Dogecoin Rockets 1,476% With Whale Buys

08/20/2024 22:15

On-chain data for Dogecoin reveals jaw-dropping spike in bullish whale activity, with key metric soaring by almost 1,500%

On-chain data for Dogecoin reveals jaw-dropping spike in bullish whale activity, with key metric soaring by almost 1,500%

The last day has seen high activity of Dogecoin (DOGE) on the blockchain, which may indicate that market participants are becoming optimistic about the popular cryptocurrency meme.

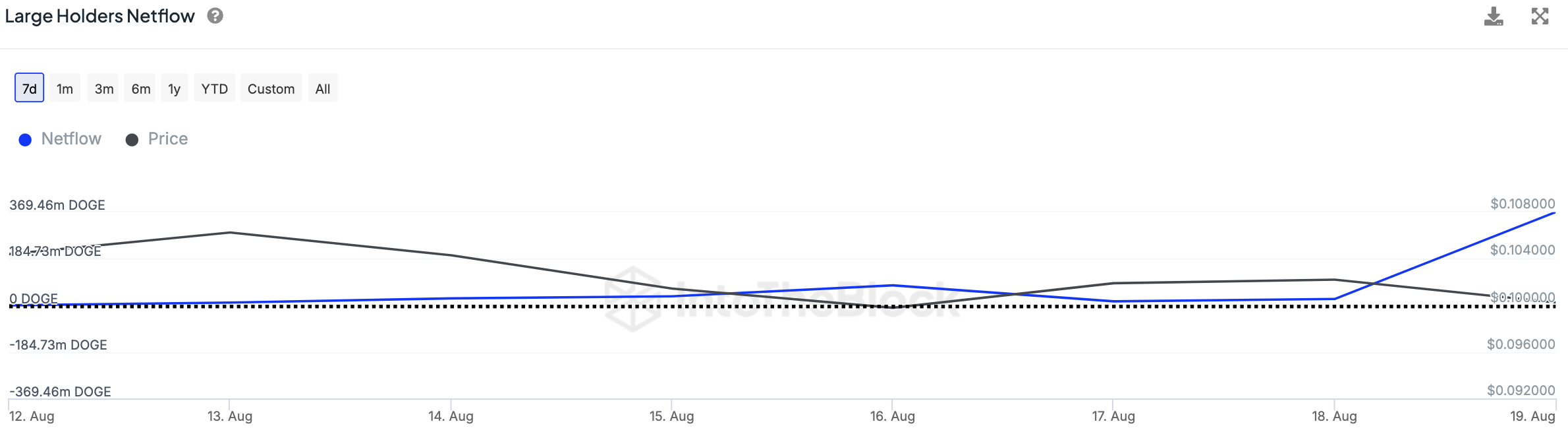

In particular, the whale netflow benchmark from IntoTheBlock indicates that DOGE is flowing into the addresses of large holders in large volumes, as it grew from 25.06 million tokens to 369.46 million tokens over the period under review.

The net inflow data shows that more of Dogecoin has been bought by big investors, or whales, who hold over 0.1% of the coins in circulation, than sold. This new money coming into the market is usually seen as good for the price of the asset.

What is more intriguing, past data shows that spikes in net inflow often coincide with market lows. This suggests that there is increased buying pressure during periods of price weakness.

More data confirms trend for DOGE

Digging deeper behind the scenes, the same on-chain data for Dogecoin reveals an uptick in accumulation by large investors. The addresses that made the cut have added 462.33 million DOGE to their wallets, while increasing their overall trading activity, with outflows rising from 22.31 million to 92.87 million DOGE.

It looks like some of the big players are getting more involved in the Dogecoin market, which suggests they think the asset is going to perform well in the future.

It is worth noting that this surge in whale activity coincides with renewed interest in Dogecoin sparked by Elon Musk's recent social media engagement. While correlation does not imply causation, the timing is intriguing.

About the author

Gamza Khanzadaev

Financial analyst, trader and crypto enthusiast.

Gamza graduated with a degree in finance and credit with a specialization in securities and financial derivatives. He then also completed a master's program in banking and asset management.

He wants to have a hand in covering economic and fintech topics, as well as educate more people about cryptocurrencies and blockchain.

Advertisement

TopCryptoNewsinYourMailbox

TopCryptoNewsinYourMailbox