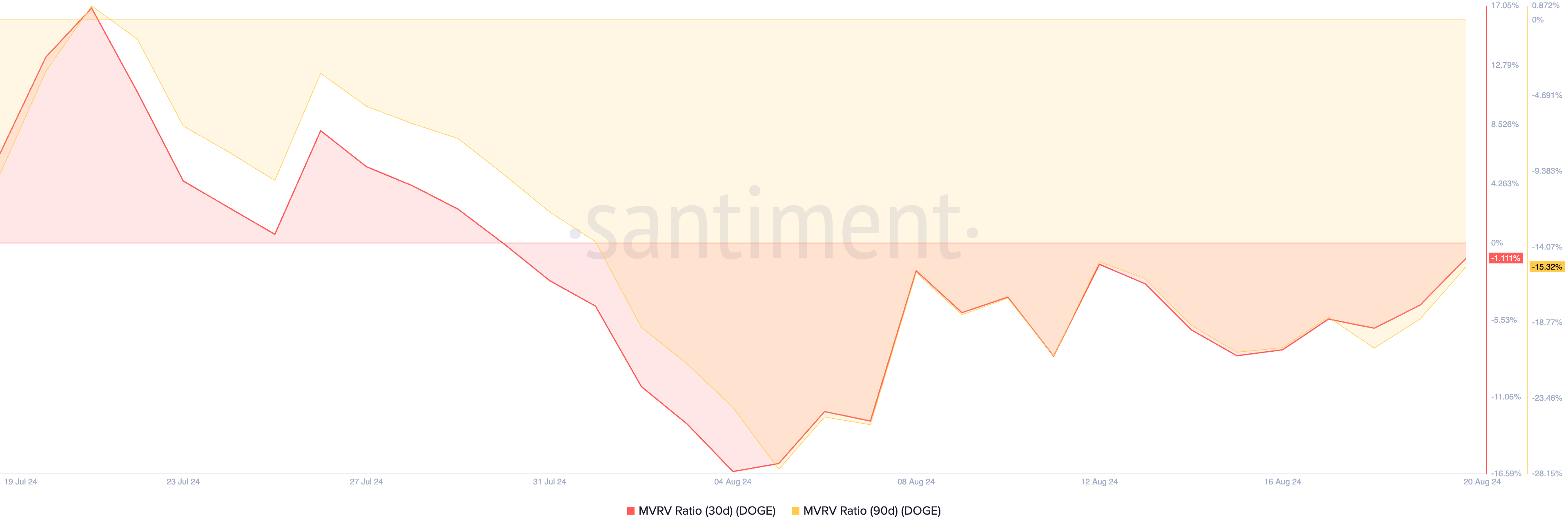

As DOGE’s volatility drops, now may be a good time to buy the meme coin. According to Santiment, its market value to realized value (MVRV) ratios assessed over different moving averages have flashed buy signals.

Per the on-chain data provider, the coin’s 30-day and 90-day MVRV ratios are -1.11% and -15.32% respectively.

The MVRV ratio compares an asset’s current market price to the average acquisition price of its circulating tokens.

When MVRV is below zero, the asset is considered undervalued, indicating its current price is lower than the cost holders paid, presenting a potential buying opportunity.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

If DOGE breaks above resistance with increased buying pressure, it could reach $0.11. However, if traders ignore the buy signal and trading activity remains low, DOGE’s value may drop to $0.08.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.